Navigation: Loans > Loan Screens > Transactions Screen Group > Make Loan Payment Screen > Payment Selection field group >

Mail-In Payment

Click the Mail-in Payment radio button in the Payment Selection field group to process a Mail-In Payment transaction (tran code 2600-04). This transaction works like a Regular Payment (tran code 600) and follows the same rules (see Regular Payment Options).

1.Select the Mail-In Payment radio button.

2.Enter payment information in the fields in the Transaction Information field group.

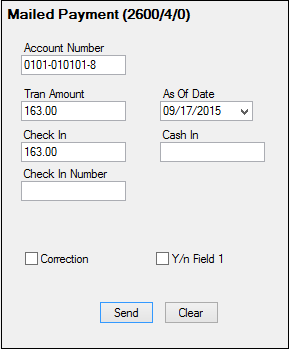

3.Click <OK>. CIM GOLDTeller will open up with the Mail-In Payment transaction box displayed and the information you entered will be displayed on the transaction, as shown in the following example.

4.If all the information is correct, click ![]() . The system will return you to the Make Loan Payment screen and the payment will be recorded. If the following message appears after you click

. The system will return you to the Make Loan Payment screen and the payment will be recorded. If the following message appears after you click ![]() , "CANNOT PROCESS ON CARD LOAN," you will need to make the payment using the Loans > Transactions > EZ Pay screen.

, "CANNOT PROCESS ON CARD LOAN," you will need to make the payment using the Loans > Transactions > EZ Pay screen.

The history description for this transaction is "Mail-In Payment."

Corrections

If you need to make a correction to a Mail-in Payment, you should complete steps 1-3 above, but when the Mail-In Payment transaction box appears from CIM GOLDTeller, check the Correction box. If you want to assess a non-sufficient funds fee at the same time as the corrected transaction, check the Y/n Field 1 box. For example, a customer mailed in a payment with a check. The check later bounces due to insufficient funds. You would need to correct the Mail-In Payment transaction and assess a non-sufficient-funds fee at the same time.

|

Tip: The name of this field should be changed to "Assess NSF Fee." Changing field names is done on the Functions > Administrator Options > Transaction Design in CIM GOLDTeller. Right-click the Y/n Field 1 field to bring up the Field Properties screen and change the name of the field. |

|---|

Once you click ![]() on the corrected Mail-In Payment transaction, the system reverses the Mail-In Payment transaction and assesses the non-sufficient funds fee (as set up on the Loans > Account Information > Account Detail screen > Late/NSF tab > NSF Fields).

on the corrected Mail-In Payment transaction, the system reverses the Mail-In Payment transaction and assesses the non-sufficient funds fee (as set up on the Loans > Account Information > Account Detail screen > Late/NSF tab > NSF Fields).

|

Note: If the amount of insurance refunds and/or precomputed interest refund is enough to pay off a loan, the message "REFUNDS COULD CLOSE LOAN/SEE PAYOFF" will be displayed when any of the following transactions are processed:

CP2 Transaction (tran code 2600-00) Insurance Payment (tran code 2600-01) Collection Payment (tran code 2600-02) Interest-Only Payment (tran code 2600-03) Mail-In Payment (tran code 2600-04) Walk-In Payment (tran code 2600-05) Regular Payment with CP2 Eligibility Test (tran code 2600-07) No Advance Payment (tran code 2600-09)

Be aware that these refunds may not in themselves be enough to pay off the loan; it may require a portion of the payment that is being posted.

Example: The loan balance is $100.00, and the principal and interest payment is $75.00. The refunds from insurance amortization and precomputed interest equal $40.00. As you attempt to post the loan payment, the system will return with the following message: "REFUNDS COULD CLOSE LOAN/SEE PAYOFF." You would then process a Payoff transaction (on the Payoff screen), which reduces the principal balance by $40.00, and then use a portion of the $75.00 insurance payment to apply toward the remaining payoff amount. You would then refund the difference of $15 to the customer. |

|---|

See also: