Navigation: Loans > Loan Screens > Cards and Promotions Screen >

Revolving line-of-credit is a type of credit where the borrower has been authorized for a maximum amount, and the borrower can take out any of those funds to use on approval from your institution or a qualified dealer. Once a purchase is paid off, the loan stays open should the borrower want to made another purchase on the loan. Promotions (purchases) are a big part of line-of-credit. Promotions can include:

•Lower interest rates for a fixed amount of days.

•No interest rate for a fixed amount of days.

•Same-as-cash offers, where the total deferred interest becomes due after a designated number of days, unless the loan is paid off before that date.

•Lower payment for the first six months of the loan.

•No payment for the first six months of the loan.

Promotions can be of varying terms and rates, determined by your institution and established at loan origination.

Multiple promotions, or purchases, can be tied to one card (account).

All promotions under the same revolving line-of credit must have a single payment Due Date. Only one payment is required to cover all promotions. The amount of each payment is calculated in a specific way, as described in the Payment Details topic.

The system calculates the average daily balance and accrued interest (finance charges) very specifically, as described in the Billing Date and Calculation Finance Charges topic.

If the loan includes a promotional-interest rate period, where the interest rate is zero or lower for a certain number of months, the Promotion Period Expiration Date shows the date the interest rate transitions from the zero or low rate to the standard rate. See the Promotion Period Expiration Date for more information.

Some promotions default to the standard rate (see Standard Rate) if the borrower does not make the designated payment by the Due Date plus Grace Days. If the borrower is more than 90 days late, the account may then fall to the default rate (see Default Rate). Options are available to allow promotional interest rates to continue if a late charge is assessed, as discussed on the Options/Balance Information tab help.

On the Loans > History screen, the system uses transaction code 33 (Promotional File Maintenance) to maintain promotion records in the afterhours, as shown below:

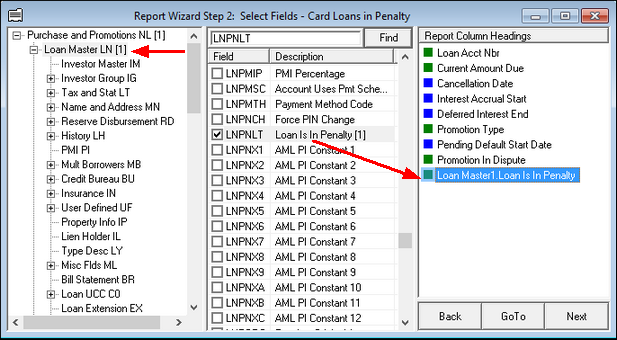

The field mnemonic LNPNLT is used by the system to flag accounts with penalty status. You can add this mnemonic to GOLDWriter or GOLDMiner reports as a headings or field calculation. This mnemonic is found in the main Loan Master (CFLN or FPLN) record. Promotional fields to use on reports are found in the Purchase and Promotions (FPNL) record.

|

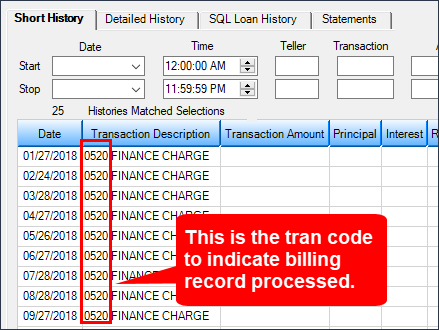

Line-of-credit billing history is shown under tran code 520, Finance Charge. When you see that in History, it indicates that the billing record was processed and finance charges calculated for that month. The system actually uses tran code 2520, but only shows the 520 in History, as shown below.

s s

The billing record is when the system calculates the amount of interest for the month and displays it as a finance charge. The billing cycle happens each month, as indicated in the Billing Summary tab. See that tab for more information.

See also: LOC Transactions. |

If you want to build tracking reports for promotions and line-of-credit loans in GOLDMiner or GOLDWriter, the following records and fields will be the most useful:

FPLN (for GOLDWriter) / CFLN (for GOLDMiner) - Loan Master Record

The most common fields you might want to use from this record include:

•LN4NBR: Loan account number •LNDUDT: Due Date of the loan •LNDTLP: Date of Last Payment •LNPBAL: P/I Balance •LNRLFC: Finance Charge Code •LNRLPT: Payment Type •LNRLPB: Payment Percent of Balance •LNOORA: Original or Actual Balance •LNRLFD: Date of Last Billing •LNRLCC: Current Finance Charge (for the whole loan) •LNRLPC: Prior Finance Charge (for the whole loan) •LNRLMD: Minimum Payment Due •LNACIN: Accrued Interest •LNDLAC: Date Last Accrued

See the rest of the field definitions on this screen for more information on mnemonics used for line-of-credit loans.

FPNL - Promotion Record

The fields in this record pertain to the specific promotional line-of-credit, not the whole loan. The most common fields you might want to use from this record include:

•NLRATE: Promotional Interest Rate •NLRLCC: Current Finance Charge •NLRLPC: Prior Finance Charge •NLCUCI: Current Uncollected Interest •NLPUCI: Prior Uncollected Interest •NLDTAC: Date Last Accrued •NLEXDT: Promotion Period Expiration Date •NLDBAC: Interest Accrual Start Date •NLDIED: Deferred Interest Date •NLOBAL: Original Balance •NLPICN: P/I Constant

See these other links for more field descriptions and mnemonics to use for the Promotion Record:

|