Field

|

Description

|

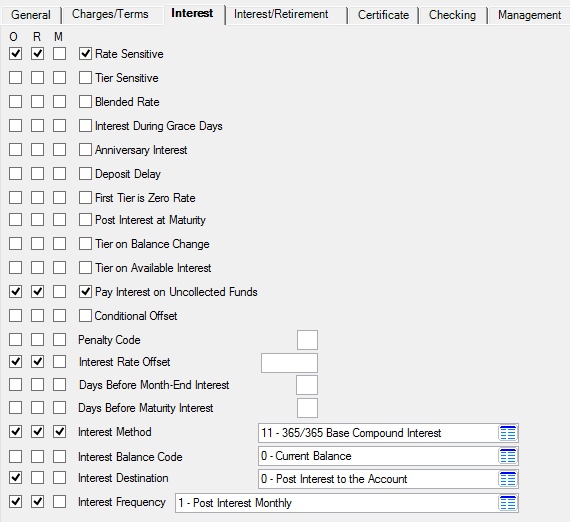

Rate Sensitive

Mnemonic: PCVART

|

Use this field to indicate whether the product is rate sensitive. Being rate sensitive means that on the Effective Date of the product's selected Rate Pointer, the rate will change accordingly for all customer accounts using the product code.

This field must be left blank and the Pay Interest on Uncollected Funds field below must be marked in order to select "02 - Cycle Average Balance" in the Interest Balance Code field below.

|

Tier Sensitive

Mnemonic: PCVATR

|

Use this field to indicate whether the product is tier sensitive. Being tier sensitive means that, on the effective date for the tier pointer on your institution's Tier Table, tiers will change accordingly for all accounts using the Tier Table.

Rate tiers must first be set up on the Deposits > Definitions > Rate Tiers screen before they can be used on this screen.

|

Blended Rate

Mnemonic: PCBLRT

|

Use this field to indicate whether the product uses a blended rate. Blended interest rates requires the use of a tier table. If blended rates are in use, interest is accrued differently on different segments of the account balance. One interest rate is assigned to the portion of the account from $.01 to the first tier level, another interest rate to the portion of the account from the first tier level to the second tier level, and another interest rate to the portion of the account from the second tier level to the third tier level.

Rate tiers must first be set up on the Deposits > Definitions > Rate Tiers screen before they can be used on this screen.

|

Interest During Grace Days

Mnemonic: PCINGR

|

Use this field to indicate whether interest is posted to the customer account during the grace period, if the product is a Certificate account.

Features for customer certificate accounts can be adjusted on the Certificate Fields tab of the Deposits > Account Information > Additional Fields screen as well as the Certificate Fields field group on the Deposits > Account Information > Account Information screen.

|

Anniversary Interest

Mnemonic: PCIANV

|

Use this field to indicate whether interest is posted to the product on its anniversary date, if the product is a Certificate account. If option "000 - Never Post Interest" is selected in the Interest Frequency field below, the Post Interest at Maturity field below must be marked in order for this option to be used. See below for more information.

Interest will post the night before the day of the month opened based on the information in the Interest Frequency field. For example, if the date opened is 02/07/2014 and the interest frequency is 001, interest will post on the night of the 6th each month.

If the Statement Cycle field is set to any code other than 1, 6, or 12, or if the Interest Frequency field is set to code 013, 016, or 023, this field cannot be marked.

The status of this field affects the Days Before Month-end Interest field below.

Features for customer certificate accounts can be adjusted on the Certificate Fields tab of the Deposits > Account Information > Additional Fields screen as well as the Certificate Fields field group on the Deposits > Account Information > Account Information screen.

|

|

Deposit Delay

Mnemonic: PCDEEP

|

Use this field to indicate whether the product uses deposit delay. Deposit delay requires all checks deposited into a customer account to be held a specified number of days before the customer can use the funds. When this field is marked, no interest is calculated during the hold. See below for more information.

Your institution determines how long to delay deposited check funds. Your institution may have different hold lengths based on whether the check is local or non-local (see the Deposits Funds Holds Options help page to learn more). GOLDPoint Systems enters your institution's hold requirements using any of the institution options discussed on the Deposit Delay Institution Options help page.

If no uncollected fund amounts are entered for the teller transaction in the Local or Non-Local fields, and the customer account uses deposit delay (this field is marked), all checks will be held the number of days specified in NDLC (discussed on the Deposit Delay Institution Options help page) as a default. If some amounts are entered but not the total amount of the checks, the difference will also be held as Local funds. For example, your institution requires non-local checks that are more than $2,000 to be held for five days until funds are available to deposit delay customers. Additionally, your institution requires Local checks to be held two days until funds are available to deposit delay customers. In GOLDTeller, the teller enters the total amount of the check ($5,000) in the Tran and Check In fields, but then enters $3,000 of the check into the Non-Local field to be held for five days. The funds on the $3,000 are available to the customer in five days, but the other $2,000 are available in two days (due to the Local hold still required for deposit delay customers).

If the customer account is a memo account (if the Memo Post Capable field is marked) deposit delay will not be entered online. It will be entered when the proof transaction is sent.

To learn more about deposit delay for individual customer accounts, see help for the Deposit Delay field group on the Deposits > Account Information > Funds Holds screen.

|

|

First Tier is Zero Rate

Mnemonic: PCT1ZR

|

Use this field to indicate whether the product will allow interest to be earned on the portion of the account that falls within the first tier level (a mark in this field indicates that interest will not be allowed). Rate tiers must first be set up on the Deposits > Definitions > Rate Tiers screen before they can be used on this screen.

For example, this field is marked and the first tier balance limit is $50.00. After a transaction, the customer account has a balance of $49.00. Interest will not be accrued on the account because the first $50.00 falls within the first tier.

|

Post Interest at Maturity

Mnemonic: PCIMAT

|

Use this field to indicate whether the product will pay interest at maturity, if the product is a Certificate account. If option "000 - Never Post Interest" is selected in the Interest Frequency field below, then interest will only post at maturity. If the Interest Frequency field is set to any other option, interest will post based on the selected frequency and at maturity.

|

Tier on Balance Change

Mnemonic: PCTRBC

|

Use this field to indicate whether the product automatically recalculates the interest rate according to the customer account's Tier Table when the account balances changes. Rate pointers and rate tiers must first be set up respectively on the Deposits > Definitions > Rate Table and Rate Tiers screens before they can be used on this screen.

|

Tier on Available Interest

Mnemonic: PCTRAI

|

Use this field to indicate whether the product automatically recalculates the interest rate according to the account Tier Table when the account balance changes because of available interest (if the product is a Certificate account). Rate tiers must first be set up on the Deposits > Definitions > Rate Tiers screen before they can be used on this screen.

|

Pay Interest on Uncollected Funds

Mnemonic: PCIUCF

|

Use this field to indicate whether the product will pay interest on uncollected funds (UCF).

To learn more about UCF, see the Uncollected Funds Types and Options help page. UCF are set up on individual customer accounts from the Uncollected Funds and Deposit Delay tab of the Deposits > Account Information > Funds Holds screen as well as the Uncollected Funds Options field group on the Deposits > Account Information > Additional Fields screen.

This field must be marked and the Rate Sensitive field above must be left blank in order to select "02 - Cycle Average Balance" in the Interest Balance Code field below.

|

Conditional Offset

Mnemonic: PCCNOF

|

Use this field to indicate whether the product's Interest Rate Offset below is a conditional offset. See below for more information.

If this field is marked, the Interest Rate Offset will be dropped from the product if any of the following occur:

•The balance on the account drops below the opening balance of the account. •The account matures. •The account rolls.

If this field is not marked, the Interest Rate Offset will never be dropped.

|

|

Penalty Code

Mnemonic: PCPNCD

|

This field contains the penalty code assessed on certificate accounts using this product code for early withdrawal or for closure before the maturity date. It is only used if the certificate feature is set and there is a value in this field. See below for more information.

All codes except 42, 92, 43, and 93 use available interest in the penalty calculation.

If a code calculated in months is used, the system will calculate the penalty based on the number of days in the current month and the months prior. For example, if the penalty code corresponds to three months and the withdrawal occurred on October 15th, the customer will be penalized interest for the months of October, September, and August, or 92 days.

Thus any withdrawal that occurs in October will be penalized for the same months, and the same amount will be calculated any day of the month. The number of penalty days will vary depending on how many days in the months used.

When the penalty code corresponds to a number of days, the system will calculate the penalty based on the number of days from the current date in the next month and backward through the prior months for the remaining number of days.

For example, if the code is 22 (90 days) and the withdrawal is processed October 15th, the start date will be November 15th and the remaining days will be used for October, September, and August. The end date will be August 17th or 90 days. The number of penalty days will never vary when exact days are used with the penalty code, but the start and end dates during any given month will vary.

If you want to use a specified number of days (e.g., 180 days), use penalty code 23 or 73. Do not choose 6 or 56, which correspond to 6 months penalty.

The following table shows the available penalty codes:

Use simple interest method

|

Use account interest method

|

Number of months or days interest penalty

|

0

|

|

No penalty

|

1

|

51

|

1 month

|

2

|

52

|

2 months

|

3

|

53

|

3 months

|

4

|

54

|

4 months

|

5

|

55

|

5 months

|

6

|

56

|

6 months

|

7

|

57

|

7 months

|

8

|

58

|

8 months

|

9

|

59

|

9 months

|

10

|

60

|

10 months

|

11

|

61

|

11 months

|

12

|

62

|

12 months

|

13

|

63

|

18 months

|

14

|

64

|

24 months

|

15

|

65

|

15 months

|

16

|

66

|

21 months

|

17

|

67

|

30 months

|

18

|

68

|

7 days

|

19

|

69

|

14 days

|

20

|

70

|

30 days

|

21

|

71

|

60 days

|

22

|

72

|

90 days

|

23

|

73

|

180 days

|

24

|

74

|

32 days

|

25

|

75

|

31 days

|

26

|

76

|

182 days

|

27

|

77

|

270 days

|

28

|

78

|

365 days

|

29

|

79

|

36 months

|

30

|

80

|

90 days minimum (half interest from transaction date to maturity)

|

31

|

81

|

Interest from last maturity to withdrawal (no penalty on 1st term)

|

32

|

82

|

180 days (+ roll in rate #1 if transaction date 6 months past last maturity)

|

33

|

83

|

*No minimum - Mark-to-Market

|

34

|

84

|

*7-day minimum - Mark-to-Market

|

35

|

85

|

*30-day minimum - Mark-to-Market

|

36

|

86

|

*90-day minimum - Mark-to-Market

|

37

|

87

|

*90-day automatic plus Mark-to-Market rate pointer #1

|

38

|

88

|

91 days

|

39

|

89

|

45 days

|

40

|

90

|

60 months

|

41

|

91

|

360 days

|

42

|

92

|

Half of the amount in Interest This Term field (DMINTT) plus the amount in Interest Accrued to Today field, both on the Deposits > Account Information > Interest Fields. Closing withdrawal transaction only (tran code 1190-1290).

|

43

|

93

|

Interest for remaining term, maximum 90 days.

|

44

|

94

|

Half of the interest accrued from Date Opened field (DMDTOP) or Last Maturity Date field (DMLMRD) date to today.

|

45

|

95

|

*180-day minimum - Mark-to-Market

|

46

|

96

|

Interest from date opened or last maturity date to withdrawal date.

|

47

|

97

|

48 months

|

*

|

When calculating Mark-to-Market penalty amounts, the rate on the account is compared to the account rate pointer’s current interest rate. If the current rate offered is less than the rate on the account, a penalty will be calculated. If today’s rate is higher, no penalty will be calculated. All Mark-to-Market penalties involve the same basic calculation: The withdrawal amount is subtracted from the amount of available interest. The result becomes the amount penalized. This amount is multiplied by the difference between the account rate and the current rate and by the number of days from today to the maturity date.

Penalty = (withdrawal amount - available interest) x (account rate - current rate) x (maturity date - today’s date)

If minimum days are also used in the penalty code, the minimum penalty amount is:

Minimum penalty = (withdrawal amount - available interest) x (account rate - current rate) x (number of days specified in penalty)

For accounts with minimum-day penalty codes, the penalty amount is compared to the minimum penalty amount and the greater of the two will be assessed to the account.

|

|

|

Interest Rate Offset

Mnemonic: PCROFF

|

Use this field to indicate an interest rate offset or margin for the product. Any value entered in this field will be used in the calculation of a product's base interest rate. See below for more information.

The rate offset will remain on the product until it is manually removed or rolled into a different product (if the product is not a Certificate account).

To remove a rate offset from a Certificate account, mark the Conditional Offset field above. When a mature or roll is processed, the rate offset will be removed from the product.

The interest rate on a customer account is calculated as follows:

Information for this calculation is based on information entered on the Deposits > Definitions > Rate Table and Rate Tiers screens.

|

|

Days Before Month-End Interest

Mnemonic: PCDYME

|

Use this field to indicate the number of days before monthend that the system should post interest on the product. This option is generally used for products that are set up to receive interest checks, as designated by selecting "01 - Pay interest By Check" in the Interest Destination field below.

|

Days Before Maturity Interest

Mnemonic: PCDYMT

|

Use this field to indicate the number of days before monthend that the system should post interest on the product, if the product is a Certificate account. This option is generally used for products that are set up to receive interest checks, as designated by selecting "01 - Pay interest By Check" in the Interest Destination field below.

Features for customer certificate accounts can be adjusted on the Certificate Fields tab of the Deposits > Account Information > Additional Fields screen as well as the Certificate Fields field group on the Deposits > Account Information > Account Information screen.

|

Interest Method

Mnemonic: PCINMT

|

Use this field to indicate the desired method to pay interest on the product. See below for more information.

Possible selections in this field are:

01 - 365/365 Base Simple Interest

02 - 365/360 Base Simple Interest

03 - 365/364 Base Simple Interest

04 - 360/360 Base Simple Interest

11 - 365/365 Base Compound Interest

12 - 365/360 Base Compound Interest

13 - 365/364 Base Compound Interest

14 - 360/360 Base Compound Interest

21 - 365/365 Base Continuous Compound Interest

22 - 365/360 Base Continuous Compound Interest

23 - 365/364 Base Continuous Compound Interest

24 - 360/360 Base Continuous Compound Interest

Interest methods using a 365-day base will automatically calculate for 366 days during a leap year. This pertains to any part of a leap year included in the interest calculation.

|

|

Interest Balance Code

Mnemonic: PCINBC

|

Use this field to indicate which balance to use when calculating payment interest on the product. See below for more information.

Possible selections in this field are:

00 - Current Balance

01 - Minimum Balance

02 - Cycle Average Balance

03 - Available Balance

04 - Opening Balance

05 - Principal Balance

06 - Principal Balance - LTD

When using code 02, interest posting and statements must occur together. The Pay Interest on Uncollected Funds field must be marked and the Rate Sensitive field above must be blank. The product cannot be a Certificate account. The interest rate used will be the ending rate on the night the interest posts.

When using code 02, variable interest rates cannot be used. Interest is recalculated at the end of the Statement Cycle based on the average account balance. Rate pointers must first be set up on the Deposits > Definitions > Rate Table screen before they can be used on this screen.

|

|

Interest Destination

Mnemonic: PCIDST

|

Use this field to indicate what to do with interest when it is posted to the product. Interest is always posted to the product and then withdrawn when this field indicates a transfer to another account. See below for more information.

Possible selections in this field are:

00 - Post Interest to the Account

01 - Pay interest By Check

02 - Transfer Interest By CDT

11 - At Maturity Post to Account, Otherwise by Check

12 - At Maturity Post to Account, Otherwise by CDT

In order to use code 01 in this field, all payee accounts (except those with a Certificate feature) must be set up through the Deposits > Customer Directed Transfers > Account Payees screen.

This field is used in the configuration of customer directed interest transfers, as explained on the Interest CDTs help page.

|

|

Interest Frequency

Mnemonic: PCINFQ

|

Use this field to indicate how often interest posts on the product. See below for more information.

This field is used when calculating the next date to post interest. Possible selections in this field are:

000 - Never Post Interest

001 - Post Interest Monthly

002 - Post Interest Bi-Monthly

003 - Post Interest Quarterly

006 - Post Interest Semi-Annually

012 - Post Interest Annually

013 - Post Interest Quarterly (January, April, July, October)

016 - Post Interest Semi-Annually (March and September)

023 - Post Interest Quarterly (February, May, August, November)

099 - Use Statement Frequency

204 - Post Every Wednesday and Month-End

206 - Post Every Friday and Month-End

214 - Post Every Wednesday

216 - Post Every Friday

255 - Post interest daily

Codes 013 and 023 are currently available for Passbook accounts only.

Selecting code 099 will make interest post with the same frequency found in the Statement Cycle field. This frequency code is only valid with Statement Cycle codes greater than 100 and less than or equal to 131.

Institution Option OPTP-PIYE enables the system to post interest on the last day of the year for all products with a Statement Cycle code between 102 and 131.

If this field is file maintained, then the Average Percentage Yield (APY) will not print on this account's statement for the current cycle, however, the next cycle's statement will show the APY.

|

|