Navigation: Loan Event Processing >

An event occurs when a pre-defined event affects a loan or when you manually request an event letter. Some examples are when a loan rolls a rate, when it is delinquent, or when a loan account is opened or closed (see List of Loan System Events for information on when an event record is automatically generated as opposed to when an event record is requested).

Each pre-defined event has an assigned event number. When an event occurs, the system automatically generates an event data file. The next day your institution will then download the events data file and merge this data file into letter templates stored on your PC. This is done through GOLD EventLetters. When an event letter is generated, it is written in history.

WARNING

Customers are wholly responsible for the format and wording of event letters. GOLDPoint Systems does not guarantee that sample letters comply with regulatory agencies. See Setup Procedures for detailed instructions on how to create the letter in Microsoft® Word and use the Mail Merge function to merge GOLD EventLetters-generated data with the letter. |

The Actions/Holds/Events tab in CIM GOLD is used to manually request a letter or change the letter being created from the default (0) to a specific letter number. GOLDEvent Letters does not allow two of the same event (even with differing letter numbers) to be ordered on the same night. Only the first event will be created.

NOTE

Unless you have manually requested the letter on the Actions/Holds/Events tab, the letter number assigned by the system will always be 0 (default). |

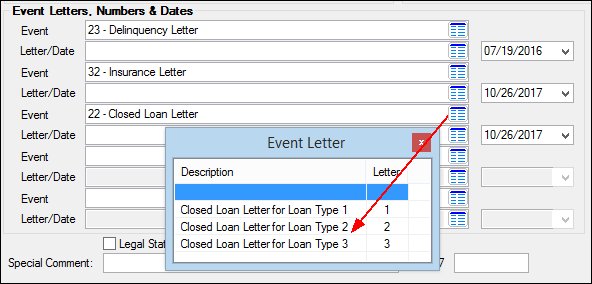

For example, if the system automatically generated a "closed loan letter," GOLD EventLetters would automatically assign it event 22, letter 0. However, perhaps you have different letters you want for different loan accounts when they are closed, such as a closed-loan letter for mortgage loans verses a closed-loan letter for precomputed loans. You would need to complete the following steps:

1.Set up the letter with the appropriate wording and the appropriate merge fields in Microsoft® Word. Make sure to name the document including the letter number. For example, if creating a closing event letter based on loan types, you could name letter number 1 "Closed Loan Loan Type 1."

2.Set up the letter numbers on the Event Letter Descriptions screen.

3.Assign the letter number and the Closed Loan Event (event 22) to the applicable accounts using the Actions/Holds/Events tab, as shown below:

Actions, Holds, Event Letters Screen

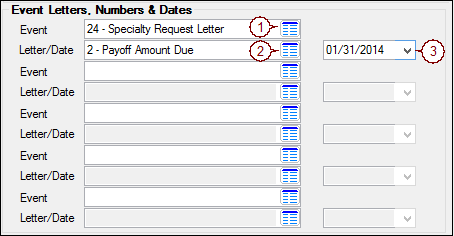

If you want a letter to be created on a specific date, such as tonight, you would enter 1 the event number, 2 the letter number if other than letter 0 (default), and 3 the date you want the letter created, as shown below.

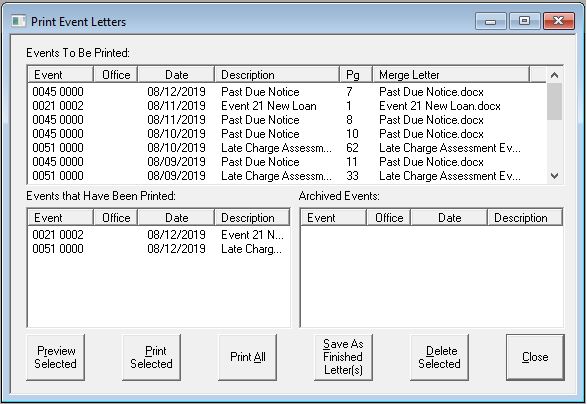

During the night of the letter date, the system will generate the letter and it will be ready for download in GOLD EventLetters. Once you download the letter, you can assign the event to a letter, then print the letter accordingly in GOLD EventLetters, as shown below:

Print Event Letters screen in GOLD EventLetters

See the Working with GOLD EventLetters chapter for more information on the steps involved in printing the event letters.

NOTE

An option is available that blocks specific event letters from generating when certain action codes are placed on an account. If you would like to block certain events based on action codes, complete the following steps:

1.Access the Loans > System Setup Screens. 2.Click the Setup Screen list icon

See the following example:

3.Select the action code for which you want to block event letters from the list view. 4.Check the Block Event Letter Requests box. 5.Click <Save Changes>.

Now when that action code is set up on accounts, an event letter will not be generated. Additionally, the Event Letters, Numbers & Dates field group will be grayed out. |

Why didn't the system generate the event letter for this account?

Certain activity on an account will prevent the account from generating an event letter record, even though you request an event letter. Under the following circumstances, the system will not create an event letter record for accounts:

•Loans with a General Category of 80 and above.

•Loans with an Origination Code of 3, 15, or 16 (loans purchased/serviced by others).

•Hold Codes 1, 2, 4, 5, 6, 27, 92, or 93.

•Hold Code 7 (legal) and 90 (judgment awarded) will create an event letter record. However, if a charge-off is also involved with the loan, the event letter record will not be created.

Where do I set up event letters in CIM GOLD?

Information entered on the Actions/Holds/Events tab from anywhere in the Loan system is saved, and the information appears on the tab wherever it exists in CIM GOLD. The Actions/Holds/Events tab can be found on the following screens:

Loans > Marketing and Collections screen

•Loans > Misc Secured F/M Data screen

•Loans > Transactions > CP2 screen

•Loans > Transactions > Payment Reversal

Note: If you want an event to generate that is not currently defined, please submit a work order to your GOLDPoint Systems account manager to have the event programmed. You can see the complete list of all possible event letters currently programmed on the Loans > System Setup Screen > Client Code Setup > Loan Event Letter Codes. See the Overview section for more information.

Also see Appendix A for a listing of fields pulled from the Loans system available for each event letter.

Event Letter Types

The following chart lists the event numbers currently defined when an ARM loan (payment method 7 or payment method 6 ARM) rolls a rate.

Event |

Subsidy |

Next Accrual |

Next P/I |

Periodic Rate |

Lifetime Rate |

|---|---|---|---|---|---|

no |

up |

no |

yes |

no |

|

no |

down |

no |

yes |

no |

|

no |

up |

yes |

yes |

no |

|

no |

down |

yes |

yes |

no |

|

no |

down |

no |

no |

no |

|

no |

down |

yes |

no |

no |

|

no |

up |

no |

no |

no |

|

no |

up |

yes |

no |

no |

|

no |

up |

yes |

yes |

yes |

|

no |

down |

yes |

yes |

yes |

|

no |

up |

yes |

no |

yes |

|

no |

down |

yes |

no |

yes |

|

no |

down |

yes |

no |

no |

|

no |

up/down |

yes |

yes/no |

yes/no |

Other events that do not pertain to ARM loan rate rolls are listed here with their event numbers.

Event |

Event |

Description |

||||

|---|---|---|---|---|---|---|

5 |

This event automatically produces an event letter when the loan rate changes on a payment method 5 or a payment method 6 (non-ARM loan). |

|||||

13 |

This event record is generated when the system encounters tran codes 440 (reserve 1 disbursement), 448 (reserve 1 disbursement correction), 640 (reserve 2 disbursement), and 648 (reserve 2 disbursement correction) for a single, family-owned (collateral code 1-4), owner-occupied loan (LNOWNR is checked) for reserve disbursement codes. |

|||||

14 |

This event record is not generated automatically. It must be requested. This letter can also be requested by using the Letter Date and Letter Number fields on the Loans > Payoff screen. Only event letter number 14 can be requested from that screen. |

|||||

15 |

This event record is automatically generated when the Prior Unpaid Charges field is changed. |

|||||

16 |

This event record is not generated automatically. It must be requested. |

|||||

21 |

This event record is generated when the system encounters tran code 680 (new loan). The origination officer's name and number are available for this letter. |

|||||

22 |

This event record is generated when the system encounters tran code 580 (close loan). |

|||||

23 |

This event record is not generated automatically. It must be requested. The loan must be delinquent when this event is ordered or the letters will not generate. (The due date must be in the past.) Date and time of appointment can be set up in Action Code 210 and 211 on the Actions/Holds/Events tab. |

|||||

24 |

This is reserved for letters that are a special request of the institution. This is the same as event 23, except the loan does not have to be delinquent.

Note: If you want to use the <<PAYOFF_AMOUNT>> merge field on this event, the following needs to take place:

|

|||||

25 |

This letter can be generated any number of days before the maturity date. You must inform GOLDPoint Systems of the number of days prior to maturity the letters should be generated. The system defaults to 120 days.

GOLDPoint Systems Only: Set OPT7-MDYS to the desired number of days. |

|||||

26 |

This letter will be generated on the maturity date. |

|||||

27 |

This letter will print when there is and action code 1 (Balloon Payment Due) on the loan. Action code 1 stops all activity on the loan. This letter can be generated from 1 to 99 days before the balloon date. You must inform GOLDPoint Systems of the number of days (01–99) prior to the balloon date the letters should be generated.

GOLDPoint Systems Only: The first two positions of the Miscellaneous Parameters field should contain the number of days (01-30) prior to the balloon date that event 27 should be generated. If left blank, then the letter will generate on the balloon date. The parameters are set up on the GOLDPoint Systems > Report Setups > Loan Reports screen for the GOLD EventLetters Report (FPSRP175). |

|||||

28 |

This letter is generated upon request from this screen; however, if no payoff record exists it will not be created. If you attempt to set up this letter, the system will first check to see if a payoff record exists. If it doesn't, you will receive the message "MUST CREATE PAYOFF RECORD FIRST." If it does, the letter will be created. You must lock in payoff, then unlock it (that creates the payoff record), then order event letter 28 on the Actions/Holds/Events tab. Use the same date you used in the Letter Date field on the Loans > Payoff screen, Balances tab. |

|||||

29 |

This letter is generated when a loan is sold to allow you to inform all associated with the loan that it was sold. All information found on the Loans > Payee Information screen can be used to build this event letter. This event can be created with information regarding the company that reserve disbursements are sent to. This event creates multiple letters; e.g., if you have three insurance companies set up, you will receive three separate letters. Institution option T EV29 will stop letters from being created for Reserve Disbursement Types 10 through 19 (taxes). If you would like this option, submit a work order. This event must be requested through a work order and set up manually. |

|||||

30 |

This letter is generated one month prior to the new subsidy effective date pulled from the Loans > Account Information > Reserves > Account Reserves Detail screen. Tracking subsidies is not currently available in CIM GOLD. Contact your GOLDPoint Systems customer service representative for more information. |

|||||

31 |

This letter is generated one month prior to the subsidy expiration date. |

|||||

32 |

This letter can be automatically generated or you can manually request it.

This event will generate a letter to inform the customer that a reserve disbursement item is about to expire. The letter will generate a specific number of days before the expiration date.

Automatically generated: If you would like the letters to be automatically generated, the following options must be set up:

This event must be requested through a work order.

Manually requested: This letter can be manually requested for reserve types 20-28 and 30-49 that will expire within 75 days. However, on closed accounts, only letters ordered within 60 days of the date closed will be created. (Example: This would be used to notify an insurance company to delete the institution’s name from the policy, etc.) |

|||||

33 |

This letter is generated when the credit limit for line-of-credit loans has been exceeded. This is for line-of-credit loans (payment method 5) only. Commercial line-of-credit loans (payment methods 9 and 10) will not generate this event. The letter will automatically be created when the date of the last transaction is today and the principal balance exceeds the credit limit.

Note: A letter will be created each time the date of the last transaction changes; this may result in more than one letter being created within several days. (The date of the last transaction is for monetary activity only.) The letter can also be ordered manually. |

|||||

34 |

All P/I change fields are checked for a change, and any change is reported on the letter. No rate changes are included in this letter. |

|||||

35 |

This letter is sent once a year as required by the National Affordable Housing Act, section 329 and follows the format defined by HUD. In the afterhours on the date requested by the institution, the system automatically selects letter 35 or 36 using the Date Opened field on the Loans > Account Information > Account Detail screen. The letter prints the payoff amount, the fees pertaining to the payoff either as part of the total payoff amount or as a separate amount, and any requirements the borrower must fulfill to prevent accrual of interest on the mortgage loan after the pre-payment date.

•To request this letter, submit a work order to GOLDPoint Systems indicating the telephone number of your Loan Service Department for the borrower to call, the name and title of the employee who signs the letter, and how the payoff fees are disclosed.

•To manually generate this letter, set up the event on the Actions/Holds/Events tab. The payoff is calculated to the end of the month following the date that the event letter is requested. |

|||||

36 |

This letter is generated and calculated the same as event 35 with the following exceptions:

Option 1: Otherwise, your prepayment will be refused until the next installment due date and interest will be charged to that date.

Option 2: Otherwise, you may be required to pay interest on the amount prepaid through the end of the month. |

|

|

Event |

Event Number |

Description |

|

|---|---|---|---|

P/I Payment Change Different than Rate Changes Letter (CNE040) |

40 |

All P/I change fields are checked for a change, and any change is reported on the letter. The letter includes a summary of interest rate changes that have occurred since the last P/I change. This letter can only be generated if the Use Event Letter 40 field on the Loans > Account Information > ARM Information screen, Rate Caps & Negative Amortization tab displays a checkmark, the rate change frequency is not the same as the P/I constant change frequency, and you have requested the event letter by work order.

For example, if the next P/I change is on April 1, the last P/I change was April 1, and the interest rate does not change on April 1, the event letter will generate showing the next P/I change date and amount and all the rate changes since April 1. |

|

41 |

Event 41 calculates the new P/I while the loan is still in the construction process. If the LIP method code is 1 or 101 and the loan fields on the Loans > Account Information > ARM Information screen call for a P/I change, the system will calculate the new loan accrual rate and P/I constant.

|

||

42 |

Event 42 will generate an LIP rate change letter if the LIP (construction) rate changes are either based on a rate change date or for rate sensitive loans. This letter will only create if the LIP method code is 1 or 101. |

||

43 |

Event 43 will generate a billing letter for charging interest on negative reserves. |

||

44 |

Event 44 generates a letter for the first late notice. In order to generate late notices through the event letter system, the event number (44, 45, or 46) must be entered in the Notice 1 Type, Notice 2 Type, and Notice 3 Type fields on Loans > Account Information > Account Detail screen, Late/NSF tab, as well as the desired number of days. See the Past Due Notices topic for more information. |

||

45 |

Event 45 generates a letter for the second late notice. See the Past Due Notices topic for more information. |

||

46 |

Event 46 generates a letter for the third late notice. See the Past Due Notices topic for more information. |

||

47 |

Event 47 will generate a letter anytime an insurance policy expires or a Force Place Insurance transaction (tran code 2870) is run. See the Force Place Screen topic in the Loans in CIM GOLD manual for more information. |

||

48 |

This event generates if a Miscellaneous Fee transaction or corresponding correction is processed on an account.

Valid transaction codes are: |

||

49 |

This letter must be requested manually. |

||

50 |

This letter must be requested manually. |

||

51 |

This event is created automatically any time an account is assessed a late charge (tran code 560). If you want to use this event letter, please submit a work order. We can set this event up to run for accounts from specific states. |

||

60 |

The One-Time Electronic Payment (event 60) record is automatically generated when your customers approve of one-time ACH loan payments. This event is created after employees click <Submit Payment> after creating a one-time payment on the Loans > Transactions > EZPay screen in CIM GOLD. Additionally, this letter is not included on the Event Letter Report (FPSRP175). |

||

61 |

The Cancelled Event Letter (event 61) record is automatically generated when your customers cancel one-time ACH payments. This letter will not generate for same-day cancellation of ACH payments. Additionally, this letter is not included on the Event Letter Report (FPSRP175). |

See also: