Navigation: Loans > Loan Screens > Bankruptcy and Foreclosure Screen Group > Bankruptcy Screen >

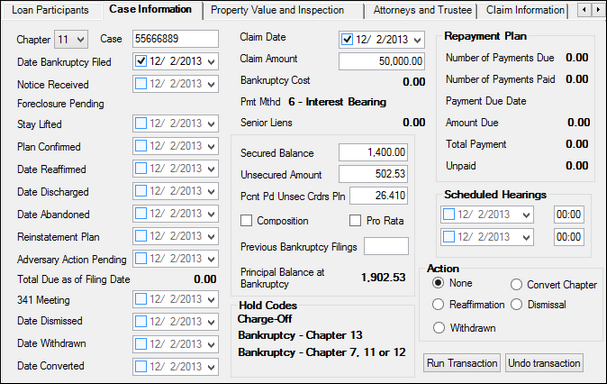

The Case Information tab on the Bankruptcy screen is used to record bankruptcy information and run the Bankruptcy transaction and any follow-up bankruptcy actions. You must first select at least one customer on the Loan Participants tab before entering information on this tab.

Once all necessary information has been entered on this tab, click <Run Transaction>. See the Bankruptcy Transactions help page to learn more about running or undoing bankruptcy transactions.

Loans > Bankruptcy and Foreclosure > Bankruptcy Screen > Case Information Tab

The fields on this tab are as follows:

Field |

Description |

||||||||||||||||||||||||

|

Mnemonic: BKCHAP |

Use this field to indicate the bankruptcy chapter being applied to the customer loan account. Possible choices are bankruptcy chapter 7, 11, 12, or 13.

See below for more information.

|

||||||||||||||||||||||||

|

Mnemonic: BKCASE |

Use this field to indicate the bankruptcy case number for the customer loan account. The bankruptcy court will send you a letter notifying you of the case number. |

||||||||||||||||||||||||

|

Mnemonic: BKFILD |

Use this field to indicate the date shown on the bankruptcy notice as the filing date for the customer loan account. When running the Bankruptcy Transaction, this field will default to the current date (if previously left blank). All bankruptcy calculations should be run as of this date.

|

||||||||||||||||||||||||

|

Mnemonic: BKNRCD |

Use this field to indicate the date the bankruptcy notice was received by your institution for the customer loan account. |

||||||||||||||||||||||||

|

Mnemonic: BKFCPN |

Use this field to indicate whether the customer loan account was in the foreclosure process when the bankruptcy was filed. Next to the checkbox is the date the bankruptcy notice was received by your institution. |

||||||||||||||||||||||||

|

Mnemonic: BKSTAD |

Use this field to indicate the date the stay was lifted by the bankruptcy court on the customer loan account, if applicable. A lift of stay means the loan can continue as is during bankruptcy proceedings. Your institution can still require payments from the borrower, collect interest, assess late charges, etc.

|

||||||||||||||||||||||||

|

Mnemonic: BKCONF |

Use this field to indicate the date a proposed bankruptcy plan was confirmed by the court on the customer loan account. Use the Repayment Plan tab to establish a new repayment plan instituted by the bankruptcy court. |

||||||||||||||||||||||||

|

Mnemonic: BKFIRD |

Use this field to indicate the date the customer filed his intention to retain collateral and reaffirm debts secured by the collateral.

|

||||||||||||||||||||||||

|

Mnemonic: BKCHRD |

Use this field to indicate the date the debt on the customer loan account was discharged by the court and the customer was designated no longer liable for the debt. |

||||||||||||||||||||||||

|

Mnemonic: BKABAD |

Use this field to indicate the date the trustee abandoned property from the bankruptcy estate, thereby releasing it to the debtor. See section 544 (a) and (b). |

||||||||||||||||||||||||

|

Mnemonic: BKPLND |

Use this field to indicate the date upon which the bankruptcy court has ordered the reinstatement plan to begin on the customer loan account. |

||||||||||||||||||||||||

|

Mnemonic: BKAAPD |

Use this field to indicate the date adversarial action was undertaken on the customer loan account. |

||||||||||||||||||||||||

|

Mnemonic: N/A |

This field displays the total amount due, including late charges and fees, on the customer loan account as of the file date.

The Bankruptcy Transaction calculates the total due as follows:

_______________________

= Total Due |

||||||||||||||||||||||||

|

Mnemonic: BK341M |

Use this field to indicate the date of the 341 Meeting, which is a meeting of creditors (Section 341 of the Bankruptcy Code). |

||||||||||||||||||||||||

|

Mnemonic: BKCAND |

Use this field to indicate the date the bankruptcy on the customer loan account was ordered dismissed by a judge. |

||||||||||||||||||||||||

|

Mnemonic: BKWTDK |

Use this field to indicate the date the bankruptcy on the customer loan account was withdrawn by the filer. |

||||||||||||||||||||||||

|

Mnemonic: BKCVDE |

Use this field to indicate the date the bankruptcy was converted from one chapter to another on the customer loan account.

This field is automatically entered by the system if the Convert Chapter radio button is selected in the Action field group. |

||||||||||||||||||||||||

|

Mnemonic: BKDCLM |

Use this field to indicate the claim date of this bankruptcy for the customer loan account. This information should be provided to your institution from the bankruptcy notice sent to you from the bankruptcy courts. |

||||||||||||||||||||||||

|

Mnemonic: BKACLM |

Use this field to indicate the amount of the institution’s bankruptcy claim submitted to the court on the customer loan account. |

||||||||||||||||||||||||

|

Mnemonic: BKACST |

This field displays the total cost of the bankruptcy incurred by the institution on the customer loan account. This value is the total of the six bankruptcy cost fields on the Claim Information tab. |

||||||||||||||||||||||||

|

Mnemonic: LNPMTH |

This field displays the payment method on the customer loan account, as indicated on the Loans > Account Information > Account Detail screen. |

||||||||||||||||||||||||

|

Mnemonic: BITOTS |

These fields display the total number of senior liens and the total dollar amount of senior liens on the customer loan account. |

||||||||||||||||||||||||

|

Mnemonic: BKSEBA |

Use this field to indicate the balance that is covered by security on the customer loan account. |

||||||||||||||||||||||||

|

Mnemonic: BKUSAT |

Use this field to indicate the balance that is not covered by security on the customer loan account. |

||||||||||||||||||||||||

|

Mnemonic: BKPPUC |

Use this field to indicate the percentage of the amount paid to any unsecured creditor on the customer loan account.

This field accepts four digits before the decimal and three digits after the decimal (for example, 9999.999). |

||||||||||||||||||||||||

|

Mnemonic: BKCPSN |

Use this field to indicate whether the bankruptcy claim on the customer loan account was settled as a result of a composition of creditors. |

||||||||||||||||||||||||

|

Mnemonic: BKPRTA |

Use this field to indicate whether the creditors on the customer loan account agreed to accept partial payment of their amount of the claim to be divided pro rata between them. |

||||||||||||||||||||||||

|

Mnemonic: BKPBKF |

Use this field to indicate the previous chapter number if the bankruptcy on the customer loan account has been converted. This field is automatically entered if the Convert Chapter radio button is selected in the Action field group. |

||||||||||||||||||||||||

Prinicpal Balance at Bankruptcy

Mnemonic: BKPBAL |

Use this field to indicate the principal balance of the loan at the time the bankruptcy was filed on the customer loan account. This field is automatically entered when <Run Transaction> is clicked. |

||||||||||||||||||||||||

These fields display hold codes associated with the customer loan account, as indicated on the Loans > Account Information > Account Detail screen. The appropriate Hold code is automatically added when the Bankruptcy Transaction is run. Note: If the customer account already has four active Hold Codes, a Bankruptcy transaction cannot be processed until one of the Hold Codes is removed to make room for the bankruptcy hold code. |

|||||||||||||||||||||||||

Repayment Plan field group |

See Repayment Plan field group for more information. |

||||||||||||||||||||||||

|

Mnemonics: BKHRD1-2, BKHRT1-2 |

Use these fields to indicate the date and time of the next (or most recent) bankruptcy hearings for the customer loan account. See the help pages linked on the Bankruptcy main screen help to learn more about how bankruptcy filing functions. |

||||||||||||||||||||||||

Action field group |

See Action field group for more information. |