Navigation: Loans > Loan Screens > Account Adjustment Screen >

Multiple Payment Applications field group

Use this field group to set up custom payment schedules for the customer account, if applicable.

The Multiple Payment Applications field group on the Account Adjustment screen allows file maintenance for one or all 12 months, depending on the status of the Multiple Payment Applications checkbox field above the field group (mnemonic LNMULP). If that checkbox field is left blank, only one field will be available in this field group. See below for more information about this App Code field.

The payment application code that is entered in this single field will make the payment the same each month.

See below for a list of payment application codes and their descriptions. |

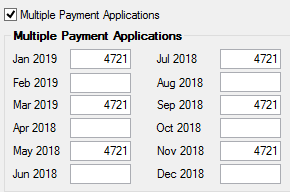

If the Multiple Payment Applications checkbox field is marked, the system opens 12 fields in this field group, one for each month (mnemonic LNAPPL, LNAPP2-LNAPP9, LNAPPA, LNAPPB, LNAPPC). The 12 fields are a 12-month "rolling" year (the example below illustrates a "rolling" year). Each field allows you to indicate how to spread the payment for that month. If nothing is entered for a particular month, no payment is expected.

An example of a multiple payment application schedule for a term of twelve (12) months might be as follows:

In the months when a payment is expected, this field will contain a payment application code (example: 214 where 2 = interest, 1 = principal, and 4 = late charges) in accordance with your agreement with their customer to collect principal, interest, late charges, etc.

The following is a list of payment application codes and their descriptions:

Code |

Description of Payment Application Code |

|---|---|

0 |

A zero or a blank space will allow skipping a loan payment only for payment method 5 or 6 loans. |

1 |

Amount to principal |

2 |

Amount to interest |

3 |

Amount to reserve 1 |

4 |

Amount to late charges |

6 |

Amount to reserve 2 |

7 |

Amount to total loan fees |

8 |

Amount to maintenance fee |

5, 9 |

Reserved for future use |

Late Charges

The late charge program will not assess a late charge in months where no payment is required due to seasonal payments. Using the schedule above, if the customer does not make their April payment, a late charge will be assessed for April. Since no payment is due for the months May, June, July, or August, no late charges will be assessed for those months. If the September payment is not made, then a late charge will be assessed for the September payment. During the months of May, June, July, and August, a late charge for April is owing and therefore will be indicated as such on the statement.