Navigation: Loans > Loan Screens > Payoff Screen >

When processing customer account payoffs (as discussed in help for the Loans > Payoff screen), you can print or display payoff quotes using the Detailed Quote and/or Customer Quote options on the bottom of the screen. You can print a quote before or after the loan is locked (see Payoff Locking).

You may want to create a quote before you lock in the payoff. That way, the system will show you what will happen to the loan if no payments are made between today and the payoff. For example, if future late charges would incur between now and the Effective Payoff Date if no payments are made, future late charges will show on the Payoff Quote. However, if you lock in the payoff, late charges are skipped from the payoff quote.

Before viewing quotes, make sure you enter the Effective Payoff Date the customer anticipates paying off the loan, then click <Recalc>. The payoff totals will be based on that date. If creating a quote for today, you can leave that field blank and the system will automatically calculate payoff totals as of today. |

In this topic:

|

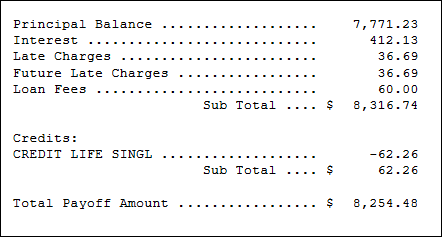

The Detailed Quote is a quick glance of what the totals are involved in the payoff. The Detailed Quote shows any amounts owing as of the Effective Payoff Date, as well as any rebated credits such as early cancellation of insurance policies or unearned precomputed interest. See the following example of a Detailed Quote:

Detailed Quote Example

The Customer Quote should be printed for the customer before actually posting the payoff by clicking <Post Payoff> on the Post Payoff tab. You can print this quote and send it to a customer as well. If the customer wants the quote sent to a different location than what is on their CIF file (Loans > Marketing and Collections > CIF tab), use the Name/Address tab to enter that information, as discussed in the Quote Sent to Different Address section below. You can also add a personal message on the Name/Address tab that will be included on the Customer Quote, as shown in the example below.

The Customer Quote shows the date the quote is good through. After that date, the quote is no longer valid and the Per Diem interest is still owed on the account.

Use the <Setup> and <Font> buttons under the Print Information option on the bottom of this screen to edit the appearance of payoff quotes when printed.

Note: If your institution does not calculate future late charges, they will not appear on the Customer Quote. In the example below, this institution does include future late charges. See Future Late Charges below for more information.

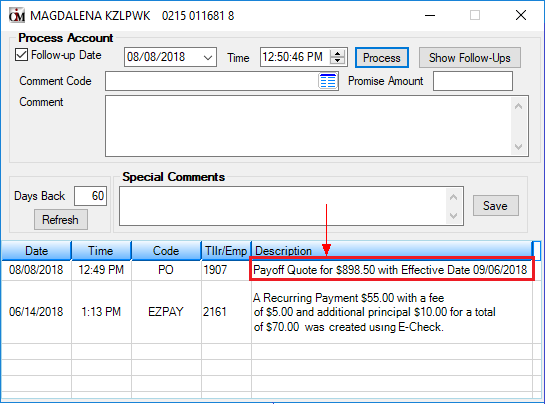

Click <Quote to Comment> to send payoff quote information to the Collection Comments. Collection Comments are found under Options > Show Collections Comments in CIM GOLD as well as the Collection Queue screens and on the Loans > Marketing and Collections screen. The Payoff does not need to be locked to send the payoff quote to the comments. See the example below:

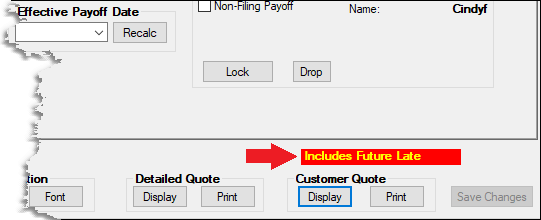

If Institution option AFLC (Assess Future Late Charges in Payoff) is enabled, the system will calculate one future late charge, regardless of how far into the future the Effective Payoff Date is set. For example, a customer wants to know how much the payoff would be if paid off three months from now. If no payments are made, the system would show that one late charge would be incurred, even though more than one late charge would likely occur in this scenario if no payments are made between now and the payoff date.

If a payoff quote is set up for a future date, and a late charge will be assessed before that date, the payoff quote will automatically calculate the late charge amount and add it to the payoff amount if option AFLC is set up. Additionally, the message "Includes Future Late" will show above the Customer Quote box on the Payoff screen, as shown below.

Future Late Charges will also show on the Customer Quote, but only if the loan has not been locked for payoff (see Customer Quote example above). Even if option AFLC is on, future late charges will still be disabled on the customer account if the following are true:

•Institution Option LC82 (Allow Late Charge on General Category 82) is disabled.

•Any of the four Hold Codes on the customer account is "2 -Charge-off: unpaid balance reported as loss by credit grantor."

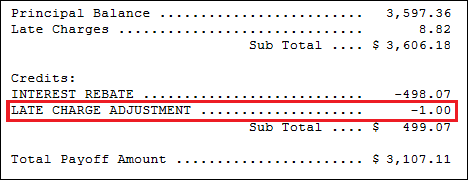

Backdating a Payoff with Late Charges

If a late charge has been assessed on a customer account, but the effective date of the payoff transaction is backdated to a date before the late charge was assessed, the amount of the late charge will be adjusted off the payoff. This adjustment will appear on the payoff quote, as shown below:

Quote Sent to a Different Address

See the help on the Mail & Comments tab for information on sending the Payoff Quote to a different address than the one connected to the borrower.

Event Letter 14 is reserved for the Payoff letter. Your institution is responsible for the wording of the event letter, and you can use any of the merge fields available for Event 14. Once the letter is tied to a merge document in Word, you can use GOLD EventLetters to merge the fields with system-generated information from loan accounts. You may need to read the complete GOLD EventLetters User's Guide if you are unfamiliar with how to set up event letters. If you just need a refresher on how to set up Word documents with loan-specific merge fields, see the following topics in the GOLD EventLetters manual for more information:

•Assigning Merge Letters to Events

•Working with GOLD EventLetters

In order for the event letters to generate, the following must be set up:

•Your GOLDPoint Systems account manager must set up event 14 in Institution Option EVNT.

•Make sure the Letter Number field in the Payoff Fields field group has "14" and the Letter Date is set for today (or the Payoff Day). GOLD EventLetters generate in the afterhours.

The Event Letter Report shows which events generated for which accounts. See the Event Letter Report (FPSRP175) for more information.