Navigation: Loans > Loan Screens > Account Information Screen Group > Precomputed Loans Screen > Options field group >

Interest Rebate Methods

Use the Int Rebate Method field to indicate the method by which the interest will be amortized and rebated back to the borrower in the event that the loan is paid off early. The field defaults to "0 - Rule of 78s." The following are the available amortization methods:

08 - Rule of 78—Extended 1st Due

09 - Deferred Payment Actuarial

11 - Texas Daily Amount Financed

13 - Rule of 78 - Multi Frequncy

14 - TN Actuarial - Multi Frequency

15 - Daily Accrual Basis Less Prepaids

The rule of 78s method uses the following formula to calculate the interest rebate:

Unearned = ((Rino x (Rino+1) / (Oino x (Oino+1)) x Orig.Add-on.Int

"Rino" is the remaining number of installments in months. "Oino" is the original number of installments (term).

The earned amount is calculated by subtracting the unearned interest from the Original Add-on Interest amount.

The amount earned for a month is calculated by subtracting the new unearned amount from the previous unearned amount.

For a 12-month loan with $500 of Original Add-on Interest, the amount of interest earned in the 6th month would be as follows:

((6 x (6+1) / (12 x (12+1)) x 500 = ((6 x 7) / (12 x 13)) x 500 = (42 / 156) x 500 = .26923 x 500 = 134.62

((5 x (5+1) / (12 x (12+1)) x 500 = ((5 x 6) / (12 x 13)) x 500 = (30 / 156) x 500 = .19230 x 500 = 96.15

134.62 – 96.15 = 38.47

This is the difference in the unearned for the 6th and 7th months of the loan.

The earned amounts for these months would be 365.38 (500 – 134.62) and 403.85 (500 – 96.15), respectively.

The unearned interest is the amount that would be rebated to the customer at payoff.

Note: See the Extend Original/Remaining Term by Deferment help for information about how the system may calculate the unearned interest slightly differently if a deferment has been processed on the account.

The actuarial method uses the following formula to calculate the interest rebate:*

PJ = ((O x AJ) - (P x ((AJ - 1) / I)))

R = (N x P) - (J x P + PJ) + .009

A =1 + I

I = Monthly simple interest rate (LNOAPR / 12)

J = Months run

N = Original term

O = Original principal

P = Monthly payment

R = Refund amount

The above formula is to calculate a refund to the due date preceding the payoff date and to calculate a refund to the due date following the payoff date. A per diem is calculated by taking the difference between the two refunds, then dividing by the number of days in the month. This per diem is multiplied by the number of days from the payoff date to the due date following the payoff date. This amount is added to the refund from the due date following the payoff.

The MS Actuarial method calculates a new payment amount and interest rate, then uses the actuarial method (see above) to calculate the interest rebate. The new payment amount is calculated as follows:

Loan Fee (amortizing fee code 1) / Loan Term (LNTERM) = Monthly Fee Amount, then P/I Constant - Monthly Fee Amount = New Payment Amount.

The new interest rate is calculated from the new payment amount.

The MS Consumer method uses the rule-of-78s method to calculate the interest rebate, but adds 20 days to the payoff date when calculating the elapsed months.

|

Note: If your institution uses Acquisition Charge Code 01 and Interest Rebate Method 3, the Acquisition Charge Amount will be subtracted from the Original Unearned Interest amount (prior to calculating the interest rebate) regardless of whether the payoff is a renewal (the status of the Renewal/Pro-Rate field on the Loans > Payoff screen will be ignored).

If Refund 360/360 at Payoff is checked, the 20 days added by this rebate method are added using a 360-day basis. |

|---|

The Actuarial Long Formula method uses the following formula to calculate the interest rebate:

A = P x (N - J - 1) + PL

B = AOL x TJ

C = (P1 - P) x T(J - 1)

D = (P x (TJ - 1)) / I

E = T(EX/30)

Interest Rebate = A - B + ((C + D) / E)

P = Original monthly payment (LNOPIC)

I = Monthly simple interest rate (LNOAPR)

T = I + 1

N = Original term of loan (LNTRMO)

PL = Last payment (the system uses the original payment (LNOPIC) as the last payment)

P1 = First payment (LNOPIC) plus extension interest (OTXINT)

J = Elapsed months

EX = Number of extension days (OTXDYS)

AOL = Amount of loan (This is the amount financed (OTAFIN).)

If there is an acquisition charge (LN78AA), a new monthly payment amount will be calculated as follows:

New Monthly Payment = LNOPIC - (LN78AA / LNTRMO)

A new rate will be calculated on the new monthly payment amount.

The TN Actuarial method uses the following formula to calculate the interest rebate:

Rebated Interest = P x (N - PV)

P = Original monthly payment (LNOPIC) minus maintenance fee (MRMFEE)

N = Number of remaining months

I = Monthly simple interest rate (LNRATE / 12)

PV = Present value (1 - (1 / (1 + I)N)) / I)

The MD Actuarial method uses the following formula to calculate the interest rebate:

Refund = ((odd days * daily factor) + monthly factor) * payment

Remaining Term = months difference between the payoff date (LNPODT) and the maturity date (LNMATD); if the maturity date is less than the payoff date, 1 month will be subtracted from the remaining term.

Periodic Rate = loan rate (LNRATE) / 12

Original Term = original term (LNTRMO); if no original term, the loan term (LNTERM) is used instead.

Payment = original P/I constant (LNOPIC). If the original P/I constant is zero, the current P/I constant (LNPICN) will be used.

Odd days = maturity day minus payoff day; if the maturity day is less than the payoff day, 30 days will be added to the maturity day before it is subtracted from the payoff day.

Daily factor = (((((Remaining Term + 1) - ((1 - 1 / (Periodic Rate + 1) ^ (Remaining Term + 1)) / Periodic Rate)) / (Original Term - ((1 - 1 / (Periodic Rate + 1) ^ Original Term) / Periodic Rate)) * ((Original Term * Payment) - (Payment * ((1 - 1 / (1 + Periodic Rate) ^ Original Term) / Periodic Rate)))) / Payment) - (((Remaining Term - ((1 - 1 / (Periodic Rate + 1) ^ Remaining Term) / Periodic Rate)) / (Original Term - ((1 - 1 / (Periodic Rate + 1) ^ Original Term) / Periodic Rate)) * ((Original Term * Payment) - (Payment * ((1 - 1 / (1 + Periodic Rate) ^ Original Term) / Periodic Rate)))) / Payment)) / (365 / 12) Monthly factor = (Remaining Term - ((1 - 1 / (Periodic Rate + 1) ^ Remaining Term) / Periodic Rate)) / (Original Term - ((1 - 1 / (Periodic Rate + 1) ^ Original Term) / Periodic Rate)) * ((Original Term * Payment) - (Payment * ((1 - 1 / (1 + Periodic Rate) ^ Original Term) / Periodic Rate))) / Payment

Note: The Minimum Interest Rebate Limit (LN78RL) field and the Minimum Earned Interest (MRMNEI) field can be used with this interest rebate method.

The Virginia Actuarial refund calculation is for precomputed interest loans. Click the list icon and select "7 - VA Actuarial." The steps in calculating the rebate/refund are shown below. Some of the steps will refer to Microsoft® Excel formulas. The formula is shown to simplify the information for the calculation that the GOLDPoint Systems software automatically performs.

The following loan fields are used by this calculation:

Date Opened (LNOPND)

First Due Date (LN1DUE)

Maturity Date (LNMATD)

Payoff date (PODATE)

Original APR (LNAPRO)

Original P/I Constant (LNOPIC)

Original Interest (LN78OI)

The calculation steps are as follows:

1.If the Payoff date is on or after the Maturity Date, then no interest is refunded.

2.If the Payoff date is less than the first anniversary of the date opened, then a full refund of the Original Interest is given. This will be adjusted by the payoff for any retention amount or payoff penalty for early payoff.

3.Find the most recent anniversary of the date opened (ANNOPND) for the payoff date.

| a. | This anniversary is found by comparing the day of the Payoff date with the day of the Date Opened. |

•If the payoff day is less than or equal to the day the loan was opened, then the open day is substituted in a work field that contains the payoff date. This date is adjusted if it is greater than 28.

•If the payoff date is greater than the open day, then one month is subtracted from the work field containing the payoff date. Then, the open day is substituted into the resulting date and adjusted if it is greater than 28.

4.Figure the odd days (ODDDAYS) to the first payment due date.

| a. | If the payoff date is on or after the first due date, then the odd days are zero. |

| b. | The odd days are calculated from the most recent anniversary of the date opened to the first due date. The days remain the same between the anniversary dates. |

| c. | The calculation is as follows: ODDDAYS = ANNOPND – LN1DUE, using a base of 365. |

5.Figure the remaining whole months (RTERM).

| a. | If the payoff date is on or before the first due date, then this is calculated from the anniversary of the date opened, based on the first due date, to maturity. One month is added to RTERM. |

| b. | If the payoff date is after the first due date, then this is calculated from the anniversary of the date opened, based on the payoff date, to maturity. Add one to RTERM if the payoff date falls on the anniversary date. This accounts for the fact that a term is not earned until 1 day after the anniversary of the date opened. |

| c. | The calculation is as follows: RTERM = ((centuryANNOPND – centuryLNMATD) x 100) + ((yearANNOPND – yearLNMATD) x 12) + monthANNOPND – monthLNMATD |

| d. | No refund is given if RTERM is zero. (See step 1.) |

6.Calculate the periodic or monthly rate (MRATE).

| a. | The monthly rate is calculated by dividing the original APR by 12. |

| b. | The calculation is: MRATE = LNAPRO / 12 |

| c. | If LNAPRO = 0, then an error is returned. |

7.Figure the present value (PV).

| a. | The calculation is: PV = 1 / (1 + ((ODDDAYS / 30) x MRATE)) |

8.The Excel equivalent of the next portion of the calculation is:

| a. | WORK2 = 1 – (POWER((1 + MRATE), -(RTERM-2))) |

9.The next step is:

| a. | WORK3 = WORK2 / MRATE |

10.The Excel equivalent of the next calculation is:

| a. | WORK1 = POWER ((1 + MRATE),(RTERM-1)) |

11.The net PV (NETPV) is then calculated:

| a. | NETPV = PV x (LNOPIC + (LNOPIC xWORK3) + (LNOPIC / WORK1)) |

12.The remaining payments amount (RPMTS) is calculated:

| a. | RPMTS = RTERM x LNOPIC |

13.The unearned or refund amount (UNEARNED) is:

| a. | UNEARNED = RPMTS - NETPV |

08 - Rule of 78—Extended 1st Due

Rebate Method 8 (Rule of 78—Extended 1st Due) is a regular Rule of 78 calculation with a different method for determining time elapsed. Interest is earned as follows:

Earn Month |

Earning Period |

|---|---|

0 |

Date Opened (LNOPND) through Refund All period |

1 |

End of Refund All period to first payment due (LN1DUE) |

2 |

First payment due through the anniversary of date opened (LN78DO) or anniversary of first due date (LN78AF), whichever is used, plus Rebate Rule Days |

3 |

Anniversary of the date opened or first due date through anniversary of date opened or first due date; etc. |

Example 1:

Refund period = 10 days (MRWDYS)

Original Interest = 500.00 (LN78OI)

Date of Loan = 08-01-10

1st Due Date = 09-01-10

Term = 48 months

Use Anniversary of Date Opened is checked

Time |

Refund Amount (acquisition fee will be subtracted if Refund Rule 6 is used) |

|---|---|

08-01-10 through 08-11-10 |

500.00 |

08-12-10 to 09-01-10 |

479.59 |

09-02-10 to 10-01-10 |

459.61 |

10-02-10 to 11-01-10 |

440.05 etc. through month 48 |

Example 2:

Refund period = 12 days (MRWDYS)

Original Interest = 500.00 (LN78OI)

Date of Loan = 08-01-10

1st Due Date = 09-15-10

Term = 48 months

Use Anniversary of Date Opened is checked

Elapsed Time |

Refund Amount (acquisition fee will be subtracted if Refund Rule 6 is used) |

|---|---|

08-01-10 through 08-13-10 |

500.00 |

08-14-10 to 09-15-10 |

479.59 |

09-16-10 to 10-01-10 |

459.61 |

10-02-10 to 11-01-10 |

440.05 etc. through month 48 |

09 - Deferred Payment Actuarial

Rebate Method 9 (Deferred Payment Actuarial) is for loans with a deferred payment. The Refund Rule field (MRRULE) should be 0 if using this method. This method is for both renewal and non-renewal processing.

The following example explains how this method is calculated. Some of the steps will refer to Microsoft® Excel formulas. The formula is shown to simplify the information for the calculation that the GOLDPoint Systems software automatically performs.

Field |

Totals |

Original Balance (LNOBAL)

|

$24,467.52 |

Original Finance Charge (LN78OI) |

$13,213.52 |

Amount Financed (LN78OP) |

$11,254.00 |

Interest Rate (LNRATE or OTORAT) |

14.48900 |

Term in Months (LNTERM or LNTRMO) |

132 |

Date Opened (LNOPND) |

3/16/2012 |

First Payment Due Date (LN1DUE) |

9/12/2012 |

Maturity Date (LNMATD) |

8/12/2023 |

Refund Within Days (QRWDYS) |

29 |

Use Anniversary of Date Opened (LN78DO) |

Checkmark (yes) |

Payoff Date (PODATE) |

4/29/2012 |

Earned Days (PODATE - LNOPND using base 360) |

43 |

Interest Earned (LN78OP x OTORAT x Earned Days/360) |

$201.49 |

Interest Refund (LN78OI - Interest Earned) |

$13,011.98 |

Payoff Amount (LNOBAL - Interest Refund) |

$11,455.49 |

If the Payoff Date is within the Refund Within # Days (MRWDYS) from the Date Opened, then all of the Original Finance Charge (LN78OI) will be refunded.

The basic formulas for calculating the refund for a payoff prior to the first due date are:

Earned Days = Payoff Date - Date Opened (LNOPND) in base 360

Earned Interest = Original Principal Before Add-Ons (LN78OP) x Original Rate (OTORAT) x Earned Days/360

Interest Refund = Original Unearned Interest (LN78OI) - Earned Interest

Once the loan has passed the first due date, the calculation changes. The maturity date will be calculated by adding the Original Term (LNTRMO) to the First Due Date (LN1DUE). If payoff occurs on or after this date, then no refund is given. The interest calculation is a daily simple interest calculation using a 360 base.

The number of elapsed months will be calculated in simple terms by subtracting the CCYYMM (century, year, month) of the First Due Date from CCYYMM of the Payoff Date. This determines the number of times the amortization loop will execute. The formula for this term calculation is (in Excel):

ETERM=((PayoffCC-LN1DUEDCC)x100) + ((PayoffYY-LN1DUEYY)x12) + PayoffMM - LN1DUEMM

If the above loan were to pay off on June 19, 2019, this would be:

ETERM = ((20 - 20) x 100) + ((19 - 12) x 12) + 6 - 9

ETERM = 0 + 84 + 6 - 9

ETERM = 81

Had the date of this example been prior to the anniversary of the first due date, then one would be subtracted from ETERM.

The method will calculate a payment constant using OTORAT/12, LNTRMO, and LN78OP.

The Excel equivalent formula using the above loan is:

PMT(0.14989/12,132,11254) = 174.46

The amortization loop starts with Original Principal Before Add-Ons (LN78OP) as the balance and follows this formula:

INT = Balance x OTORAT/12

PRN = PMT – INT

Balance = Balance – PRN

•The loop will accumulate the amount to interest (ACCINT) for each month for ETERM months.

•The amount to interest for the ETERM+1 month will be divided by 30.

•That amount will be multiplied by the number of days from the last anniversary of the due date to the payoff date in base 360.

•This will be the amount of extra interest earned (XINT).

•The total interest earned (TINT) will be ACCINT + XINT.

•This amount will be subtracted from LN78OI to yield the interest refund.

Refund = LN78OI – TINT.

Using our example of a payoff on June 19, 2019 the refund would be:

(Remember that there is no month 0 in Excel so you must add one month.)

ETERM=81 (6 years 9 months 7 days)

ROUND(-CUMIPMT(OTORAT/12,LNOTRM,LN78OP,1,82,0),2) = 9510.59 interest to 6/12/19

ROUND(-CUMIPMT(OTORAT/12,LNOTRM,LN78OP,1,83,0),2) = 9591.26 interest to 7/12/19

9591.26 – 9510.59 = 80.67

80.67 / 30 = 2.6890 (per diem)

•The number of days from the anniversary of the due date (6/12/19) and the payoff date (6/19/19) is 7.

•This number is multiplied by the per diem to yield the extra interest (7 x 2.6890 = 18.82).

•The total interest earned is 9510.59 + 18.82 = 9529.41.

•The interest refund is LN78OI – 9529.41 = 13213.52 - 9529.41 = 3684.11.

Had this loan paid off on June 9, 2019 the calculation would be:

ETERM = 80 (6 years 8 months 27 days)

ROUND(-CUMIPMT(OTORAT/12,LNOTRM,LN78OP,1,81,0),2) = 9428.76

ROUND(-CUMIPMT(OTORAT/12,LNOTRM,LN78OP,1,82,0),2) = 9510.59

9510.59 – 9428.76 = 81.83

81.83 / 30 = 2.7276 (per diem)

•The number of days from the anniversary of the due date (5/12/19) and the payoff date (6/9/19) is 27 using base 360.

•This number is multiplied by the per diem to yield the extra interest (27 x 2.7276 = 73.65).

•The total interest earned is 9428.76 + 73.65 = 9502.41.

•The interest refund is LN78OI – 9502.41 = 13213.52 – 9502.41 = 3711.11.

This interest rebate method is available on any payment frequency. A refund is not eligible if the payoff date (PODATE) is equal to the original maturity date (MLOMAT). The anniversary of the date opened that is just prior to the payoff date will be calculated.

This rebate method is calculated as follows:

•The calculation is run through an amortization schedule using the open date (LNOPND) and the first due date (LN1DUE).

•For any subsequent periods, LN1DUE and the original frequency (LNFRQO) are used for the next period date. If LNFRQO is blank, the system uses the loan frequency (LNFREQ).

•The face amount (LNFACE = Total Payments - Original Precomputed Interest) and original interest rate (LNORTE) are used as the starting balance and rate, respectively. An error occurs if either of these fields are blank.

•The first payment amount (OTFPAM) is used for the period from LNOPND to LN1DUE. If OTFPAM is blank, the original P/I constant (LNOPIC) is used instead.

•For every subsequent anticipated payment, the system uses LNOPIC.

•Subsequent payments run from due date to due date unless the target due date exceeds the amortization date, in which case a partial period interest calculation is made from the last due date to the amortization date.

•The system calculates the amortization based on the elapsed periods using the interest calculation method (LNIBAS) code. The number of days is based on the dividend and the interest base on the divisor. For example, if LNIBAS=103, 365/360, then the days are calculated on a 365-day basis but the interest calculation is divided by 360.

•The total of these calculations is the amount of interest earned.

•The refund is then calculated by subtracting this interest earned from the original interest (LN8OI).

Rebate calculation will stop if any of the following is placed on the account:

•Action Code 23 – Loan Locked in for Payoff

•Action Code 39 – Stop fees and cost amortization up to action date

•Hold Code 60 – Account Frozen

•The loan is released (LNRLSD = Yes).

•The asset classification (LNACLS) is 4 (doubtful) or 5 (loss).

•The trading indicator (LNTIND) is 2 (held for resale).

•The loan is non-performing (LNNONP = Yes).

If the loan is delinquent and institution option SAPI (Stop Precomputed G/L Amortization if Delinquent) is set up for your institution.

11 - Texas Daily Amount Financed

Rebate Method 11 is similar to rebate method 10, except instead of using the Original Principal (LNFACE) to calculate the rebate, it uses the Original Principal Before Add-Ons (LN78OP), as shown below:

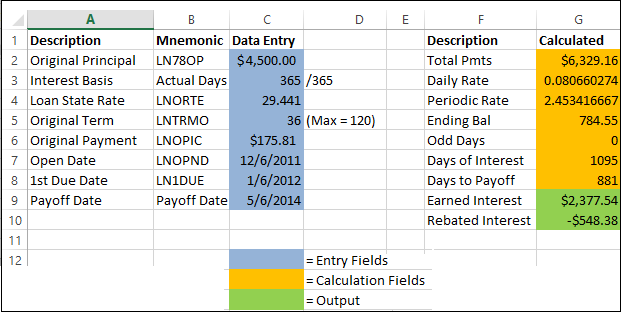

The results of this calculation are as follows:

Payment Number |

Int Start |

Pmt Date Int End |

# of Days |

# Days Elapsed |

Total Days |

Principal |

Interest |

Payment |

Paid Bal |

New Bal |

Sum Interest |

|---|---|---|---|---|---|---|---|---|---|---|---|

1 |

12/6/2011 |

1/6/2012 |

31 |

31 |

31 |

4500.00 |

112.52 |

175.81 |

63.29 |

4436.71 |

112.52 |

2 |

1/6/2012 |

2/6/2012 |

31 |

31 |

62 |

4436.71 |

110.94 |

175.81 |

64.87 |

4371.84 |

223.46 |

3 |

2/6/2012 |

3/6/2012 |

28 |

28 |

90 |

4371.84 |

98.74 |

175.81 |

77.07 |

4294.77 |

322.20 |

4 |

3/6/2012 |

4/6/2012 |

31 |

31 |

121 |

4294.77 |

107.39 |

175.81 |

68.42 |

4226.35 |

429.59 |

5 |

4/6/2012 |

5/6/2012 |

30 |

30 |

151 |

4226.35 |

102.27 |

175.81 |

73.54 |

4152.81 |

531.86 |

6 |

5/6/2012 |

6/6/2012 |

31 |

31 |

182 |

4152.81 |

103.84 |

175.81 |

71.97 |

4080.84 |

635.70 |

7 |

6/6/2012 |

7/6/2012 |

30 |

30 |

212 |

4080.84 |

98.75 |

175.81 |

77.06 |

4003.78 |

734.45 |

8 |

7/6/2012 |

8/6/2012 |

31 |

31 |

243 |

4003.78 |

100.11 |

175.81 |

75.70 |

3928.08 |

834.56 |

9 |

8/6/2012 |

9/6/2012 |

31 |

31 |

274 |

3928.08 |

98.22 |

175.81 |

77.59 |

3850.49 |

932.78 |

10 |

9/6/2012 |

10/6/2012 |

30 |

30 |

304 |

3850.49 |

93.17 |

175.81 |

82.64 |

3767.85 |

1025.95 |

This method processes as follows:

•This method works on simple months (every monthend is 1 month of earnings). If the open date is on the last day of the month and the afterhours is run that day, the system amortizes the first month’s earnings that day. Every monthend afterwards will be 1 additional month of earnings. For example, the first month of earnings is calculated on the open date, regardless of whether the loan had an extended first period. At the next monthend, the second months’ worth of earnings will be amortized.

oFor first month amortization, The calculation is: Earned = LNFACE (Face Amount) * LNORTE/100 * (Days Elapsed in 360 Basis/360) where interest calculated does not exceed OTFPAM (First Payment) – (OTMNTA/LNTRMO) (Maintenance Fee / Original Term)

oFor second month amortization, The calculation is: Earned = LNFACE (Face Amount) * LNORTE/100 * (Days Elapsed in 360 Basis/360) where interest calculated does not exceed LNOPIC (Original P/I Payment) – (OTMNTA/LNTRMO) (Maintenance Fee / Original Term)

Note: If there was carryover interest from the prior period, that interest will be collected in the following months until the interest is fully collected.

•Subtract the interest earned from the original interest (LN78OI) and compare against the current unearned (LN78CG) to determine how much interest will amortize. This amortization method is a 360-day basis along with any extended days.

Notes about this method:

•This method uses the original contract rate (LNORTE) as the rate to amortize by.

•When running payments through the amortization schedule, the odd first payment (OTFPAM) will be considered for the first payment.

•The maintenance fee amount (OTMNTA) is divided by the original term to come up with the monthly maintenance fee. The monthly maintenance fee amount will be subtracted from the original payment (OTFPAM) and original payment (LNOPIC) when running the payments through the amortization schedule.

•The amortization schedule determines the sum of interest earned for a period and calculates the remaining unearned.

•The method can handle negative amortization situations. If the first few periods are negative amortization, the unpaid portion of the interest will be carried over to the following periods until satisfied. At that point, the loan balance will begin to decrease in the schedule.

•If the amortization is greater than the original interest (LN78OI) and there is a remaining amount in LN78CG, LN78CG is the amount to amortize.

•If Institution Option AMOP SAPI is set, amortization stops when the loan is non-performing (LNNONP). Once the loan is performing again, amortization will catch up on the account at the next monthend.

•If the account is non-accrual (LNACST = Y), amortization will stop until the non-accrual indicator is removed. This can be coded in the method or set as an option.

13 - Rule of 78 - Multi Frequency

This interest rebate method uses Rule of 78s. In calculating the refund, the system determines how many frequencies have elapsed using the original frequency and the number of installments. For example, if the loan frequency is weekly with an Original Installment Number value of 20 and 10 weeks have elapsed, the system needs to refund 10 weeks’ worth of precomputed interest. The number of total installments on the loan for frequencies other than monthly comes from the Original Installment Number field. If this field is blank, the systems uses the Current Installment Number.

The Use Anniversary of Date Opened (LN78DO) or Use Anniversary of First Due Date (LN78AF) need to be available for use when using this method.

•If Use Anniversary of Date Opened is selected, the system refunds one installment less the day after the anniversary of the open date.

•If Use Anniversary of First Due Date is selected, the system refunds one installment less the day after the anniversary of the first due date. These patterns repeat themselves based on the frequency of the loan.

For loan frequencies other than monthly, the following rebate rules apply if the Rebate Rule Days field (LN78DR) has a value of 15:

Semi-Monthly – 7 (no)/8 (yes) Day Rule

Bi-Weekly - 7 (no)/8 (yes) Day Rule

Weekly – 3 (no)/4 (yes) Day Rule

•If the Minimum Interest Rebate Limit field (LN78RL) is populated, the refund cannot be less the amount in the field. Otherwise, there is no rebate.

•When an institution runs the Precomputed to Interest-bearing transaction (on the Loans > Transactions > Charge-off screen > Convert Precomputed to Simple tab), they need to use the same refunding parameters that the payoff would run.

14 - TN Actuarial - Multi Frequency

This interest rebate method calculates similarly to Int Rebate Method code 12 (TN Actuarial w/o Fee), except that it calculates using weekly, bi-weekly, and semi-monthly frequencies.

When calculating the refund for this method, the system determines how many frequencies have elapsed using the original frequency and the number of installments elapsed. For example, if the loan frequency is weekly with an Original Installment Number value of 20 and 10 weeks have elapsed, the system needs to refund 10 weeks’ worth of PC interest. The number of total installments on the loan for frequencies other than monthly comes from the Original Installment Number field. If this field is blank, the systems uses the Current Installment Number.

The Use Anniversary of Date Opened (LN78DO) or Use Anniversary of First Due Date (LN78AF) need to be available for use when using this method.

•If LN78DO is selected, the system refunds one installment less the day after the anniversary of the open date.

•If LN78AF is selected, the system refunds one installment less the day after the anniversary of the first due date. These patterns repeat themselves based on the frequency of the loan.

This method does not use the Rebate Rule Days field (LN78DR). Earnings are based on a one-day rule: amount is earned one day after the anniversary of open date or anniversary of first due based on options LN78DO or LN78AF.

If the Minimum Interest Rebate Limit field (LN78RL) is populated, the refund cannot be less the amount in the field. Otherwise, there is no rebate.

When an institution runs the Precomputed to Interest-bearing transaction (on the Loans > Transactions > Charge-off screen > Convert Precomputed to Simple tab), they need to use the same refunding parameters that the payoff would run.

15 - Daily Accrual Basis Less Prepaids

This rebate method functions identically to Rebate Method 10 (Daily Accrual Basis), except all prepaid charges are subtracted from the first and regular monthly payment amounts. These removed prepaid charges include the Fee at 8%, Fee at 4%, Prepaid Fees, and Maintenance Fee amounts.

This method can be used to meet regulatory requirements when local laws prevent interest being charged on fees.