Field

|

Description

|

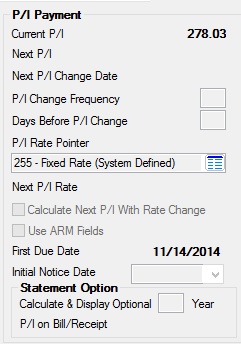

Current/Next P/I

Mnemonic: LNPICN, LNPINX

|

These fields are file maintainable on the ARM Rates & P/I Tables tab. The Current P/I is the portion of the regular payment that is divided between the amount to interest and the amount to principal. The Next P/I is the portion of the regular payment that is divided between the amount to interest and the amount to principal for the next P/I payment. (This field will be blank if it has not been calculated.)

|

Next P/I Change Date

Mnemonic: LNPIEF

|

This is the payment due date for the new P/I. It is the date the next P/I replaces the current P/I. This field is used in conjunction with the Next P/I field above. Enter the date using MMDDYYYY format, or use the drop-down calendar to select the date. See below for more information.

The P/I change date is used for both manual and automatic P/I changes. The Next P/I (above) will be calculated on the date of the number of days entered in the Days Before P/I Change field below prior to the actual date entered in the field.

In order to make changes manually, the P/I Change Frequency field below should be zero (0).

File maintenance to this file is done on the ARM Rates & P/I Tables tab.

|

WARNING: For new loans, the program uses the First Due Date field below. It will not calculate a new P/I until the date in the First Due Date field is in the past.

|

|

|

P/I Change Frequency

Mnemonic: LNAMPC

|

This field contains the frequency on which the P/I will change on this loan. It should be entered in months. If the P/I is supposed to change annually, “12” would be entered in this field. Enter "6" for semi-annual changes; "1" for monthly changes.

|

Days Before P/I Change

Mnemonic: LNAMID

|

This field contains the number of days prior to the P/I change date you want the new P/I to be calculated. You can use either 30 day months or actual number of days in the month. See below for more information.

If the number in this field is based on 30-day months and “75” is in the field, the new P/I will be calculated two months and 15 days prior to the P/I change date. For the rate and P/I to roll at the same time, this field should contain 30 more days than the Days Before Rate Change field.

Institution option 9 AMAD allows this field and the Days Before Rate Change field to work on actual day months.

The following is an example of how to determine exactly which night the new rate and P/I are calculated and when notice letters are generated. The example is using 30-day months with 75 days in the Days Before P/I Change; the Days Before Rate Change is 45, the Next Rate Change Date is 03-01, and the Next P/I Change Date is 04-01.

Using 30-day months means that for every full month you count back, you use 30 days regardless of the actual days in the month. If 03-01 is the rate change date, you would count 30 days for February and then back 15 more days in January (using Jan. 31st), ending up on 01-17. The system will always process the calculations and generate the change letters in the afterhours the night before the change date.

In the example above, if you use Institution Option AMAD, the actual number of days option, then the date will be 01-16. The system will generate the night before 01-16, which is also 75 days before the P/I change date. (Remember, in some years February has 29 days.)

|

Note: When using the 30-day month option (default), the system assumes every month consists of 30 days.

|

If Institution Option AMAD is used, the system will count every calendar day, including the 31st day of applicable months or 28/29 days for February, except as noted below. If the rate and P/I calculations occur within 5 days of one another, the system will roll them together when the rate adjustment normally would occur. When the adjustment occurs, the system will automatically create the appropriate ARM event letter notice.

If you are using the actual number of days option, the following will occur:

| • | If the P/I calculation date occurs prior to the rate change calculation date, only the new P/I will calculate on the P/I calculation date. The rate will then calculate on its scheduled date. |

| • | If the rate change calculation date occurs prior to the P/I change calculation date, and the P/I change date is within the next 5 days of the rate change calculation date, then both the rate and P/I will calculate on the rate change calculation date. |

|

|

P/I Rate Pointer

Mnemonic: LNRPTR

|

Select the P/I index rate pointer to be used for this account. Index rate pointers and descriptions are institution-defined and entered on the Loans > System Setup Screens > Interest Rate Table screen.

This field controls the rate at which the P/I is to be calculated. The rate pointer entered in this field should be the same as that entered in the Index Rate Pointer field on this screen unless the P/I payment should be calculated on a different rate than the loan is accruing.

|

Note: The P/I rate pointer will use the Lifetime Maximum Rate Cap and Lifetime Minimum Rate Cap fields when a new rate is calculated. However, if the accrual rate pointer and the P/I rate pointer are different indexes, then the P/I rate pointer does not use the periodic rate cap fields.

|

|

Next P/I Rate

Mnemonic: LNAMNI

|

This field contains the rate on which the next P/I was calculated. This field is only informational. File maintenance to this field will not affect the P/I calculations.

If there has been one or more P/I change calculations and the loan is delinquent, the system will find the accrual rate that was in effect at the time of the P/I calculation and use that rate, along with any margin or cap limits, to calculate the Next P/I Rate. This will only happen if the month of the accrual rate calculation is the same as the month of the P/I calculation.

|

Note: New P/I calculations that are not coordinated with a rate change will not use periodic or lifetime cap limits.

|

|

Calculate Next P/I With Rate Change

Mnemonic: MLUSNR

|

When this box is checked, each time a new rate is calculated, a new P/I will also be calculated, based on the rate change date. This field would generally be used for daily simple interest loans (payment method 6 with Use ARM Fields box checked below) that have annual payments, annual rate, and P/I changes. See below for more information.

Example: A loan is set up for annual payments due on November 4, with an annual rate change effective November 4 of this year and an annual P/I change effective November 4 of next year. The new rate and P/I payment are to be calculated on October 21 of this year (14 days prior to the rate change effective date).

Additional Information

The Rate Change Frequency and the P/I Change Frequency (above) fields must be the same. For example, if the Rate Change Frequency field contains 12 (12 months), the P/I Change Frequency field must also contain 12.

The Next P/I Change Date field above must be equal to, or one payment frequency behind, the Next Rate Change Date field. For example, if the rate change is 11/04 of the current year, the P/I could be 11/04 of the following year.

In the previous example, the Days Before Rate Change field is 14, and the number of days between the Next Rate Change Date field and the Next P/I Change Date is 365; therefore, the number of days before the P/I change would be calculated to be 379 (365 + 14 = 379).

|

Note: The Days Before P/I Change field above is not used, regardless of whether the field contains data. In addition, it automatically becomes non-file maintainable when the Calculate Next P/I With Rate Change checkbox is checked.

|

|

|

Use ARM Fields

Mnemonic: LNRTSN

|

This field will only be file maintainable if the loan is a daily simple interest (payment method 4 or 6). It is used for creating scheduled rate changes on simple interest loans. The default value is unchecked, which indicates that the ARM fields will not be used. If this field is checked, the system will act like this is an ARM loan (payment method 7). It is from these fields that scheduled rate changes are created. Even though you may access the ARM fields, the system will still use the simple interest calculations for the loan.

|

First Due Date

Mnemonic: LN1DUE

|

This is the date the first payment on the loan is due. It is used with the P/I change date and the statement option. File maintenance to this file is done on the Loans > Account Information > Account Detail screen.

|

Initial Notice Date

Mnemonic: M1ITDT

|

The Initial Notice Date field controls if and when an Initial Rate Change Notices (FPSRP314) will be generated. In addition, a loan must be a payment method 7, or a payment method 6 with the Use ARM Fields field above checkmarked and the General Category 1-39. See below for more information.

The Truth in Lending Act (Reg Z) requires that an Initial Rate Change notice be provided to consumers that have an adjustable rate mortgage (ARM) that is a closed-end consumer credit transaction secured by the consumer’s principal dwelling in which the annual interest rate may increase after consummation. If the new interest rate (or the new payment calculated from the new interest rate) is not known as of the date of the notice, then an estimate must be disclosed and identified as an estimate. Refer to the actual regulation for additional information pertaining to the notice requirements.

This notice is a rendered form, meaning that preprinted forms are not used. Headings, logos, etc., are printed at the time the notice is generated. Notices can be printed at your office, eliminating the need for GOLDPoint Systems to print and ship them to you. In addition, complete copies of notices, including logos, boxes, and headings, are stored in GOLDView, providing you with the ability to reprint an exact copy of the notice.

For more information, see the Initial Rate Change Notices (FPSRP314) documentation on DocsOnWeb.

|

|

Statement Option field group

Mnemonic: MLTRMY

|

The Calculate & Display Optional Year P/I on Bill/Receipt field in this field group stores the number of years to be used for the optional P/I to be displayed on the Bill and Receipt (FPSRP003). A message on the statement shows an optional P/I that would amortize the loan on a shorter term than the contractual term. Open the link below for more information.

For example, if the loan is a 30-year ARM and you enter "15" in this field, then when the bill and receipt is created, a message will indicate what the optional P/I would be to amortize the loan as though it had been a 15-year loan. The P/I is always calculated based on the first payment due date and the current principal balance. In other words, it doesn’t calculate 15 years from the statement date but 15 years from the beginning of the loan.

In the above example, if the loan term is 360 months and 12 installments have been paid, the term used to calculate the 15-year optional P/I would be 168 (180 months minus 12 payments equals 168 remaining payments).

The optional P/I is calculated by taking the number of payments represented in this field (if 15 is stored in this field, the system converts it to 180 (15 years x 12 months/year)) and subtracting the number of installments paid to determine the remaining number of payments. The system then uses the remaining number of payments and the current principal balance to calculate the optional P/I.

Once the number of installments on the loan reaches the number of years in the field, then the disclosure on the bill and receipt stops. In the above example, when 180 installments have been made the message stops.

If the optional P/I would be less than the actual P/I, then the message will not appear.

|

|