Navigation: Deposit Screens > Definitions Screen Group >

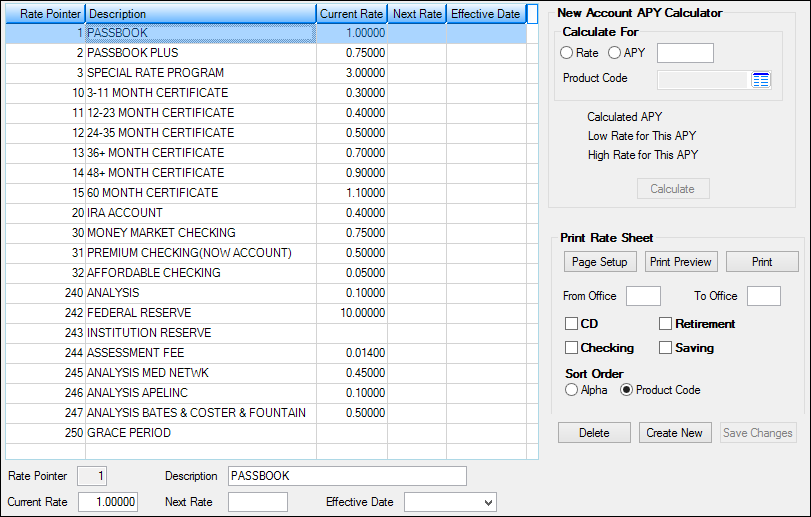

Use the Rate Table screen to view and edit information about interest rate tables for your institution to designate on customer accounts. Interest rates and Rate Pointers must be set up on this screen before they can be used on various screens throughout CIM GOLD, including the Deposits > Definitions > Product Codes screen (where your institution creates the products it offers its customers).

The list view on this screen displays information about all rate pointers previously set up at your institution. To create a new rate pointer and add it to this list, press <Create New>, enter information in the fields on this screen, then press <Save Changes>. Select a rate pointer in this list to edit that rate pointer's information in the fields on this screen.

Employees at your institution who have proper security can delete unwanted rate pointers by selecting a rate pointer in the list view and clicking <Delete>. Note: Rate pointers that are currently in use cannot be deleted.

Deposits > Definitions > Rate Tables Screen

Afterhours changes to interest rates on customer accounts can be audited using the Interest Rate Rolling Report (FPSDR053). To audit other changes to rate fields, use the Rate Tracking Report (FPSDR082), Rate Offset Report (FPSDR115), or the Critical File Maintenance Report (FPSDR172).

Interest features for individual customer accounts can be adjusted on the Deposits > Account Information > Interest Fields screen as well as the Interest Fields field group on the Deposits > Account Information > Account Information screen. Interest rates can also be set up based on balance tiers using the Deposits > Definitions > Rate Tiers screen.

Time periods to retain rate information in the system can be adjusted for your whole institution on the Deposits > Definitions > System History Retention screen.

The fields on this screen are as follows:

Field |

Description |

|

|

Mnemonic: TBPTR |

Use this field to indicate the rate pointer number of the rate pointer being created. Rate pointers are ID numbers that specify an interest rate and tell the system if and when the rate for all customer accounts using the rate pointer will change. This value is institution-defined and can be any number from 1–255.

Rate pointers are assigned to products on the Deposits > Definitions > Product Codes screen. Interest rates can also be set up based on balance tiers using the Rate Tiers screen.

Once a rate pointer has been created, the value in this field cannot be altered. Unwanted rate pointers can be deleted by selecting them in the list view and clicking <Delete>, but rate pointers that are currently in use by customer accounts should not be deleted. |

|

|

Mnemonic: TBCL34 |

Use this field to indicate a description for the rate pointer being created/edited. This description will appear alongside the Rate Pointer in CIM GOLD fields that request a rate pointer designation. |

|

|

Mnemonic: TBRATE |

Use this field to indicate the current (base) interest rate for the rate pointer being created/edited. |

|

|

Mnemonic: TBRTNX |

Use this field to indicate the next interest rate for the rate pointer being created/edited. If a value is entered in this field, an Effective Date must also be specified below. |

|

|

Mnemonic: TBDTEF |

Use this field to indicate the effective date for the rate pointer being created/edited. If a value is entered in this field, a Next Rate value above must also be specified. This date must be in the future. |

|

New Account APY Calculator field group

Mnemonics: N/A |

Use these fields to calculate the APY for a customer account using a given Rate or APY value for a selected Product Code (from the Product Codes screen). See below for more information.

|

|

|

Mnemonics: PCDFCD, PCDFRT, DMDFCK, PCSTA1 |

Use these fields to set parameters and print rate sheets for your institution. This field group exists on this screen as well as the Deposits > Definitions > Rate Tiers screen.

Use the From and To Office fields to designate a range of office numbers within your institution. Only offices whose numbers are within this range will show up on the rate sheet.

Use the checkbox fields to indicate which major account types will show up on the rate sheet. Options include CD, Checking, Retirement, and Saving. Only marked account types will show up on the rate sheet. If no checkboxes are marked, all account types will appear.

Use the Sort Order fields to indicate whether the rate sheet will print the list in alphabetical or Product Code numeric order. |

* When the Effective Date is reached on a customer account (when a customer deposit account is opened, rolled, or renewed), the rate pointer assigned to that account's Product Code (from the Deposits > Definitions > Product Codes screen) tells the system to replace the Current Rate value with the Next Rate value as the account's new Base Rate (shown on the Deposits > Account Information > Interest Fields screen). This rate is used in calculating the actual interest rate on the customer account, as shown in help for the Base Rate field.

|

Record Identification: The fields on this screen are stored in the FPTB record (Rate Table). You can run reports for this record through GOLDMiner or GOLDWriter. See FPTB in the Mnemonic Dictionary for a list of all available fields in this record. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen. |