Navigation: Deposit Screens > Definitions Screen Group > Product Codes Screen > Interest/Retirement tab >

Retirement Defaults field group

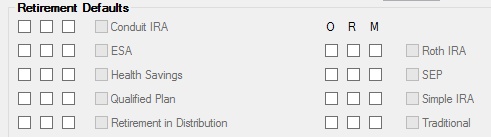

Use this field group on the Interest/Retirement tab to view and edit information about retirement features for the product being created/edited. For more information about creating product codes, see the Entering Product Codes help page.

Retirement features can be adjusted for individual customer accounts in the Retirement Plan Type field group on the Deposits > Account Information > Additional Fields screen. Other retirement features can also be adjusted for individual customer accounts in the Retirement fields on the Deposits > Account Information > Customer Directed Transfers > Customer Directed Transfers screen.

The fields in this field group are as follows:

Field |

Description |

|

|

Mnemonic: PCCOND |

Use this field to indicate whether the product is a conduit IRA. See below for more information.

|

|

|

Mnemonic: PCEDUC |

Use this field to indicate whether the product is an education savings IRA account.

This type of IRA is a savings plan for higher education. Parents and guardians are allowed to make nondeductible contributions to an education IRA for a child under the age of 18. The funds in an education IRA can be withdrawn tax free when they are needed for educational purposes. |

|

|

Mnemonic: PCRHSA |

Use this field to indicate whether the product is a health savings account (HSA).

HSAs are accounts set up to be used for health purposes (doctor bills, prescriptions, etc) that are approved by the government. After approval, an HSA can be used for the medical needs of an individual or their family. This account type can also be used with a checking account feature to allow check withdrawals and card transactions to be processed against the account. |

|

|

Mnemonic: PCRQLP |

Use this field to indicate whether the customer account is part of a qualified retirement plan.

Either this or the SEP field below must be marked if the product is a Qualified, Conduit, or Simple IRA account. |

|

|

Mnemonic: PCINPD |

Use this field to indicate whether the product is a retirement account in distribution. |

|

|

Mnemonic: PCROTH |

Use this field to indicate whether the product is a Roth IRA account.

A Roth IRA is very similar to a Traditional IRA (See below). Contributions are never deductible, and qualified distributions are tax-free. A qualified distribution is one that is taken at least five years after the taxpayer establishes their first Roth IRA and when they are age 59.5, disabled, using the withdrawal to purchase a first home (limit $10,000), or deceased (in which case the beneficiary collects). |

|

|

Mnemonic: PCSEPP |

Use this field to indicate whether the product is a Simplified Employee Pension (SEP) account. An SEP is a type of retirement plan that an employer (including self-employed individuals) can establish. The employer makes contributions to each eligible employee's SEP on a discretionary basis. Contributions to SEPs are immediately 100% vested, and the IRA owner directs the investments.

Either this or the Qualified Plan field above must be marked if the product is a Qualified, Conduit, or Simple IRA account. |

|

|

Mnemonic: PCSIMP |

Use this field to indicate whether the product is a simple IRA account. The Simple IRA plan consists of a deferral program for employees and a mandatory contribution made by employers. The Simple IRA plan's availability is limited to employers with 100 or fewer employees who earned at least $5,000.00 in the previous calendar year.

Either the Qualified Plan or SEP field above must be marked if the product is a Qualified, Conduit, or this type of account. |

|

|

Mnemonic: PCRIRA |

Use this field to indicate whether the product is a traditional IRA account.

A traditional IRA is a personal savings plan that provides tax advantages for saving for retirement. Contributions to a traditional IRA may be tax deductible (either in whole or in part). Also, the earnings on amounts in an IRA are not taxed until they are distributed. The portion of the contributions that is tax deductible does not get taxed until distributed. |