Navigation: Loans > Loan Screens > Account Information Screen Group > Additional Loan Fields Screen > Valuation/Billing tab > Statements and Coupons field group > Coupon/Bill Code >

Ordering Coupons

Coupons can be ordered through GOLDTeller (tran code 82) or by using the action codes in the Loan system. Institution Option SCPB must be enabled for the coupon printing feature to be available.

To order coupons through the Loan system:

| 1. | Access the Loans > Account Information > Actions, Holds and Event Letters screen in CIM GOLD. |

| 2. | In one of the Action Code fields on that screen, click the list icon |

| 3. | In the Action Date field, select the date you want the coupons printed and sent to this account. |

| 4. | Click <Save Changes>. |

The night the coupon is either created (if GOLDPoint Systems coupons) or added to the vendor tape, the system then changes action code 100 to 101 or action code 105 to 106. This allows you to know if coupons have been created or are still waiting to be created. Once you have ordered the coupon (action code 100), the system evaluates the loan setup to determine how many coupons are needed and when to begin and end the coupons.

|

Note: If you order coupons using the Action Code fields on the Actions, Holds and Event Letters screen, the system first looks for action code 100 or 105. It then looks for an Action Date. If the date is blank, no coupons are ordered. If the date is today or less, coupons will be ordered. If the date is in the future, coupons are not ordered until the night of the date. Example: Today is 8-7. You order coupons with a date of 8-10. During the afterhours of the night of 8-10, coupons will be ordered. |

|---|

The fields which will impact beginning and ending dates of coupons are Coupon/Bill Code, Coupon/Bill Cycle, Payment Method (Loans > Account Information > Payment Information screen), Reserve Constant (Loans > Account Information > Reserves > Account Reserve Detail screen), Analysis Effective Date, P/I Constant Change Date, a calculated next P/I Constant, Term of the loan (minus installments paid), Balloon Date, and the Action Code (Actions, Holds and Event Letters screen) used (100 or 105).

If the Reserve Analysis Effective date is blank, the system uses Feb. 1. If an Action Code of 1, 2, 3, 5, 7, 10, 11, or 18 is placed on the account, the system will create coupons up to the Action Code entered for the Action Code. For example, if Action Code 1 has been entered on the account with an Action Code of 07-01-13, enough coupons will be printed to last until the Action Code instead of the intended coupon end date.

|

Note: If the Reserve Analysis Effective field and the rate change dates are equal, the system will perform an additional calculation to determine if the analysis has run this year or not by taking the Reserve Analysis Effective date with the current year and subtracting four months. It then determines if the Last Analysis Date (on the Loans > Account Information > Reserves > Reserve Analysis screen > Options, Limits & Loan Fields tab) is between this calculated date and the Reserve Analysis Effective date with the current year. If it is, the analysis has already run and coupons will be ordered. If not, the system assumes the analysis has not run and the rate will be changing at analysis time. If the Last Analysis Date is blank and the loan was recently opened, the system will create coupons if ordered. |

|---|

Determination of Beginning and Ending Dates of Coupons (No Reserve Constant)

Coupon/Bill Cycle Code 001 and 101 (Payment Method 0 Non-Adjustable Loans)

When ordering coupons using action code 100 or 105, coupons will be created from the due date to the Reserve Analysis Effective date. If the loan has a Maturity, Balloon Date, or Action Date which occurs prior to the analysis date, coupons will print up to the month prior to the ending term of the loan. If the Reserve Analysis Effective date is blank, the default is 02-01.

Coupon/Bill Cycle Code 001 and 101 (Payment method 7 Adjustable Loans)

When ordering coupons using action code 100, coupons will be created from the current due date to the Next P/I effective date (if the Next P/I has not been calculated). If the Next P/I has been calculated, coupons will be created from the Next P/I effective date to the following P- change date.

When ordering coupons with action code 105, coupons will be created from the current due date to the Next P/I constant change date even if the Next P/I constant has already been calculated.

Coupon/Bill Cycle Code 002 and 102 (Payment Method 0 Non-Adjustable Loans)

When ordering coupons using either action code 100 or 105, coupons will be created from the due date to the Reserve Analysis Effective date. When opening a new loan where the Due Date and the Reserve Analysis Effective date are the same, coupons will only be created with the annual coupon run request. If the Reserve Analysis Effective date is blank, the default is 02-01.

Coupon/Bill Cycle Code 002 and 102 (Payment Method 7 Adjustable Loans)

When ordering coupons using action code 100, coupons will be created from the current due date to the Reserve Analysis Effective date (if the next uncalculated P/I change date is prior to the analysis date coupons will end at the P/I change date). If the next P/I has been calculated and there is another P/I change date prior to the analysis effective date, then the coupons will be created from the calculated P/I change date to the next P/I change date. Remember the coupon end date will be the earliest of the loan balloon payment due date or action code date, the next uncalculated P/I change date, the Reserve Analysis Effective date, or the ending term of the loan. If the Reserve Analysis Effective date is blank, the default is 02-01.

When ordering coupons using action code 105, coupons will be created from the current loan due date to the earliest of the loans ending term, the balloon date or action code date, the P/I change date, or the Reserve Analysis Effective date even if the next P/I has already been calculated.

Determination of Beginning and Ending Dates of Coupons (With a Reserve Constant)

Coupon/Bill Cycle Code 001 and 101 (Payment Method 0 Non-Adjustable Loans)

When ordering coupons using action code 100 or 105, coupons will be created from the due date to the Reserve Analysis Effective date. If the loan has a maturity date, balloon payment date, or action code date which occurs prior to the analysis date, coupons will print up to the month prior to the loan's ending term. If the Reserve Analysis Effective date is blank, the default is 02-01.

Coupon/Bill Cycle Code 001 and 101 (Payment Method 7 Adjustable Loans)

When ordering coupons using action code 100, coupons will be created from the current due date (if the Next P/I has not been calculated) to the Next P/I effective date or Reserve Analysis Effective date, whichever is first. If the Next P/I has been calculated, coupons will be created from the Next P/I effective date to the following P/I change date or the Reserve Analysis Effective date, whichever is first. If the Reserve Analysis Effective date is blank, the default is 02-01.

When ordering coupons with action code 105, coupons will be created from the current due date to the next P/I constant change date or the Reserve Analysis Effective date (whichever is first) even if the next P/I constant has already been calculated.

Coupon/Bill Cycle Code 002 and 102 (Payment Method 0 Non-Adjustable Loans)

When ordering coupons using either action code 100 or 105, coupons will be created from the due date to the Reserve Analysis Effective date. When opening a new loan where the due date and the reserve analysis effective date are the same, coupons need to be ordered manually one month prior to the due date or with your annual coupon run request. If the reserve analysis date is blank, the default is 02-01.

Coupon/Bill Cycle Code 002 and 102 (Payment Method 7 Adjustable Loans)

When ordering coupons using action code 100, coupons will be created from the current due date to the Reserve Analysis Effective date if it is prior to the next uncalculated P/I change date. If the next P/I has been calculated and there is another P/I change date prior to the analysis effective date, then the coupons will be created from the calculated P/I change date to the Next P/I change date. Remember, the coupon end date will be the earliest of the balloon date or action code date, the next uncalculated P/I change date, the Reserve Analysis Effective date, or the ending term of the loan. If the Reserve Analysis Effective date is blank, the default is 02-01.

When ordering coupons using action code 105, coupons will be created from the current loan due date to the earliest of the loans ending term, balloon date or action code date, the P/I change date, or the Reserve Analysis Effective date, even if the Next P/I has already been calculated.

Special Comments If you receive one coupon with the error message "PAYMENT NOT EXACT," try the following to correct the error:

|

Institution Option (Vendor Tapes)

In addition to the billing cycle there is also an institution option (57) pertaining to outside vendor tapes. This option identifies which day of the week or month you want a vendor tape created.

Example: You may have an option set up to only create a National Computer Print coupon tape every Thursday. With this option you can order coupons every day. However, the system will store that information and only put those loans on the NCP tape each Thursday. In this instance you will only get a report of coupons ordered each Thursday rather than every day that you requested coupons. |

Annual Coupon Processing

New coupons are created each year after the annual analysis is run. The system will print the first coupon beginning with the Reserve Analysis Effective date and will generally print 12 coupons. (If you have a P/I change date, balloon date, or action code date or the term ends before 12 coupons, they stop at the respective date.) In addition, there is an institution option that stops the creation of coupons for adjustable loans with no reserve constant. This eliminates your sending coupons twice a year (at P/I change date and annually) when the payment amount is the same. This is especially helpful if you are paying a vendor each time a payment book is created (request).

Examples

The following examples show the different type of coupons that can be ordered:

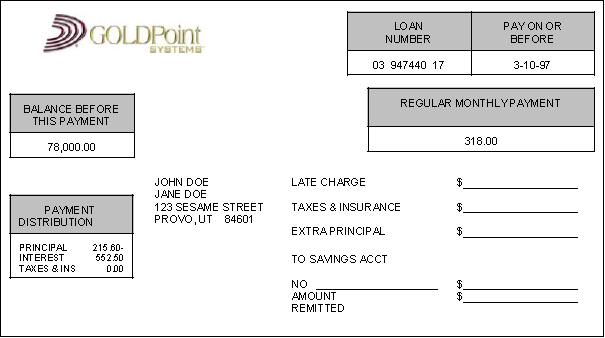

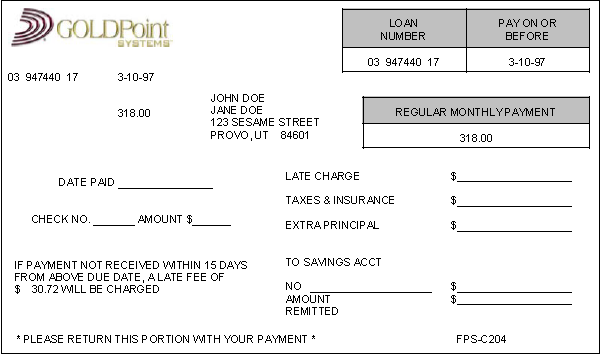

Bill Code 1, Bill Cycle 101 - Standard GOLDPoint Systems Coupon with Payment Breakdown, No Late Charges

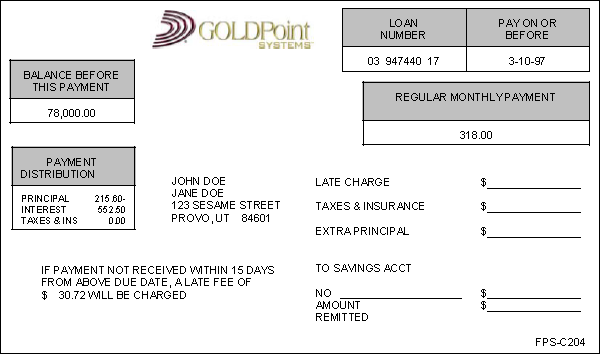

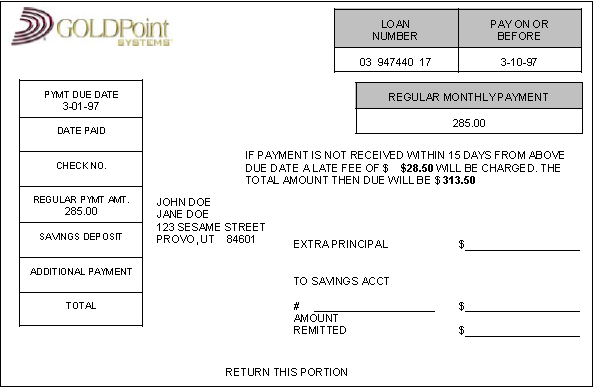

Bill Code 3, Bill Cycle 101 - Standard GOLDPoint Systems Coupon with Payment Breakdown and Late Charge Message

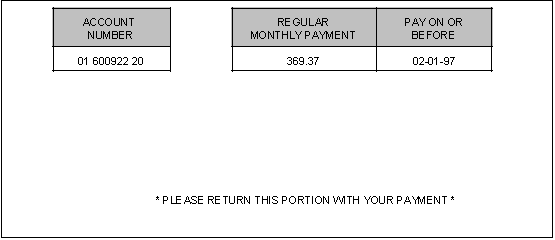

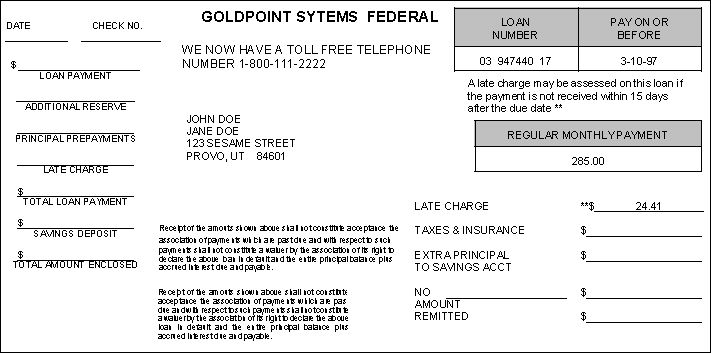

Bill Code 4 - Modified Type Coupon

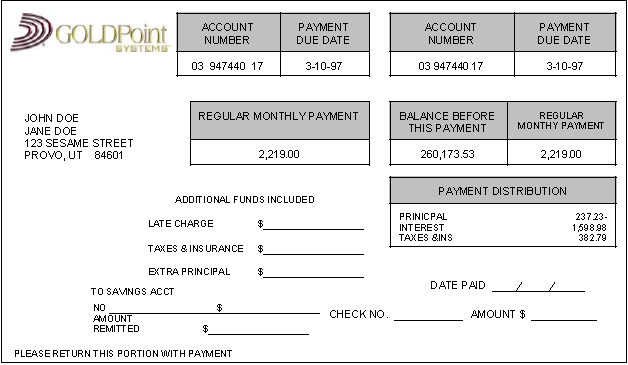

Bill Code 014, Bill Cycle 101 - Standard GOLDPoint Systems Coupon with Payment Breakdown and No Late Charges

Bill Code 015 - Standard GOLDPoint Systems Coupon without Payment Breakdown, with Late Charge Message

Bill Code 016 - Standard GOLDPoint Systems Coupon without Payment Breakdown, but with Late Charge plus Payment, Laser Only

Bill Code 017 - Standard GOLDPoint Systems Coupon without Payment Breakdown including Late Charge and Advertising Message

Free-format Statement

The following free-format statement will be created if:

| 1. | Coupon/Bill Code is 11. |

| 2. | Coupon/Bill Cycle is greater than or equal to 200. |

| 3. | Statement Code is greater than or equal to 120 and less than 130. |

The following is an example of the free-format statement:

. 64 1 128 234 FRED FLINDERS MONTHLY BILLING STATEMENT-CODE 11 WILMA FLINDERS 1525 W. 820 N. PROVO, UT 84604 ACCOUNT NBR PAYMENT STATEMENT DUE ON DATE 031 123456 05 6-01-14 5-22-14

PROPERTY ADDRESS: 1525 W. 820 N. SOCIAL SECURITY NBR: 222-66-8888

_________________________ BALANCES PRIOR TO PAYMENT DUE __________________________

PRINCIPAL RESERVE TAXES PAID INTEREST PAID INTEREST PAID TO BALANCE BALANCE YEAR-TO-DATE YEAR-TO-DATE RATE DATE

23,456.81 158.34 680.01 8.625 4-01-14

_______ DISTRIBUTION OF PAYMENT(S) RECEIVED SINCE LAST STATEMENT ( 4-21-14) ______

AMT TO PRINCIPAL AMOUNT TO PAYMENTS LATE CHARGE TOTAL RESERVES AND DEFERRED INT INT / DEF TO RESERVE PAYMENTS AMOUNT PAID PAID OUT

DISTRIBUTION OF PAYMENT DUE -------CURRENT PAYMENT-------- ------DELINQUENT AMOUNTS------ LATE TOTAL PRINCIPAL INTEREST RESERVE PRINCIPAL INTEREST RESERVE CHARGES AMOUNT DUE 80.01 168.02 48.43 79.43 168.60 48.43 592.92

*****YOU MAY DISPLAY AN ADVERTISING MESSAGE HERE*****

** RETAIN THIS PORTION FOR YOUR RECORDS **

__________________________________ PAYMENT COUPON ________________________________

* IMPORTANT -- PLEASE WRITE YOUR FRED FLINSTONE ACCOUNT NUMBER ON YOUR LOAN ACCOUNT NBR PAYMENT STATEMENT PAYMENT CHECK, AND RETURN IT DUE ON DATE WITH THIS PORTION TO OUR OFFICE. 031 123456 05 6-01-14 5-22-14

CURRENT PAYMENT............ 296.46 PAST DUE PAYMENTS ( 1)..... 296.46 UNPAID LATE CHARGES........ *************** TOTAL AMOUNT DUE..........* 592.92 * *************** * NOTE -- YOUR PAYMENT IS DUE ON 6-01-14 AND IS PAST DUE AFTER THAT DATE. PAYMENT MUST REACH OUR OFFICE BY 6-16-14. IF NOT, THEN ADD AN ADDITIONAL LATE CHARGE AMOUNT OF..................... 12.40 TOTAL DUE AFTER 6-16-14... 605.32

EXTRA PRINCIPAL PAYMENT...._____________ EXTRA RESERVE PAYMENT......_____________ ADVANCE PAYMENT(S)........._____________ DEPOSIT TO (SAVINGS/CHECKING) ACCOUNT NUMBER= ......___________09

TOTAL AMOUNT REMITTED......_____________

|

The free-format statement is printed on forms provided by your institution or by GOLDPoint Systems. GOLDPoint Systems will print statement information as well as company logos on an 8 1/2" by 11" page on a laser printer. If you provide GOLDPoint Systems with your own pre-printed forms, such as Moore business forms, you should use the "Q form." Q forms have a perforation at the lower portion of the page, allowing the customer to remove the payment coupon and return it to your institution.

At the top of the free-format statement is printed a line of information used for internal purposes only. Above the words "Monthly Billing Statement" appears four sets of numbers (see sample statement above).

•The first number is the number of this statement. For example, "189" means this is the 189th statement printed for your institution in this batch of statements.

•The second number is the page number of this statement. For most statements this will be "1," since most statements have only one page.

•The third number is the institution number assigned by GOLDPoint Systems to your institution. This number is beneficial to GOLDPoint Systems personnel only.

•The fourth number is the GOLDPoint Systems report number. Again, this number is beneficial to GOLDPoint Systems personnel only.

Several options are available for the free-format statement. You have the option to have the property address appear on the statement, if the loan has a property address. Property addresses are set up on the Customer Relationship Management > Households screen in CIM GOLD. The property address appears directly below the mailing address (see sample statement above). If you would like the property address to appear on the statement, please submit a work order with your request.

You also have the option to have optic scanner lines printed on the last line of the statement (see sample statement above). Optic scanner lines are used with lock box. If you would like this option please submit a work order with your request.