Navigation: Loans > Loan Screens > Cards and Promotions Screen >

Nearly everything in line-of-credit loans keys off the Billing Date. The Billing Date is when the system calculates the finance charges (accrued interest) and billing amount for the loan for that month. The Finance Charge Code field tells the system when to run the billing cycle, as well as whether to use the low, average, or high daily balance when calculating finance charges.

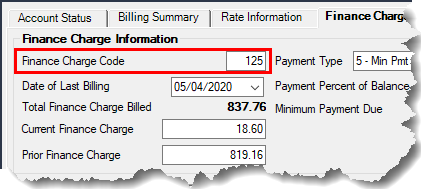

The Finance Charge Code field on the Finance Charge tab sets the requirements for both the Billing Date and which balance the account will use, as shown below:

•The first number in the Finance Charge Code field (such as the "1" in the example above), tells the system which balance to use: high (1), average (0 or blank), or low (2).

•The second field indicates the number of days before the Due Date to run the billing record, which is when the system sets the Date of Last Billing and calculates the Finance Charges.

Interest on a line-of-credit loan is calculated through the average daily balance method. This method requires knowing the Average Daily Balance of each promotion (purchase). Luckily for you, this screen shows you the Average Daily Balance for each purchase and displays it on the Promotion Billing tab. See below:

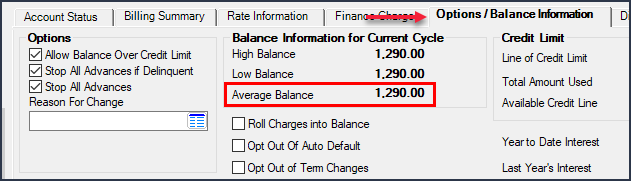

The Cards and Promotions screen also shows the Average Daily Balance for the whole loan on the Options/Balance Information tab, as shown below:

If you want to calculate Average Daily Balance yourself, here's how we calculate it:

First you need to know the balance of each purchase (promotion) for every day of the billing cycle. Then you add up each day's balance and divide that number by the number of days in the billing cycle.

Example:

Feb 26 - March 10 is 13 days. 13 X $500 = $6,500 March 11 - March 25 is 14 days. 14 X $450 = $6,300

$6,500 + $6,300 = 12,800 / 28 (days in the billing cycle) = $457.14

You would repeat this process for each purchase/promotion on the loan, if the loan has more than one promotional balance.

But you aren't done yet. We need that Average Daily Balance to calculate the finance charges (accrued interest) for the billing cycle.

Now that you know the Average Daily Balance, you can calculate the finance charge for the billing cycle. Again, we show all this for you on the Promotion Billing tab, but if you want to test it out for yourself, see Finance Charge Calculation below. |

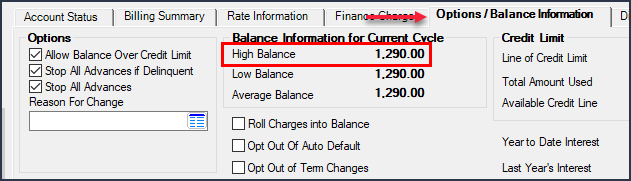

If the Finance Charge Code is set to calculate by high balance (the first number in the Finance Charge Code field is a "1"), the highest balance on the promotion that month will be used to calculate the finance charges. The High Balance for the billing cycle is shown on the Options/Balance Information tab, as shown below:

Unlike the Average Daily Balance (see definition above), there is no calculation involved in figuring the High Balance. It's simply the highest balance of the loan (or promotion) during that billing cycle.

See Finance Charge Calculation below for more information. |

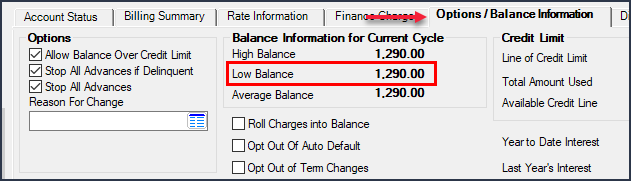

If the Finance Charge Code is set to calculate by low balance, the lowest balance on the loan that billing cycle will be used to calculate the finance charges. The Low Balance for the billing cycle is shown on the Options/Balance Information tab, as shown below:

Unlike the Average Daily Balance (see definition above), there is no calculation involved in figuring the Low Balance. It's simply the lowest balance of the loan (or promotion) during that billing cycle.

See Finance Charge Calculation below for more information on calculating finance charges. |

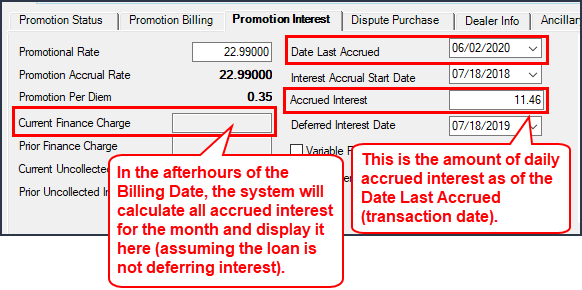

Interest is calculated on a daily basis for LOC revolving card loans. Interest is calculated from transaction date to transaction date. The Billing Date is also considered a transaction date. For example, if a payment transaction was processed seven days after the Billing Date was run, the interest would be calculated from the Billing Date to the date of the payment, and the system would show the amount of interest accrued for those seven days in the Accrued Interest field on the Promotion Interest tab.

Once another Billing Date runs, interest for the remaining days of that month is calculated; the Accrued Interest amount field is cleared; and the system adds the Accrued Interest amount and the interest amount accrued from the date of last transaction to the Billing Date and enters the total in the Current Finance Charge field also on the Promotion Interest tab. However, if the promotion is deferring interest for a time, as is common with LOC promotion loans, the interest accrual amounts are totaled in the Prior and Current Uncollected Interest fields, as is described in the Promotion Period Expiration Date topic.

See these important fields below:

So how does the system calculate finance charges (interest)?

The equation is as follows:

Average/Low/High Balance on the promotion X Interest Rate = N N divided 365 X number of days from last transaction to current transaction = Accrued Interest

Then Accrued Interest moves into the Finance Charge field in the afterhours of the Billing Date (and any interest from the last transaction to the Billing Date is also included).

If the promotion includes P/I Constant, this would be the amount of interest required of the P/I Constant.

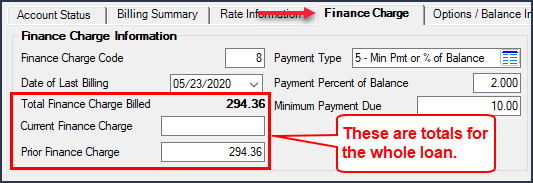

Finance charges are calculated per promotion, and the Finance Charge tab at the top half of the Cards and Promotions screen will show the totals for the entire loan, as shown below:

Example 1:

Let's say the current interest rate is 15.999 percent, the Average Daily Balance on the loan is $1,368.52 (Finance Charge Code is set to using the Average Daily Balance), and the number of days in the billing cycle is 31.

1,368.52 X .15999 = 218.94951 218.94951 / 365 X 31 = $18.60 — This is the amount of Finance Charges this month.

Note: Interest Calculation Method should only be set to 101. Any other entry is ignored.

Example 2:

Current interest rate is 15.999 percent, High Balance is $1,460.23 (Finance Charge Code is set to using the High Balance), and the number of days in the billing cycle is 31.

1,460.23 X .15999 = 233.49077 233.49077 / 365 X 31 = $19.83 — This is the amount of Finance Charges this month.

Note: The Average/High/Low Balance option set in the Finance Charge Code field is only available for the whole loan. So any promotion included in that loan will follow the requirement of the Finance Charge Code. In other words, one promotion cannot use High Balance, while another promotion uses Average Daily Balance. They will calculate finance charges using the same balance option.

Calculating Finance Charges When Balances and Interest Rates Change

So far, calculating finance charges seems easy, right? Not so fast. What if the loan was accruing interest at one rate during part of the billing cycle, but then the interest rate went up for the last 15 days of the billing cycle? And the Finance Charge Code indicates to use the Average Daily Balance.

The system can handle that, no problem. Here's an example:

Promotion Balance on April 1 is $5,000 with a promotional interest rate of 2.99 percent. On April 18 the promotional interest is dropped and the standard interest rate of 19.99 is now in effect from April 18 on.

First, we figure out the Average Daily Balance from April 1 to April 18. If you want to know exactly how Average Daily Balance is calculated, see Average Daily Balance Calculation above. But let's just cut to the chase and tell you it's $5,000.

Then we figure out the days difference from April 1 to April 18, which is 17.

5,000 X .0299 = 149.50 149.50 / 365 X 17 = $6.96

Now we calculate Average Daily Balance from April 18 to April 30 (the Billing Date); let's keep it at $5,000, just for ease. And we use the new interest rate of 19.99.

Then we figure out the days difference from April 18 to April 30, which is 12.

5,000 X .1999 = 999.5 999.5 / 365 X 12 = $32.86

Finally, add the two amounts together:

$6.96 + $32.86 = $39.82

|

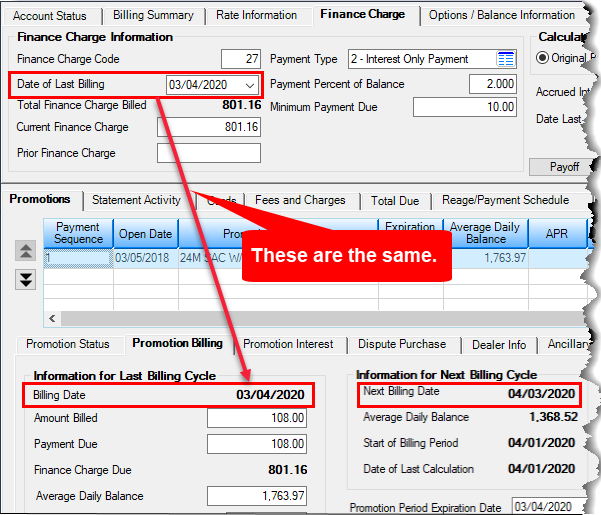

The Date of Last Billing (LNRLFD) on the loan and Billing Date (NLBLDT) for each promotion are the same. This must be the same date as the Date Opened when the loan is originated. After that first month, the Billing Date and Date of Last Billing will move when the next billing period begins. Billing Date to the Next Billing Date is the number of Days in Billing Cycle. It is determined by actual days, not periodic days.

See the Date of Last Billing field for more information on when the system calculates the finance charges.

Billing Dates |

The Date of Last Transaction (LNTRAN) is is an important date when calculating Average Daily Balance. When funding new loans, the Finance Charge Date (Date of Last Billing) and Transaction Date must be the same. During loan origination, be sure those dates are the same. For example, if you board the loan one day and fund the next day, you'll want to make sure those dates are the same, or it will throw off the calculations of the loan going forward.

A transaction date is any time the line of credit balance goes up or down. A payment can cause the balance to go down, as can a payment reversal, an interest rate change, or losing a promotional interest rate. From that date on, the system will calculate the Average Daily Balance at the new balance of the loan, or with the new interest rate of the loan.

For individual promotions, the Date of Last Calculation (NLCLAD) on the Promotion Billing tab can be the same as the Transaction Date. See Calculating Average Daily Balance with More Than One Promotion below.

If an additional purchase is made, the Average Daily Balance goes up, and the finance charge is calculated at the new balance from that date on. |

Important!: The Date Last Finance Charge and Transaction Date on a newly originated and boarded loan must be the same. If they are not, it will throw off the calculation of the Average Daily Balance for that month. |

|---|

Things get a bit more complicated when there are more than one purchases with different interest rates on a card loan. When calculating the Average Daily Balance for LOC loans with purchases/promotions, the system looks at two areas:

1.Average Daily Balance per Promotion Record 2.Average Daily Balance per Loan

|