Navigation: Loans > Loan Screens > Payoff Screen >

Once the payoff has been Locked and all necessary Adjustments have been made, this tab and GOLDTeller can be used to pay off the customer account. GOLDTeller must be open before payoffs can be processed on this tab.

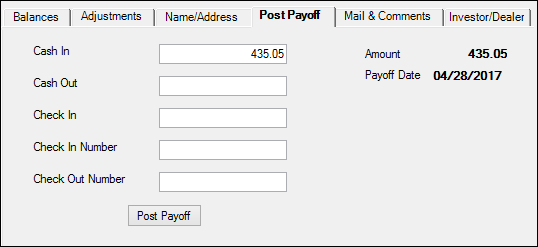

Loans > Payoff Screen > Post Payoff Tab

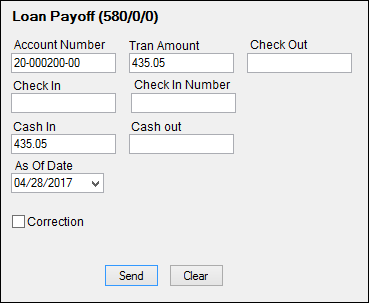

Once payoff information has been entered in the fields on this tab, click <Post Payoff>. The system automatically opens CIM GOLDTeller and enters the data into the Loan Payoff transaction (tran code 580), as shown below. Once you post the payoff through CIM GOLDTeller, the system will close out the loan.

Payoff Transaction (tran code 580)

Once a loan is paid off, it is closed. Additionally, letter number 14 (Payoff letter) can be generated through GOLD EventLetters that you can send to the customer to let them know their account has been paid off and closed (see Letter Number). Closed accounts remain on the system until the date specified in Institution Option OFLM. At which time, the account is archived (see Institution Option ARCM).

See the Payoff transaction information in the Transactions Manual for more information.

Payoff By Journal

If you need to pay off a loan by journal (because the loan has a discharged bankruptcy or a charge-off that your institution wants to close out the loan), use the Payoff by Journal (tran code 580-01) or Payoff-Journal Offset (tran code 2580-01) transactions instead. See the following details concerning these payoffs in the following sections:

|

The fields on this tab are as follows:

Field |

Description |

|

|

Mnemonic: GTIBAMT_01 |

Enter the amount of cash the customer brought in to pay off their loan. Customers may use a combination of cash and checks, in which case, enter the cash amount in this field and the amount of the check in the Check In field. This field is not file maintainable until the loan has been Locked for payoff.

The system automatically returns any overpayment in the form of a check. If you would rather return any overpayments via cash, you would need to manually enter the difference between the payoff amount and Cash In amount, and enter that amount in the Cash Out field. Important: You cannot use cash to return overpayments if the customer paid by check and cash.

You must have GOLDTeller open before clicking <Post Payoff>. Once you click <Post Payoff>, the system automatically enters the data into GOLDTeller using the Loan Payoff transaction (tran code 580). Once you post the payoff through GOLDTeller, the system will close out the loan.

|

|

Cash Out

Mnemonic: GTIBAMT_02 |

This field can only be used if the customer uses only cash to pay off a loan. If the customer brings in more cash than is required to pay off a loan, enter the difference of the payoff amount and the cash in the Cash Out field. This amount will go back to the customer. Note: If you leave this field blank, the system will pay back the difference using a check.

Example: A customer brings in a $100 bill to pay off their loan totaling $84. You would:

1.Enter "100.00" in the Cash In field. 2.Enter "16.00" in the Cash Out field. 3.Click <Post Payoff>. CIM GOLDTeller will open with the Payoff transaction displayed, as shown below: 4.Click <Send> and the Payoff transaction will process. 5.If GOLDTeller is set up properly, the cash drawer will open, where you can deposit the $100 bill and return $16.00 to the customer.

You will need to calculate the Cash Out amount manually. Your institution may have policies that require any payoff overpayment to be returned via check, whether paying by cash or check. Consult your institutions best practices when using cash for overpayment payoffs.

Note: Overpayments returned via cash do not use the Payoff Overpayment G/L account (on the GOLD Services > General Ledger > G/L Account By Loan Type screen), obviously. |

|

|

Mnemonic: N/A |

Use this field to indicate the part of the loan being paid off by check. Use the Check In Number field below to indicate the check number of the check being used. See below for more information.

You must have GOLDTeller open before clicking <Post Payoff>. Once you click <Post Payoff>, the system automatically enters the data into GOLDTeller using the Loan Payoff transaction (tran code 580). Once you post the payoff through GOLDTeller, the system will close out the loan.

|

|

|

Mnemonic: GTIBAMT_04 |

Use the Check In field to enter the number of the check used to pay off the loan, if applicable. If the customer used only cash to pay off the loan, you would leave this field blank. |

|

Check Out Number

Mnemonic: GTIBAMT_04 |

If the check amount the customer uses to pay off the loan is more than the total payoff amount, the system returns the excess amount to the borrower via a check. If your institution uses the UNAC option (Use Next Available Check Number), you are not required to enter a Check Out Number. However, if your institution does not have the UNAC option, you must enter a number in this field for overpayment checks. See the GOLD Services > Next Available Check Number screen for more information about the UNAC option.

The system automatically calculates the difference between the payoff amount and overpayment check amount and enters it on the CIM GOLDTeller Payoff transaction, which appears once the <Post Payoff> button is clicked.

The Amount paid back to the customer will appear on the Adjustments tab. The amount of the overpayment check will be pulled from the Payoff Overpayment G/L account specified on the GOLD Services > General Ledger > G/L Account By Loan Type screen.

Institution Option OVCK

If returning excess amounts via check, the amount needs to be more than what is entered in Institution Option OVCK.

For example, the limit for Institution Option OVCK is $1. A customer brings in a check for $400 to pay off their loan totaling $399.53. You would:

1.Enter "400" in the Check In field. 2.Enter the Check In Number in the applicable field. 3.Click <Post Payoff>. 4.CIM GOLDTeller will open with the applicable fields already entered. Process the transaction. 5.The system will credit the remaining 47 cents to the Payoff Overpayment G/L account specified on the GOLD Services > General Ledger > G/L Account By Loan Type screen. This amount is included on the Over/Under Payments Report (FPSRP297). If the customer would rather have that 47 cents, you would need to manually run a Cash to Customer transaction, then balance the G/L accounts using G/L Debits and Credit transactions accordingly. |