Navigation: Loans > Loan Screens > Account Information Screen Group > Payment Information Screen > Loan Information tab >

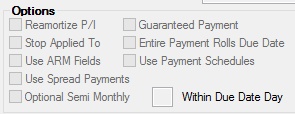

Options field group

Use this field group to view and edit options on the customer loan account.

The fields in this field group are as follows:

Field |

Description |

|||||||

|

Mnemonic: LNAMZ6 |

Check this box if you want to allow an interest-bearing loan tied to prime to calculate a payment which will amortize the loan. See below for more information.

|

|||||||

|

Mnemonic: LNAPLY |

When this box is checked, if the payment being posted is more than than the actual payment amount, the extra amount will not be added to the Applied To Payment field; the extra amount will automatically be posted to reducing the Principal Balance instead of being credited toward the next payment due.

Partial payments (payments for less than the full amount) will update the Applied To Payment field. When a partial payment is made, the Applied To Payment field will be updated and will continue to do so until sufficient funds have been applied to roll the Due Date. If the amount paid plus the amount in the Applied To Payment field exceeds the payment due, the Due Date will roll and the Applied To Payment field will be cleared. But with this option set, the extra amount does not go towards the Applied To Payment, and instead, the extra amount goes directly to decreasing the Principal Balance.

Important Note: The Entire Payment Rolls Due Date option (LNEPMT) should not be used in conjunction with the Stop Applied To this option. These two options conflict on purpose. |

|||||||

|

Mnemonic: LNRTSN |

This field will only be file maintainable for interest-bearing loans (payment method 6). It is used for creating scheduled rate changes on interest-bearing loans. The default value is unchecked, which indicates that the ARM fields will not be used. If this box is checked, the system will act like this is an ARM loan (payment method 7). It is from these fields that scheduled rate changes are created. Even though you may access the ARM fields, the system will still use the simple interest calculations for the loan.

|

|||||||

|

Mnemonic: LNSPRD |

The Use Spread Payments option is an override indicator that tells the system to use the SPRDPMTS program for calculating payments and processing payments. See below for more information.

|

|||||||

|

Mnemonic: LNGPMT |

This box is selected when a loan is originated from GOLDTrak PC (using field TF_GUARANTEED_PMT_LN). The person originating the loan determines whether the payment is guaranteed. This is an information only field and manually updated. The mnemonic is LNGPMT and it can be included on GOLDWriter and GOLDMiner reports.

An example of a guaranteed payment is a third-party company offering to make loan payments on behalf of their customers. The payment is always made whether or not the customer actually pays their bill to the third-party company, making the payment guaranteed. |

|||||||

|

Mnemonic: LNEPMT |

Checkmark this box if you want the system to roll the due date when the amount of payment equals the Next Payment Due (see above) amount or more. See below for more information.

|

|||||||

|

Mnemonic: LNPMSC |

This checkbox indicates if there is an alternate payment schedule set up for this account. The default value is not checked (no). If checked, the system will look to the Payment Schedule list view, located on the Loans > Transactions > CP2 screen > Payment Schedule tab for the payment amount due and the corresponding payment effective date. |

|||||||

|

Mnemonic: LNOO24 |

Check this option to indicate that your institution uses an alternate version of the regular semi-monthly payment Frequency. See below for more information.

|

|||||||

|

Mnemonic: LNWIDY |

This option is available for customers who are set up to make automatic or recurring payments (see ACH Payments tab) but who also want to make additional payments within the same frequency. See below for more information.

|