Navigation: Loans > Loan Screens > Transactions Screen Group > Make Loan Payment Screen > Payment Selection field group >

Collection Payment

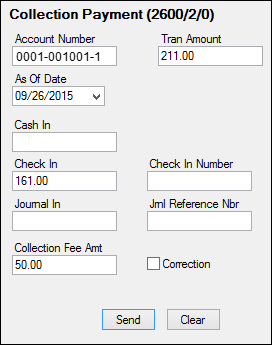

Click the Collection Payment radio button in the Payment Selection field group to process a Collection Payment (tran code 2600-02).

This transaction is processed when the loan payment is received by a third party (such as an attorney or collection agency). Attorneys or collection agencies deduct their fee and forward a new check to your institution, which is the payment amount minus their fee. Using this transaction increases the principal balance on the loan by the amount of the fee, and combines the principal increase amount with the check received and posts the full loan payment. (It does both a journal and a check transaction.)

To make a Collection Payment:

| 1. | After accessing the correct account for which you want to make this payment, select the Collection Payment radio button on the Make Loan Payment screen. |

| 2. | Select either the Check or Cash radio button depending on whether the payment is being made with cash or check (usually check). |

| 3. | If the borrower has more than one account, select the account for this payment from the Account Number field. |

| 4. | Enter the amount of the attorney or collection agency fee in the Fee Amount field. |

| 5. | Select today's date in the Effective Date field. |

| 6. | Click <OK>. Once you click <OK>, the Collection Payment transaction is displayed in CIM GOLDTeller with the fields already entered, as shown below: |

| 7. | Click |

|

Note: This transaction is different from the Agency Payment transaction (tran code 2600-10) because this transaction increases the principal balance of the loan by the fee amount. |

|---|

Example: The actual loan payment amount is $160.00. The attorney received the borrower's check for $160.00 but held back the attorney fee of $20.00. The attorney forwarded a check to you for $140.00.

You would process the check as follows:

1.In the Transaction Amount field, enter "160.00."

2.In the Fee Amount, enter "20.00."

3.In the Check In field, enter "140.00."

The transaction will increase the principal balance by $20.00 (tran code 500 journal). It will then process a journal payment for $20.00 (tran code 600 journal), and another loan payment for $140.00 (tran code 600 check).

The history description for this transaction consists of three descriptions: "Collection Fee, Collection Pmt, Collection Pmt."

|

Note: If the amount of insurance refunds and/or precomputed interest refund is enough to pay off a loan, the message "REFUNDS COULD CLOSE LOAN/SEE PAYOFF" will be displayed when any of the following transactions are processed:

CP2 Transaction (tran code 2600-00) Insurance Payment (tran code 2600-01) Collection Payment (tran code 2600-02) Interest-Only Payment (tran code 2600-03) Mail-In Payment (tran code 2600-04) Walk-In Payment (tran code 2600-05) Regular Payment with CP2 Eligibility Test (tran code 2600-07) No Advance Payment (tran code 2600-09)

Be aware that these refunds may not in themselves be enough to pay off the loan; it may require a portion of the payment that is being posted.

Example: The loan balance is $100.00, and the principal and interest payment is $75.00. The refunds from insurance amortization and precomputed interest equal $40.00. As you attempt to post the loan payment, the system will return with the following message: "REFUNDS COULD CLOSE LOAN/SEE PAYOFF." You would then process a Payoff transaction (on the Payoff screen), which reduces the principal balance by $40.00, and then use a portion of the $75.00 insurance payment to apply toward the remaining payoff amount. You would then refund the difference of $15 to the customer. |

|---|

See also:

Payment Selection field group.