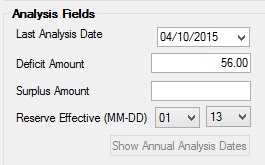

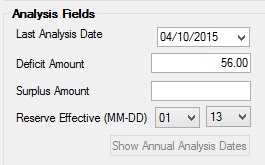

The fields in this field group allow you to set limits for the reserve analysis. This is for the selected account only. You must have information in the Reserve Effective field (see below) in order for this account to be included in the reserve analysis.

Clicking the <Show Annual Analysis Dates> button opens the Show Annual Reserve Analysis Dates dialog.

The fields in this field group are as follows:

Field

|

Description

|

Last Analysis Date

Mnemonic: LNLADT

|

This field contains the date on which the reserve analysis was last processed for this loan. The system supplies this information, and you are able to file maintain the field. History for the next analysis begins on this date.

See also:

•Reserve Analysis Statement (FPSRP339) and Reserve Analysis Report (FPSRP339) on DocsOnWeb |

Deficit Amount

Mnemonic: LNRDEX

|

The reserve deficiency as of the last reserve analysis is stored in this field. The system will supply this information, but you are allowed file maintenance on the field if necessary. This field will be blank if there is no deficit at the time of analysis.

|

Surplus Amount

Mnemonic: LNNETX

|

The system enters the surplus amount as of the Last Analysis Date in this field. It is this field that the system uses to create the excess check. Any surplus amounts displayed in this field will either be overwritten or changed to a blank as a new analysis is performed. If an analysis is done via the Reserve Analysis tab, this field is updated when the <Post Analysis> button is clicked.

If the surplus is less than the Surplus Limit Amount from either the institution option (found on the Loans > System Setup Screens > Reserve Analysis Options screen) or the individual Surplus Limit (in the Analysis Limit field group), this amount will be blank (the payment is lowered by the surplus.)

|

Reserve Effective

Mnemonic: LNANAL

|

Use this field to indicate when this account should have reserve analysis processed for their reserves. See below for more information.

Once reserves are processed, the system sends all information to the Loans > Check Printing > Reserve Checks screen, where you can print notices; print reserve disbursement checks to insurance companies; print refund checks; print a remittance form; and other reserve information.

Additionally, you can download and print statements to send to your customers notifying them of reserve payment projections using the Reserve Analysis Statement (FPSRP339). For more information on this statement and report, see Reserve Analysis Statement (FPSRP339) and Reserve Analysis Report (FPSRP339) on DocsOnWeb.

All loans with the same reserve effective date will be included in the same annual analysis. This field corresponds with the For Reserve Analysis Effective Date of field on the Reserve Analysis Options screen.

If the loan Due Date Day is changed, this reserve effective date day will change to match the Due Date Day. This field can be changed manually, but the reserve effective date day must match the Due Date Day or else the system will display an error message and prevent saving changes until the error is corrected.

|

WARNING: Any loan without data in this field will not be analyzed. Also, certain hold codes or the Skip Analysis field will stop loans from being analyzed.

|

|

WARNING: If the Reserve Effective field is blank and you use payment coupons, the system treats this date as 02-01 and uses that date to stop/start coupons.

|

|

Note: Two options on the Loans > Account Information > Reserves > Reserve Analysis Options screen may affect when reserve payments are made:

•If you select the the Use Paid Date Instead of Expiration option, the system will use the Pay Date instead of the Expiration Date for when the system processes reserve analysis payments. The Anticipated Payments section and the Payment Effective Date on the Reserve Analysis Statement will both use the Pay Date.

•If the Use Relative Effective Date option is selected, the Payment Effective Date of the reserve analysis will be the next due date after the Reserve Effective date. However, if the Due Date and Reserve Effective dates are the same (which is usually the case), then the Payment Effective Date will be the same. The Payment Effective Date is reflected on the Reserve Analysis Statement (FPSRP339). |

|

Note: This field must contain data when the <Show Annual Analysis Dates> button is clicked; otherwise, an error message will be displayed.

|

|

|