Navigation: Loans > Loan Screens > Transactions Screen Group > Make Loan Payment Screen > Payment Selection field group >

Interest Only Payment

Click the Interest Only radio button in the Payment Selection field group to process an Interest-only Payment (tran code 2600-03).

The amount of this transaction must be for at least 30 days of interest (even if 30 days of interest isn't due), plus fees and late charges. The 30-Day Interest Inquiry identifies the interest amount (see 30-Day Interest Inquiry, transaction code 2170-00).

Institution option IPCL, if set to "N" (no), will stop the transaction if the loan is a contract (when the Purchased radio button on the Loans > Account Information > Additional Loan Fields screen, Origination/Maturity tab, is selected). This type of payment also cannot be processed if the account uses Special Charge-Off Processing.

|

Note: If institution option IORC is set to "1," then the following requirements must be fulfilled before an interest-only payment will be allowed:

1.The principal balance must be below $10,000.00.

2.The original maturity (MLOMAT) must be in the future. If MLOMAT is blank, then the loan maturity date (LNMATD) will be used instead.

3.The loan opened date (LNOPND) must be three or more months ago.

4.Three full payments must have been made on the loan. A payment is considered a full payment if the history's partial amount plus amount to fees plus amount to principal plus amount to interest plus amount to late charges is less than the principal/interest constant as of the history date.

5.The last payment can't be an interest-only payment.

6.Allow the payment if this is the second interest-only payment in the calendar year. You can also allow a third interest-only payment made in a calendar year, if the third payment is being made in December. |

|---|

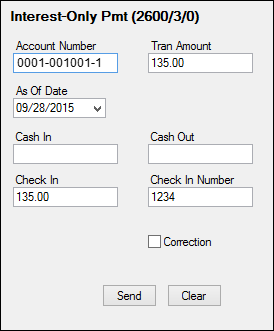

After you enter information in the Transaction Information field group and click <OK>, CIM GOLDTeller launches with the Interest-only Payment transaction displayed, as shown below:

This transaction rolls the loan due date at least one payment frequency when the 30-day interest amount is paid. The transaction disregards the Payment Application and applies the money to fees, late charges, interest, and principal (in that order). Once the fees and late charges are paid, it then posts to all interest that is accrued, and if any amount is left over, it then applies that amount to principal. (If the amount of interest accrued is not at least as much as 30-days interest, you still must collect the 30-day interest amount and the difference is credited to the principal balance.) The Applied To Payment field on the Loans > Account Information > Account Detail screen > Account tab, is always cleared to zero.

When you process this transaction:

•The Due Date (Account tab) is advanced by at least one frequency (see next bullet).

•This transaction adds the amount posted to principal, plus the amount in Applied To Payment, and divides that by the PI Constant (Account Detail screen > Payment Detail tab). It then rolls the due date by the number of P/I Constants that are satisfied, and any remaining amount will stay in Applied To Payment. (The net result is that it is rolling the due date by more than one frequency depending on the amount in the Partial Payments/Applied To Payment field.)

•The Maturity Date (Additional Loan Fields screen > Origination/Maturity tab) always advances by one frequency.

•The Date Last Accrued field (Account tab) will be updated to the date the transaction was processed.

•The Date Interest Paid To field (Account Detail screen > Interest Detail tab) will be updated.

This transaction does not affect variance fields. The history description for this transaction is "Int Only Payment."

|

Note: If the amount of insurance refunds and/or precomputed interest refund is enough to pay off a loan, the message "REFUNDS COULD CLOSE LOAN/SEE PAYOFF" will be displayed when any of the following transactions are processed:

CP2 Transaction (tran code 2600-00) Insurance Payment (tran code 2600-01) Collection Payment (tran code 2600-02) Interest-Only Payment (tran code 2600-03) Mail-In Payment (tran code 2600-04) Walk-In Payment (tran code 2600-05) Regular Payment with CP2 Eligibility Test (tran code 2600-07) No Advance Payment (tran code 2600-09)

Be aware that these refunds may not in themselves be enough to pay off the loan; it may require a portion of the payment that is being posted.

Example: The loan balance is $100.00, and the principal and interest payment is $75.00. The refunds from insurance amortization and precomputed interest equal $40.00. As you attempt to post the loan payment, the system will return with the following message: "REFUNDS COULD CLOSE LOAN/SEE PAYOFF." You would then process a Payoff transaction (on the Payoff screen), which reduces the principal balance by $40.00, and then use a portion of the $75.00 insurance payment to apply toward the remaining payoff amount. You would then refund the difference of $15 to the customer. |

|---|

See also: