Navigation: Loans > Loan Screens > Account Information Screen Group > Reserves Screen Group > Account Reserve Detail Screen > Reserve Payment tab >

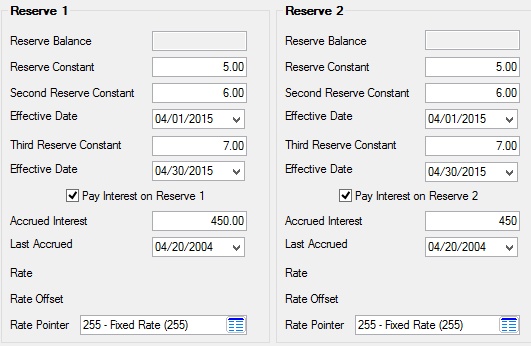

Reserve 1 and 2 field groups

You can set up to four different reserve payments; two for reserve balance 1 and two for reserve balance 2. Each of the two reserve balances is represented by an identical Reserve field group on this tab.

|

Note: Reserve 2 may be used for insurance that need not be transferred to an investor custodial account. However, your institution may have an option installed which transfers reserve 2 amounts to custodial accounts. Make sure you know how this option is set up before setting up custodial account transfers. |

|---|

|

WARNING: Be sure Reserve 2 is marked on the Loans > Account Information > Account Detail screen. If not, it will not appear in the Next Payment Due amount field on the Account tab of that screen. |

|---|

The fields in these field groups are as follows:

Field |

Description |

|

Mnemonic: LNR1BL, LNR2BL |

This field contains the amount that has been paid by the borrower to apply to such things as taxes, insurance, etc. It can only be entered through a teller transaction.

Institution Option I R2NG prevents a negative Reserve 2 Balance. With this option, if a transaction creates a negative balance, the error message, “Disbursement/Reserve 2 Would be Negative” appears on the Afterhours Processing Exceptions Listing report. If you would like this option, submit a work order. |

|

Mnemonic: LNR1CN, LNR2CN |

This field contains the portion of the regular payment to apply to the Reserve Balance above. This field contains the amount that has been paid by the borrower to apply to such things as taxes, insurance, etc. It can only be entered through a teller transaction.

Institution Option I R2NG prevents a negative Reserve 2 Balance. With this option, if a transaction creates a negative balance, the error message, “Disbursement/Reserve 2 Would be Negative” appears on the Afterhours Processing Exceptions Listing report. If you would like this option, submit a work order. This is the portion of the payment to be used for taxes, insurance, etc. This field is user-entered and file maintainable. |

|

Mnemonic: LNR1NX, LNR2NX |

This field is used with the Effective Date below to indicate what the new Reserve Constant (above) becomes on that date. It is also used to round the payment during ARM or reserve analysis. The reserve analysis updates this field for you. However, if the new reserve payment is equal to the old reserve payment, this field is not updated. This field cannot be zero if the Third Reserve Constant field below has a dollar amount in it. |

|

Mnemonic: LNR1EF, LNR2EF |

These field groups contain two Effective Date fields, corresponding to the Second (above) and Third Reserve Constant (below) fields. The reserve analysis will update these fields for you. However, if the new reserve payment is equal to the old reserve payment, this field is not updated on the date indicated. If you change this field, the reserve analysis will not override your change, but the analysis will be noted on the Afterhours Exception Listing.

If the loan Due Date Day is changed, the effective date days will change to match the Due Date Day. These fields can be changed manually, but effective date days must match the Due Date Day or else the system will display an error message and prevent saving changes until the error is corrected. |

|

Mnemonic: LNR1C2, LNR2C2 |

This field is used with the corresponding Effective Date to indicate what the new Second Reserve Constant field above will become on that date. This field is only used if the Second Reserve Constant field has already been used. As the value in the Second Reserve Constant field rotates into the Reserve Constant field above, this field's value will move into the Second Reserve Constant field. This is also a user-entered field and, as such, is file maintainable. The reserve analysis will update this field for you. |

|

Mnemonic: LNIRS1, LNIRS2 |

Checkmark this field if interest is to be paid on the Reserve Balance (above) on this loan. |

|

Mnemonic: LNR1AI, LNR2AI |

This field contains the amount of interest accrued on the first Reserve Balance (above) when your institution pays interest on reserves. The system will supply this information for you based on the following calculation.

Balance X Rate X Number of Days / 365

“Balance” is based on 365/365 simple interest from transaction to transaction like a payment method 6 loan. It is calculated from the date Last Accrued (below) to the latest transaction date on the reserve balance at the reserve rate. You are also able to file maintain the field if necessary. |

|

Mnemonic: LNR1LA, LNR2LA |

This field gives the date up to which interest was last accrued on the Reserve Balance (above). This information is supplied by the system, but you can file maintain the field if necessary. |

|

Mnemonic: LNR1IR, LNR2IR |

The Rate field contains the rate at which interest is calculated on the first Reserve Balance (above) when your institution pays interest on reserves. This field is used only if the Pay Interest on Reserve field above is checkmarked. You should enter data for this field, if needed. |

|

Mnemonic: LNR1OF, LNR2OF |

The reserve rate offset is used in conjunction with the Rate Pointer field below and the Loans > System Setup Screens > Interest Rate Table screen to calculate an interest rate. This field may be either positive or negative to allow points above or below the rate index indicated by the Rate Pointer. The field is file maintainable. |

|

Mnemonic: LNR1RP, LNR2RP |

This field is used to calculate rate changes on the Reserve Balance (above) using the the Interest Rate Table screen. Use of this pointer allows prime-sensitivity on reserves, or the ability to easily change the rate as needed without manually changing each loan. Rate tables are set up on the Interest Rate Table screen and are user defined. Available pointers can also be found on the Interest Rate Table screen.

Rate pointer 255 indicates the rate for this account should never change. |