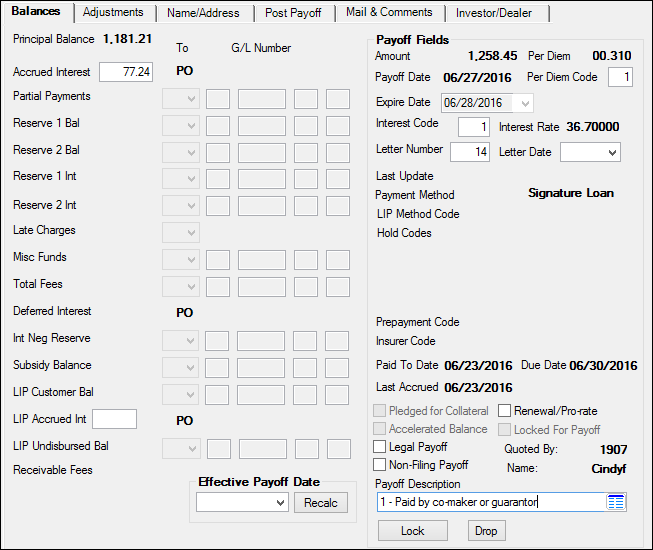

Navigation: Loans > Loan Screens > Payoff Screen >

Use this tab to view and edit balance information for the account payoff. You must first enter an Effective Payoff Date and click ![]() before calculating payoff information. See Payoff Locking and Payoff Quotes for more information.

before calculating payoff information. See Payoff Locking and Payoff Quotes for more information.

Loans > Payoff Screen, Balances Tab

The fields on this tab are as follows:

Field |

Description |

||

|

Mnemonic: POPBAL |

This field displays the unpaid principal balance on the loan account. This field is only affected by teller transactions and is not file maintainable on this screen.

The value in this field does not include the Deferred Interest (see below). This value is added into the Payoff Amount when applied. |

||

|

Mnemonic: POACIN, POACIP, POACI1-3 |

This field displays two different types of information, depending on the payment method of the loan account. For all payment methods except line-of-credit loans (payment method 5) and precomputed (payment method 3), this field displays the accrued interest on the loan that has not been collected, so is therefore, part of the payoff. For line-of-credit loans, this field shows the accrued and/or charged interest on the loan.

Accrued Interest is calculated by taking the amount of interest accrued on the Principal Balance above (plus Deferred Interest and any interest due) from the Last Accrued date to the Payoff Date (interest calculation can include the Payoff Date if your institution requests the option from GOLDPoint Systems). The code number for this calculation is entered in the Interest Code field. The Accrued Interest is added to the payoff Amount when applied.

Accrued Interest = Principal Balance x Interest Rate x Days Difference from Date Last Accrued to Payoff Date / by base (which is the second number in Interest Code)

Example: 256.90 x .299 x 120 / 365 = 25.25 of Accrued Interest due at payoff

The system recalculates the value in this field each time the screen is accessed (unless the payoff has been Locked).

Renewals

For some states, if the loan is being paid off for the purposes of opening a new loan (renewal loans), additional calculations for the Accrued Interest may apply. You will see the difference in the Accrued Interest calculation when you check or uncheck the Renewal/Pro-rate field on the Payoff screen for interest-bearing loans originated in specific states. See Per State Renewal Regulations for more information. |

||

|

Mnemonic: POPRTL, POPRTM, POPRT1-3 |

This field displays partial payments made on the loan. This amount is subtracted from the payoff Amount when the payoff is processed.

This field is not file maintainable. Funds are credited to partial payments by a teller transaction and remain there until another teller transaction is processed to debit partial payments and relocate the funds elsewhere (usually as a payment).

This field is generally used by the collection department if less than a full payment has been collected. Once the remaining portion of the payment is received, those funds post to this fields before the full payment amount is debited from this field and credited as payment.

Funds in this field are not automatically applied as a payment by the system. The Partial Payment Report (FPSRP198) and the Loan Warning Report (FPSRP083) identify accounts that have partial payment funds. Bill and receipt statements subtract the partial payment amounts for the total due. |

||

|

Mnemonic: POR1BL, POR1BM, POR1B1-3, POR2BL, POR2BM, POR2B1-3 |

These fields display amounts that have been paid by the customer to apply to such things as taxes, insurance, etc. These fields are only affected by teller transactions and are not file maintainable on this screen.

The amounts in these fields are subtracted from the payoff Amount when the payoff is processed (unless Institution Option CKPO is enabled).

Institution Option R2NG prevents a negative Reserve 2 Bal value. |

||

|

Mnemonic: POR1AI, POR1AJ, POR1A1-3, POR2AI, POR2AJ, POR2A1-3 |

These fields display interest amounts that are accrued on Reserve Balances (when your institution pays interest on reserves, see above). This value is calculated as follows:

Bal # Rate X # OF Days / 365

“Bal” is based on 365/365 simple interest from transaction to transaction like a payment method 6 loan. It is calculated from the date Last Accrued to the latest transaction date on the reserve balance at the reserve rate.

The amounts in these fields are subtracted from the payoff Amount when the payoff is processed. These fields are not file maintainable. |

||

|

Mnemonic: POSBAL, POSBA1-3 |

This field displays the amount held and used to subsidize the regular payment made by the customer. This amount is commonly paid by a builder or a government agency.

The amount in this field is subtracted from the payoff Amount when the payoff is processed. This field is not file maintainable. |

||

|

Mnemonic: POINRI, POINRJ, POINRS, POINR1-3 |

This field displays the accrued interest on negative reserves.

As the payoff is posted, funds are automatically credited to the interest account. This field is only affected by teller transactions and is not file maintainable on this screen. |

||

|

Mnemonic: POLATE, POLATF, POLAT1-3 |

This field displays the total amount of late charges due on the loan account as of today. This is not the amount of late charges as of the Effective Payoff Date. See Future Late Charges in the Payoff Quotes topic for more information. This amount is part of the Payoff Amount.

Renewals

For Kentucy, if the late charges were assessed within a certain amount of days from the payoff, and the payoff is part of a renewal, the late charges may be waived. You will see all or a portion of the late charges waived when you check or uncheck the Renewal/Pro-rate field on the Payoff screen for interest-bearing loans originated in Kentucky. See Per State Renewal Regulations for more information. |

||

|

Mnemonic: POMISC, POMISD, POMIS1-3 |

This field is a memo field for payment method 8 loans (rentals). This is a monetary amount field that may be used in any way your institution desires. Possible uses for this field are insurance claim funds or rents collected on properties in foreclosure.

The amount in this field is subtracted from the payoff Amount when the payoff is processed. This field is not file maintainable. |

||

|

Mnemonic: POFEES, POFEET, POFEE1-3 |

This field displays all unpaid miscellaneous fees that have been assessed on the customer account. Loan fees are assessed by using the Loans > Marketing and Collections screen and clicking <Assess Fee>, or you can also manually assess fees through CIM GOLDTeller using tran code 660 to assess the fee and tran code 850 to pay the fee. (See the Miscellaneous Fees Processing topic for more information.)

Institution Option CFEE requires a teller override when posting a payment if miscellaneous fees are due on the loan account.

Renewals

For Kentucy, if the miscellaneous fees were assessed within a certain amount of days from the payoff, and the payoff is part of a renewal, the fees may be waived. You will see all or a portion of the fees waived when you check or uncheck the Renewal/Pro-rate field on the Payoff screen for interest-bearing loans originated in Kentucky. See Per State Renewal Regulations for more information. |

||

|

Mnemonic: PODEFI, PODEFJ, PODEF1-3 |

This field displays all unpaid interest that has been added to the principal balance of the loan account. This field is not file maintainable. |

||

|

Mnemonic: POCBAL, POCBA1-3 |

This field displays the amount deposited by the customer to be disbursed according to the LIP Method Code on the Loans > Account Information > Account Detail screen.

This field is originally entered by teller transaction. As disbursements are made, the value in field will be reduced.

The amount in this field is subtracted from the payoff Amount when the payoff is processed. This field is not file maintainable. |

||

|

Mnemonic: POLACC, POLACE, POLAC1-3 |

This field displays the interest accrued on the LIP Disbursed Balance (on the Loans > Account Information > Account Detail screen) from the Last Accrued date to the Payoff Date.

This amount is determined by the LIP Interest Rate field (on the Account Detail screen). This field is only used when a loan is in process and LIP Method Code (from the Account Detail screen) 001 or 101 is being used. In these instances, interest is accrued using the LIP Interest Rate rather than the loan rate.

The system recalculates the value in this field each time the screen is accessed (unless the payoff has been Locked). The amount in this field is added to the payoff Amount when the payoff is processed. This field is not file maintainable. |

||

|

Mnemonic: POLBAL, POLBA1-3 |

This field displays the amount of funds not yet disbursed from a loan-in-process (LIP) customer account. See below for more information.

|

||

|

Mnemonic: N/A |

This field displays the total amount of receivable fees collected on the customer account. |

||

|

Mnemonic: N/A |

Use this field to indicate the date you want to process the payoff on the customer account. Click <Recalc> to recalculate the fields on this screen depending on the date entered in this field. |

||

Payoff Fields field group |

See Payoff Fields field group for more information. |