Navigation: Deposit Screens > Definitions Screen Group > Product Codes Screen >

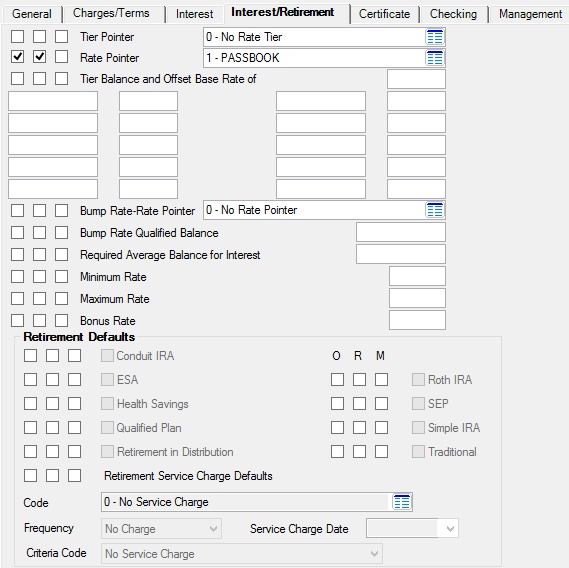

Use this tab to view and edit information about interest and/or retirement features of the product being created/edited. Most of the fields on this screen are only available if the Interest and/or Retirement Feature field is marked on the top of the screen. For more information about creating product codes, see the Entering Product Codes help page.

Deposits > Definitions > Product Codes Screen, Interest/Retirement Tab

Interest features for individual customer accounts can be adjusted on the Deposits > Account Information > Interest Fields screen as well as the Interest Fields field group on the Deposits > Account Information > Account Information screen. Interest rates must first be set up on the Deposits > Definitions > Rate Table screen before they can be used on this screen. Retirement features can be adjusted for individual customer accounts in the Retirement Plan Type field group on the Deposits > Account Information > Additional Fields screen. Other retirement features can also be adjusted for individual customer accounts in the Retirement fields on the Deposits > Account Information > Customer Directed Transfers > Customer Directed Transfers screen.

The fields on this tab are as follows:

Field |

Description |

|

|

Mnemonic: PCTPTR |

Use this field to indicate where to get the new Tier Table on the product when your institution's Tier Table is changed. The product will be paid interest based on the rate tied to the tier pointer number in this field.

Rate tiers influence the calculation of a customer account's interest rate by indicating the offsets or rates that will be used based on the balance of the account. This field contains selections representing options on your institution's Tier Table from the Deposits > Definitions > Rate Tiers screen. |

|

|

Mnemonic: PCRPTR |

Use this field to indicate the rate pointer to use on the product. Rate pointers are ID numbers that specify an interest rate and tell the system if and when the rate for all customer accounts using the product code will change. Rate pointers must first be set up on the Deposits > Definitions > Rate Table screen before they can be used on this screen.

Maturing certificates and product rolls may change this field. Features for customer certificate accounts can be adjusted on the Certificate Fields tab of the Deposits > Account Information > Additional Fields screen as well as the Certificate Fields field group on the Deposits > Account Information > Account Information screen.

Product roll features can be adjusted for individual customer accounts on the Deposits > Account Information > Roll Schedules screen. |

|

Tier Balance and Offset Base Rate of

Mnemonic: PCTRTB, PCTRTR |

Use the Base Rate field (located to the right of the field name as shown below) to indicate the base interest rate on the product. See below for more information.

|

|

|

Mnemonic: PCBPTR |

Use this field to indicate a rate pointer used as a Bump Rate for the product. Rate pointers are ID numbers that specify an interest rate and tell the system if and when the rate for all customer accounts using the product code will change. Rate pointers must first be set up on the Deposits > Definitions > Rate Table screen before they can be used on this screen. The bump rate will remain on the product until it rolls, renews, or matures.

Rate pointers must first be set up on the Rate Table screen before they can be used on this screen. |

|

|

Mnemonic: PCBPQB |

Use this field to indicate the qualifying account balance used for adding a Bump Rate on the product. |

|

Required Average Balance for Interest

Mnemonic: PCBALI |

Use this field to indicate a minimum average account balance required to post interest on the product. Interest will post on the product only if the zero average balance (the APY average balance calculation) for the cycle is above the value entered in this field.

This option is only available if the product is not a Certificate account and the Interest Frequency field is set to "099 - Use Statement Frequency." Additionally, the Interest Balance Code field must be set to "02 - Cycle Average Balance." When using Interest Balance Code 02, variable interest rates cannot be used. Interest is recalculated at the end of the Statement Cycle based on the average account balance. Rate pointers must first be set up on the Deposits > Definitions > Rate Table screen before they can be used on this screen. |

|

|

Mnemonic: PCRTMN |

Use this field to indicate the lowest interest rate possible on the product. Rate pointers must first be set up on the Deposits > Definitions > Rate Table screen before they can be used on this screen. |

|

|

Mnemonic: PCRTMX |

Use this field to indicate the highest interest rate possible on the product. Rate pointers must first be set up on the Deposits > Definitions > Rate Table screen before they can be used on this screen. |

|

|

Mnemonic: PCBNRT |

Use this field to indicate a bonus offset used when calculating the interest rate on the product. Rate pointers must first be set up on the Deposits > Definitions > Rate Table screen before they can be used on this screen. |

|

Retirement Defaults field group |

See Retirement Defaults field group for more information. |

|

Retirement Service Charge Defaults field group |

See Retirement Service Charge Defaults field group for more information. |