Navigation: Loans > Loan Screens > Transactions Screen Group > Make Loan Payment Screen > Payment Selection field group >

Insurance Payment

Click this radio button in the Payment Selection field group to process an Insurance payment transaction (tran code 2600-01). This transaction is processed if the monthly loan payment is received from an insurance company. This transaction is similar to the regular payment (tran code 600), but this transaction posts with an insurance type, and you can waive any fees (such as late charges) at the same time as the payment.

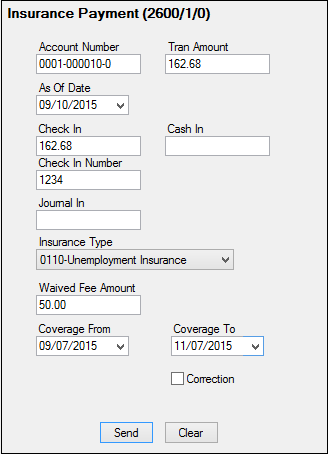

Once you enter information in the Transaction Information fields and click <OK>, GOLDTeller launches with the Insurance Payment transaction displayed and the fields already entered with the information you previously entered on the Make Loan Payment screen, as shown below:

This transaction has the following fields:

Account Number

Transaction Amount

As of Date

Check In

Check In Number

Cash In

Journal In

Insurance Type (This field may have a different name, such as Descriptor or F/M 1. Someone at your institution with proper security should change the name of this field to "Insurance Type," and then add all possible insurance descriptors used by your institution to the drop-list. This is explained in detail in the CIM GOLDTeller User's Guide > CIM GOLDTeller Screen Details > Functions > Administrator Options > Transaction Design > Creating a drop-list field. See descriptor definitions below.)

Waived Fee Amount (These are any late charge fees that should be waived.)

Coverage From

Coverage To

The following are the descriptors (insurance types) used in the Insurance Type field:

Descriptor |

Description |

|---|---|

0100 |

Accident and Health Insurance |

0110 |

Unemployment Insurance |

0120 |

Property Insurance |

0130 |

Credit Life Insurance |

0140 |

GAP Insurance - Auto |

0141 |

GAP Insurance - Motorcycle |

0142 |

GAP Insurance - RV |

0150 |

User Defined Insurance |

0165 |

AD&D Insurance |

0171 |

LPD (AUTO) Insurance |

0172 |

Property Dual |

0173 |

Property Dual Protected |

0175 |

Collateral Plus |

0190 |

VSI Insurance |

0191 |

Non-File Insurance |

0197 |

Homegard Insurance |

0198 |

Flood Insurance |

0199 |

Fire Insurance |

By indicating the Insurance Type, the description of the transaction is stored in history identifying this is an insurance payment.

If an amount is entered in the Waived Fee Amount field, the transaction will reduce the amount in the Late Charges Due field (LNLATE). Note: You may want to change the Waived Fee Amount description to "Waived Late Charges" in the GOLDTeller setup to make it more clear. Changing field names is done on the Functions > Administrator Options > Transaction Design in CIM GOLDTeller. Right-click the Waived Fee Amount field to bring up the Field Properties screen and change the name of the field.

The payment is applied in the order designated in the Payment Application field.

When making an insurance payment, an open policy must be in effect for the insurance type for which you are making the payment, or the transaction will not run.

If you don't enter a late charge amount:

1.It automatically waives the last unpaid late charge.

2.It does not decrease the number of times assessed.

3.It does increase the number of times waived.

|

Note: Some states don't allow late charges to be collected after injuries or layoffs. You will need to determine what late charges were assessed before and after the injury, and waive the applicable charges. |

|---|

If the Insurance Payment transaction is run for at least two consecutive months, the system automatically assigns Special Comments code AB (Account being paid by insurance) to the account for Credit Reporting purposes. See the Special Comments field on the Credit Reporting screen for more information.

The history description for this transaction is the type of insurance you entered in the Insurance Type field on this transaction (for example, "A&H Ins Payment").

|

Note: If the amount of insurance refunds and/or precomputed interest refund is enough to pay off a loan, the message "REFUNDS COULD CLOSE LOAN/SEE PAYOFF" will be displayed when any of the following transactions are processed:

CP2 Transaction (tran code 2600-00) Insurance Payment (tran code 2600-01) Collection Payment (tran code 2600-02) Interest-Only Payment (tran code 2600-03) Mail-In Payment (tran code 2600-04) Walk-In Payment (tran code 2600-05) Regular Payment with CP2 Eligibility Test (tran code 2600-07) No Advance Payment (tran code 2600-09)

Be aware that these refunds may not in themselves be enough to pay off the loan; it may require a portion of the payment that is being posted.

Example: The loan balance is $100.00, and the principal and interest payment is $75.00. The refunds from insurance amortization and precomputed interest equal $40.00. As you attempt to post the loan payment, the system will return with the following message: "REFUNDS COULD CLOSE LOAN/SEE PAYOFF." You would then process a Payoff transaction (on the Payoff screen), which reduces the principal balance by $40.00, and then use a portion of the $75.00 insurance payment to apply toward the remaining payoff amount. You would then refund the difference of $15 to the customer. |

|---|

See also: