Navigation: Loans > Loan Screens > Bankruptcy and Foreclosure Screen Group > Bankruptcy Screen >

When a person files for bankruptcy with the U.S. Bankruptcy Court, the Bankruptcy Court will send your institution a letter notifying you of the intent for bankruptcy. When you receive this letter, you will use the Bankruptcy screen to enter information about the bankruptcy proceedings as follows:

1.Find the account and select a participant on the Loan Participants tab.

2.Access the Case Information tab, and enter the chapter of bankruptcy the person has filed for in the Chapter field (BKCHAP).

3.Enter the case number of the bankruptcy lawsuit in the Case field (BKCASE).

4.Enter the date the bankruptcy was filed with the court in the Date Bankruptcy Filed field (BKFILD).

5.Enter the date you received the bankruptcy notice in the Notice Received field (BKNRCD).

6.Click <Run Transaction> to run the transaction.

When a bankruptcy transaction is run on a customer loan account, the following actions take place on the account:

•The system places Hold Code (LNHLD1-4) 4 (Bankruptcy - Chapter 7, 11 or 12) or 5 (Bankruptcy - Chapter 13) on the account. Note: If all four of the Hold Code fields are filled before the bankruptcy transaction is run, you will receive an error. You will need to clear one of the Hold Code fields before running the Bankruptcy transaction.

•Action Code 94 (credit bureau date of occurrence) and the date (LNACCD, LNA2-9CD, LNA10C) the bankruptcy transaction is run are set up on the account. This means the account will be reported as bankrupt during monthend credit reporting.

•The applicable Consumer Information Indicator (NDCIID) is set up accordingly on the account for monthend credit reporting purposes.

oIf Chapter 7, the CIID is "A - Petition for Chapter 7 Bankruptcy."

oIf Chapter 11, the CIID is "B - Petition for Chapter 11 Bankruptcy."

oIf Chapter 12, the CIID is "C - Petition for Chapter 12 Bankruptcy."

oIf Chapter 13, the CIID is "D - Petition for Chapter 13 Bankruptcy."

•Late Charge Code (LNLTCD) on the Loans > Account Information > Account Detail screen > Late/NSF tab) is set to "0 - No Late Charge."

•If institution option BKLC is set up for your institution, unpaid late charges due (LNLATE) will not be waived once the bankruptcy transaction is waived. If it is not set up, all late charges are waived.

•If institution option KLLT is set up for your institution, the life-of-loan late charges will not be deleted from the account. If your institution does not have that option set up, the amount in the Lifetime Late Charges Collected field (LNLLTC) will be deleted.

•Do Not Send Statements for This Account (LNSCYC) is checked on the CIF tab of the Marketing and Collections screen. The account will no longer receive statements. If the debt is later reaffirmed (see Reafirmation in the Action field group), the Do Not Send Statements for This Account box will open up for file maintenance, and you can uncheck the box if you want to continue sending the account owner statements. Note: Institution option STBK (Stop All Billing Statements on Bankrupt Loans) must be on in order for the system to stop sending statements.

•If you have been ordered by the Bankruptcy Court to no longer call, email, or contact the borrower, you should change the phone and email restrictions accordingly. To do so, use the CIF tab on the Marketing and Collections screen, then click the Edit Phone and Edit Email links. Find the Phone Restriction and Email Restriction fields and set them to "13 - Contact Attorney Only" or "1 - No email allowed" respectively.

•Any automatic or recurring payments set up on the account are stopped. The Charge-off transaction (from the Loans > Transactions > Charge Off Transactions screen) may also need to be run in order to charge off any remaining amount of the loan.

•Additionally, you can use the Repayment Plan tab if the bankruptcy proceedings call for a repayment of the debt.

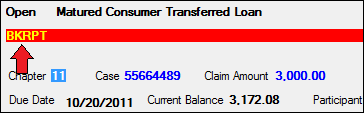

•The Account Status will display the message "BKRPT" at the top of the screen for the account, as shown below:

Other institution options may affect what occurs on the account when a bankruptcy transaction is run. See Bankruptcy Institution Options for more information.

Other Bankruptcy Transactions

As the bankruptcy moves along, your institution will receive further notices from the bankruptcy courts as to how to handle the loan.

•You may need to discharge the loan and all the debt, no longer requiring the debtor to make payments.

•You may need to restructure the debt, so the debtor continues making payments to avoid repossessing their collateral.

•The bankruptcy may be dismissed by the judge, so the bankruptcy is thrown out and you will need to reverse the bankruptcy.

•The debtor may choose to convert the chapter of bankruptcy they have filed.

•Your institution may want to withdraw your claims during the bankruptcy.

For any of these actions, use the radio buttons in the Action field group on the Case Information tab to run further transactions involving this bankruptcy.

Additionally, if you need to set up a new repayment plan as ordered by the court, use the Repayment Plan tab.

Remove Bankruptcy Transaction

If you decide to remove the bankruptcy, click <Undo Transaction> at the bottom of the Case Information tab. The Remove Bankruptcy transaction causes the following to occur:

•Clears bankruptcy chapter (BKCHAP).

•Clears bankruptcy file date (BKFILD).

•Clears bankruptcy case (BKCASE).

•Clears bankruptcy claim amount (BKACLM).

•Clears bankruptcy claim date (BKDCLM).

•Clears bankruptcy reaffirmed date (BKFIRD).

•Clears bankruptcy cancel date (BKCAND).

•Clears bankruptcy withdraw date (BKWTDR).

•Clears the reaffirmed indicator (BKFIRM).

•Clears bankruptcy converted date (BKCVDE).

•Set the bankruptcy Consumer ID and date (BKCIID, BKCIDT).

•Clears hold codes 4 (Chapter 7, 11, 12) or 5 (Chapter 13).

•Clears action code 94 if the Bankruptcy transaction put it on.

•Any automatic or Recurring payments that were previously set up on the account are started again.

•If late charges were waived as part of the Bankruptcy transaction, the Remove Bankruptcy transaction will add them back on.

|

Note: The Remove Bankruptcy transaction can only be run if the Bankruptcy transaction was run previously. If late charges were waived as part of the Bankruptcy transaction, the Remove Bankruptcy transaction will add them back on. |

|---|