Navigation: Loans > Loan Screens > Account Information Screen Group > Precomputed Loans Screen > Amortization of Interest to G/L field group >

Amortization Methods

The amortization method for collecting precomputed interest is usually established when the loan is opened. However, if you have proper security clearance, you can click the list icon ![]() and select from the list the amortization method by which the precomputed interest will be amortized. The field defaults to “00 - Rule of 78s.” Please note that this field should only be changed by a supervisor who understands the complexities of amortizations.

and select from the list the amortization method by which the precomputed interest will be amortized. The field defaults to “00 - Rule of 78s.” Please note that this field should only be changed by a supervisor who understands the complexities of amortizations.

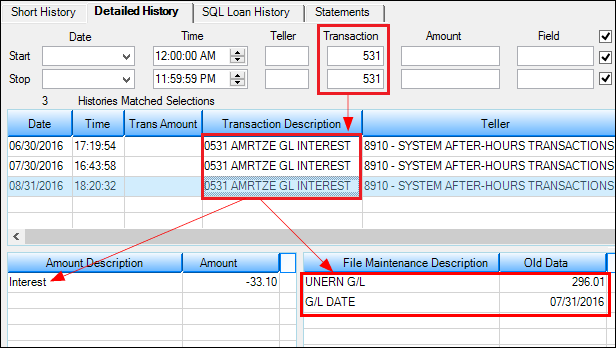

The system automatically amortizes precomputed interest to the G/L based on the method selected here. When the system amortizes precomputed interest, you can view the date and amount amortized on the Loans > History screen > Detailed History tab by searching for transaction code 0531, as shown below:

Note: Update function 33 must be set to amortize the interest to the General Ledger. Also, the Precomputed Interest Amortization report (FPSRP215) shows the amortization of interest.

Available amortization methods are listed below. Select a method below to jump to that section on this help page.

13 - Rule of 78s - Multi Frequency

14 - TN Actuarial - Multi Frequency

15 - Daily Accrual Basis Less Prepaids

The system will automatically calculate the Earned Interest and Unearned Interest fields based on the method here. However, detailed descriptions of some of the methods are described below for your reference.

Note: The following items will prevent the interest from amortizing to the G/L:

1.If this is a non-performing loan (LNNONP is checked).

2.If a General Category (LNGENL) of 80, 82, 83, 84, 86, or 87 is on the loan.

3.If this loan has been service released (LNRLSD is checked).

4.The Trading Indicator (LNTIND) is set to "Held for Resale."

5.The Asset Classification field (LNACLS) is either "4-Doubtful" or "5-Loss."

6.Action Code (LNACCD) = 23 (Loan Locked in for Payoff)

7.Hold Code (LNHLD1-4) = 4 (Chapter 7 or 11 Bankruptcy), 5 (Chapter 13 Bankruptcy), or 60 (Account Frozen)

Also, Institution Option SAPI needs to be set to prohibit amortization if the loan becomes non-performing (LNNONP is checked).

Amortization Code 0 (Rule of 78s):

The Unearned Interest is the amount that would be rebated to the customer at payoff. The Unearned Interest is calculated by the formula:

Unearned Interest = ((Rino x (Rino+1) / (Oino x (Oino+1)) x original add-on interest amount (This is the amount of interest that is added back onto the loan payments when a loan is originated, thus "precomputed.")

“Rino” is the remaining installments in months. “Oino” is the original installments (term).

Unearned Interest = (Remaining.Sum.of.the.digits / Original.sum.of.the.digits) x original amount of add-on interest

(6 / 2) x (6 + 1) = 3 x 7 = 21 (21 / 78) x 500 = .26923 x 500 =134.62

(5 / 2) x (5 + 1) = 2.5 x 6 = 15 (15 / 78) x 500 = .19230 x 500 = 96.15

Original Add-on Interest Amount = $500.00

Original Term = 12

Original Sum of the Digits = 78

The Earned Interest amount is calculated by subtracting the Unearned Interest from the add-on interest amount.

The amount earned for a month is calculated by subtracting the new unearned amount from the previous unearned amount.

Example:

For a 12-month loan with $500 of original add-on interest, the amount of interest earned in the 6th month would be as follows:

((6 x (6+1) / (12 x (12+1)) x 500 = ((6 x 7) / (12 x 13)) x 500 = (42 / 156) x 500 = .26923 x 500 = 134.62

((5 x (5+1) / (12 x (12+1)) x 500 = ((5 x 6) / (12 x 13)) x 500 = (30 / 156) x 500 = .19230 x 500 = 96.15

134.62 – 96.15 = 38.47 earned for the 6th month.

This is the difference in the Unearned Interest for the 6th and 7th months of the loan. The Earned Interest amounts for these months would be 365.38 (500 –134.62) and 403.85 (500 – 96.15) respectively.

Installment Number |

Remaining Term |

Unearned Interest |

Interest Earned |

Monthly Earned |

|---|---|---|---|---|

1 |

11 |

423.08 |

76.92 |

76.92 |

2 |

10 |

352.56 |

147.44 |

70.51 |

3 |

9 |

288.46 |

211.54 |

64.10 |

4 |

8 |

230.77 |

269.23 |

57.69 |

5 |

7 |

179.49 |

320.51 |

51.28 |

6 |

6 |

134.62 |

365.38 |

44.87 |

7 |

5 |

96.15 |

403.85 |

38.46 |

8 |

4 |

64.10 |

435.90 |

32.05 |

9 |

3 |

38.46 |

461.54 |

25.64 |

10 |

2 |

19.23 |

480.77 |

19.23 |

11 |

1 |

6.41 |

493.59 |

12.82 |

12 |

0 |

0.00 |

500.00 |

6.41 |

Amortization Code 1 (Straight Line):

This method takes the original add-on interest (Original Unearned Interest) amount and divides it into equal parts based on the term of the loan.

(Monthly amount = Original Unearned Interest / Term )

500 / 12 = 41.666666 per month

Multiplying this amount by the remaining months will equal the Unearned Interest amount. Note: Sometimes the amount earned in a month will be 41.66 and other times it will be 41.67, because we calculate this amount by subtracting the current interest unearned from the previous interest unearned. (This eliminates a penny difference from being posted to the G/L.)

Example:

ORIG - (IND x MONTHLY.AMT) = Unearned Interest

ORIG = original add-on interest

IND = installment number

MONTHLY.AMT = original add-on interest / the term of the loan

500.00 - (1 x 41.6666) = 458.33 41.67

500.00 - (2 x 41.6666) = 416.67 41.66

500.00 - (3 x 41.6666) = 375.00 41.67

500.00 - (4 x 41.6666) = 333.33 41.67

500.00 - (5 x 41.6666) = 291.67 41.66

Amortization Code 2 (Level Yield):

Overview

The level yield method of amortization is based on the interest method of amortization and amortizes each month over the original term of the loan until the loan either reaches maturity or becomes non-performing (see exception below). The amortization works by calculating the rate of the loan from the face amount (LNFACE). Since amortization is based on the original contractual term of the loan, we need to tally how many months have elapsed from the loan open date to the current date of amortization based on simple terms. In addition, if you enter a value other than 0 or blank in the Rebate Rule Days (LN78DR) field, the program will add the number of days to either the Date Opened or the First Due Date (depending on whether the Use Anniversary of 1st Due Date or Use Anniversary of Date Opened option is selected) to determine the beginning of the elapsed period.

If the institution number is equal to 362, then interest is unamortized if the loan becomes non-performing.

Note: If institution option APFD is set up for your institution, then precomputed interest can start amortizing to the General Ledger prior to the first payment due date, even when the Use Anniversary of 1st Due Date is selected.

Calculation Steps

The calculation for Level Yield has several steps. This calculation normally requires a monthly payment frequency (LNFREQ=1), but this amortization code can be modified to work with weekly, bi-weekly, and semi-monthly frequencies* as well (contact GOLDPoint Systems for more information). Some of the steps below will refer to Microsoft Excel® formulas. Excel is not used by the GOLDPoint Systems mainframe computer, but the formula is shown to simplify the information for the calculation that the mainframe performs.

These amortization method codes use the Level Yield method:

The face amount of the loan (LNFACE) that is used in the calculation is usually populated by GOLDTrak PC using the following formula:

LNFACE = (LNOPIC * LNTRMO) + OTXINT - OTOINT

1.The original amount of precomputed interest (LN78OI) is saved in the field DFRD_ORIG.

2.The unearned amount (LN78CG) is saved in DFRD_REM.

3.The first of the next month is figured and saved in NXTMON.

4.The original term (ORIGTERM) is taken from the original loan term (LNTRMO) or from the current loan term (LNTERM) if the original is zero. ORIGTERM cannot be zero.

5.The remaining term (RTERM) and elapsed term (ETERM) are calculated from the date opened (LNOPND) to NXTMON. If the loan has been open even one day in the month, the entire month is counted. RTERM and ETERM are adjusted for precomputed loan interest for loans that use the 15-day rule (Rebate Rule Days (LN78DR) = 15). If the loan was opened after the 15th day of the month, then one month is added to RTERM and subtracted from ETERM.

6.The P/I constant (ADJPI) is calculated using the loan face amount (LNFACE):

ADJPI = LNFACE + DFRD_ORIG / ORIGTERM

7.The adjusted rate (ADJRT) is calculated to seven decimal places. The equivalent Excel formula is:

ADJRT = RATE(ORIGTERM, -ADJPI, LNFACE) * 12

8.The earned amount (EARNED) is calculated using LNFACE, ADJPI, ADJRT, and ETERM. The equivalent Excel formula is:

EARNED = -CUMIPMT(ADJRT/12, ORIGTERM, LNFACE, 1, ETERM, 0)

9.Skip to step 16 to finish the calculation for precomputed loans and insurance finance charges.

10.The unearned amount (UNEARNED) is calculated by subtracting the earned amount from the original amount.

UNEARNED = DFRD_ORIG – EARNED

The unearned amount cannot be greater than the current remaining amount (DFRD_REM). If it is, the current remaining amount is completely earned, and the unearned amount becomes DFRD_ORIG is forced to be positive again.

12.The unearned amount (UNEARNED) is calculated by subtracting the earned amount from the original amount.

UNEARNED = DFRD_ORIG – EARNED

The unearned amount cannot be greater than the current remaining amount (DFRD_REM). If it is, the current remaining amount is completely earned and the unearned amount becomes zero.

13.This new unearned amount is subtracted from the unearned amount on file to figure the amount earned this month. This is done to keep the G/L in sync with the file.

EARNED_THIS_MONTH = DFRD_REM - UNEARNED

* This method will always amortize at monthend regardless of the selected frequency, but it will amortize the number of frequencies elapsed.

Amortization Code 3 (Effective Yield):

The calculation for effective yield is very involved and has several steps. This calculation is only valid for precomputed interest loans (payment method 3). The steps are as follows:

1.Find the monthend date for the month of processing.

2.Find the monthend date for the first due date (LN1DUE).

3.Find the elapsed months by calculating the difference in these in actual days (#Days), and then use this number to determine the months (#Months) as follows:

•If the processing monthend is less than the monthend of the first due date, the difference is 0. (#Months = 0)

•If the two dates are the same, then the number of months is 1. (#Months = 1) If #Days is less than 30, then the number of months is 2. (#Months = 2)

•If #Days is less than 366 days, then use a factor of 29.0; else use 30.3 in the following formula to figure #Months: #Months = (#Days / factor) + 9.1

| 4. | Figure the number of paid months to three decimal places. |

PdMos = (LNOBAL – LNPBAL) / LNOPIC

| 5. | Get the whole part of this number by truncating the paid months. |

PdWhole = truncated PDMos

| 6. | Get the fraction part by subtracting the whole months from the paid months. |

PdFract = PdMos – PdWhole

| 7. | Delinquency is then determined by: |

#Delq = #Months – PdMos

If #Delq is greater than 2, then the loan is delinquent, otherwise it is current.

| 8. | We now have all of the information we need to calculate the effective yield for the loan. If the loan is not delinquent, then an amortization is done for the number of elapsed months (#Months) using original principal before add-ons (LN78OP), the original APR (LNOAPR), and the original P/I constant (LNOPIC.) |

Earned = FV(LNOAPR/12,#Months,-LNOPIC) (Approximate Excel equivalent)

The program loops, making the payment calculations and accumulating the interest amount.

* BALANCE = LN78OP

* PMTLOOP start

* INT = BALANCE * RATE

* CumiInt = CumiInt + INT

* BALANCE = BALANCE - (LNOPIC - INT)

* PMTLOOP end

* Do PMTLOOP #Months times

| 9. | If the loan is delinquent, then two amortizations are performed. In the first, we add 2 to PdWhole and amortize the loan for that number of months. Then we add 3 to PdWhole and amortize again. The answer from the first amortization is subtracted from the answer of the second amortization, multiplied by PdFract and then added back to the answer of the first amortization. This is the amount of interest earned. |

Earned = ((Ans2 – Ans1) * PdFract) + Ans1

| 10. | The earned amount is adjusted by the percentage that this original fee amount (OrigFee) is of the total fees (TotFees). The fee total is calculated by subtracting the original principal balance from the original loan balance. |

TotFees = LNOBAL – LN78OP

The percentage is calculated by dividing the original fee amount by Totfees.

Fee% = OrigFee / Totfees

The earned amount is then adjusted by multiplying it by this percentage.

Earned = Earned * Fee%

| 11. | The unearned amount is calculated by subtracting the earned amount from the original unearned amount. This becomes the new unearned/remaining amount. |

(Unearned = LN78OI - Earned) or

(Unearned = F1FORG – Earned)

| 12. | This new unearned amount is subtracted from the unearned amount on file to figure the amount earned this month. This is done to keep the G/L in sync with the file. |

(Earned_this_Month = LN78CG - Unearned) or

(Earned_this_Month = F1GREM – Unearned)

Originally, we used Add-On Rate (LN78AO) in the calculation for the loan G/L interest and did not figure and multiply by a percentage.

The procedure follows steps 1-7 for the Unearned Interest and adds the following steps:

| 1. | The APR for the loan with this fee/yield (Rate1) is calculated using these formulas: |

OrigAmt = the original fee/cost/etc amount

Bal1 = LN78OP + LN78OI + OrigAmt

PI1 = Bal1 / LNTERM

Rate1 = RATE(LNTERM,-PI1,Bal1)*12 (Approximate Excel equivalent)

| 2. | The APR for the loan without the fee/yield (Rate2) is calculate using these formulas: |

Bal2 = LN78OP + LN78OI

PI2 = Bal2 / LNTERM

Rate2 = RATE(LNTERM,-PI2,Bal2)*12 (Approximate Excel equivalent)

| 3. | The difference in these figures is calculated to determine the APR (DiffRate) for the fee/yield. |

DiffRate = Rate1 – Rate2

| 4. | A payment constant (DiffPI) is calculated using this new information. |

DiffPI =

ROUND(PMT(DiffRate/12,LNTERM,OrigAmt)*-1,2)

(Approximate Excel equivalent)

| 5. | We now have all of the information we need to calculate the effective yield for an amortizing fee or a deferred yield. The difference here is that we are earning the fee or yield amount and not the interest on it. |

* RATE = DiffRate / 12

* BALANCE = OrigAmt

* PMTLOOP start

* INT = BALANCE * RATE

* CumiPrin = CumiPrin + (DiffPI - INT)

* BALANCE = BALANCE - (DiffPI - INT)

* PMTLOOP end

* Do PMTLOOP #Months times

| 6. | The process now follows steps 9-11 for the Unearned Interest with the substitution of the original fee/yield amount for Original Unearned Interest (LN78OI) and the remaining fee/yield for Unearned Interest (LN78CG). |

Amortization Code 4 (Amortize to Due Date):

If Use Anniversary of 1st Due Date (LN78AF) is checkmarked, an additional month is earned the day after the anniversary of the due date. If Use Anniversary of Date Opened is checkmarked, an additional month is earned the day after the anniversary of the opened date. The only difference in this method as compared to method 0 (Rule of 78s) would be fewer or no partial months of precomputed interest earned.

Amortization Code 5 (Level Yield 2):

The calculation for Level Yield 2 is only valid for precomputed interest loans (payment method 3) with a monthly payment frequency (LNFREQ=1). The steps are as follows:

| 1. | The original amount of precomputed interest (LN78OI) is saved as “ORIG” in the calculation. This is used at the end of the calculations to determine what percentage of all the add-on interest belongs to the earned amount that is being calculated. |

| 2. | Figure the first of next month (NXTMON). The calculation will amortize to this date. |

| 3. | Get the original term of the loan (ORIGTERM). LNOTRM is used unless it is zero, in which case LNTERM is used. |

| 4. | Calculate the extension interest (EXTINT). EXTINT = LNOBAL – (ORIGTERM x LNOPIC) |

| 5. | Figure the first of the month after the date opened (FRSTMON). For example, if the date opened (LNOPND) was 12/17/2010; the program uses 01/01/2011. |

| 6. | Figure the end of the month of the date opened (OPNDME). If the date opened (LNOPND) was 12/17/2010; the program uses 12/31/2011. |

Now we are ready to figure the first month of amortization (FRSTAMRT). This is the month of the date opened when the Is Extension Interest Added to Original Interest (LN78EI) option is selected or EXTINT is equal to zero. If this is the case, FRSTAMRT = LNOPND (forced to the first of the month), and you can jump to step 12. Otherwise, continue to the next step.

| 7. | Figure the number of days from the date opened (LNOPND) to (LN1DUE) using a 360 days base. |

| 8. | Subtract 30 from this number to get the extension interest days (EXTDAYS). |

| 9. | Add this result to the date opened (LNOPND) using a 365-days base to get the date opened plus extension days date (OPNEXT). This date is forced to the first of the month and becomes our possible first amortization date (FRSTAMRT). |

| 10. | Get the month of OPNEXT (DFMM) and the month of LN1DUE (DSMM). If the years of these dates are not the same, add 12 to DSMM, else continue. |

| 11. | Subtract DFMM from DSMM. If the answer is greater than 1, then FRSTAMRT = OPNEXT + 1 month, else FRSTAMRT = OPNEXT. FRSTAMRT is forced to the first of the month. |

The date of first amortization cannot be greater than the date for which we are running (both are forced to the first of the month for this compare). Normally, the amortization selection program has decided this and it does not arrive at this point in the amortization process. If, however, an account slips by, it will be rejected and nothing is earned. Otherwise, we continue on with the process of preparing for the amortization.

| 12. | Figure the partial month days for loans with extension interest (LN78EI) is checked and EXTINT not equal to zero). If the loan does not have extension interest, then you can skip to the next step. |

Otherwise, it is figured by:

| 1. | Subtracting 30 days from the First Due Date (LN1DUE) using 365 days as the base. |

| 2. | Figure the days between this date and the first of the month of the first due date (LN1DUE) using a 360-days base. |

| 3. | This answer becomes the partial month days (PARTDAYS). |

| 4. | Skip to step 14. |

| 13. | Figure the partial month days for loans without extension interest (LN78EI) is blank and EXTINT equal to zero). This is done by doing the following: |

| 1. | Figure the number of days difference from the date opened (LNOPND) and the first of next month (FRSTMON) using 360 days as a base. |

| 2. | This answer becomes the partial month days (PARTDAYS). |

| 14. | Figure the remaining days (REMDAYS) by subtracting the partial days from 30. |

REMDAYS = 30 – PARTDAYS

| 15. | Calculate the P/I constant (PICN) to use in the amortization. |

| 1. | If LN78EI is checked then: |

| 1. | Figure the number of days from OPNDME to LN1DUE using 360 days as the base. |

| 2. | If this answer is greater than 30, add 1 to ORIGTERM to the term (OTERM) used in the P/I calculation. |

| 2. | If LN78EI is blank then: |

| 1. | Use ORIGTERM as the term (OTERM) in the P/I calculation. |

| 3. | The P/I constant is equal to the amortizing balance (LN78AB) divided by the term. |

PICN = LN78AB / OTERM

| 16. | Calculate the rate (JRATE) for the amortization to 7 decimal places. This uses our normal rate calculation routine using these variables: |

| 1. | The original principal (LN78OP). |

| 2. | A payment frequency of 1. |

| 3. | The term in OTERM. |

| 4. | The P/I constant in PICN. |

| 5. | The approximate Excel equivalent of the formula is: |

JRATE = Rate(term,-LNOPIC,LN78OP) * 12

| 17. | Figure the first month in which a whole month’s amortization will occur by adding one month to the first month of amortization (FRSTAMRT) and forcing that date to the first of the month. |

| 18. | Using this date, figure the number of whole months (#MONTHS) to the first of the next month (NXTMON). |

| 19. | Calculate the interest for the partial days. This interest becomes the first of the cumulative interest earned (CUMUINT). The original principal before add-ons (LN78OP) is the balance (BALANCE) used. The formula is: |

CUMUINT = (BALANCE * JRATE * PARTDAYS) / 360

| 20. | For the rest of the calculation, we divide JRATE by 12 so this doesn’t have to be done each time through the loop. This is our nominal rate (RATE). |

RATE = JRATE / 12

We now have all of the information we need to calculate the level yield for the loan. This calculation is done by making pseudo-payments on the loan. The program loops for the number of whole months (#MONTHS) yield for and performs the following calculations:

| 21. | The amount of payment interest (PMTINT) is calculated: |

PMTINT = BALANCE x RATE

| 22. | The amount of interest prior to the payment in the month is calculated: |

PRIORINT = (BALANCE x RATE x REMDAYS) / 360

| 23. | A new balance is the calculated: |

BALANCE = BALANCE – (LNOPIC – PMTINT)

| 24. | The amount of after payment interest (AFTERINT) is calculated on this new balance next: |

AFTERINT = (BALANCE x JRATE4 x PARTDAYS) / 360

| 25. | These interest amounts are added to the cumulative interest: |

CUMUINT = CUMUINT + PRIORINT + AFTERINT

| 26. | The program loops though these calculation for #MONTHS times. When the looping is complete, CUMUINT has the amount of interest earned. The program then performs calculations to extract the earnings for the original amount (ORIG) as a percentage of all finance charges. |

| 27. | The percentage is calculated by: |

PERCENT = ORIG / (LN78AB – LN78OP)

| 28. | The earned amount (EARNED) is calculated by multiplying the cumulative interest by this percentage. This amount cannot be greater than the original amount. |

EARNED = CUMUINT x PERCENT

| 29. | The unearned amount is calculated by subtracting the earned amount from the original amount. |

UNEARNED = ORIG – EARNED

| 30. | This new unearned amount is subtracted from the unearned amount on file to figure the amount earned this month. This is done to keep the G/L in sync with the file. |

(Earned_this_Month = LN78CG - UNEARNED) or

(Earned_this_Month = F1GREM - UNEARNED) etc.

The FASB method of amortization is based off the interest method of amortization and amortizes each month based on the movement of the principal balance. If the balance decreases, then the system will amortize the loan. If the balance does not change, the loan will not amortize. The FASB method therefore ignores any non-performing statuses.

The amortization works by calculating the rate of the loan from the face amount (LNFACE). The face amount should equal the original balance of the loan minus any precomputed interest. The principal balance is compared against the original balance to help determine how many months have elapsed since the loan was opened.

The following exceptions will prevent amortization from occurring:

Action Code (LNACCD) = 23 (Loan Locked in for Payoff) or 39 (Stop fees and cost amortization up to action date)

Hold Code (LNHLD1-4) = 60 (Account Frozen)

Account Released (LNRLSD) set to “Y”

Asset Classification (LNACLS) = 4 (Doubtful) or 5 (Loss)

Trading Indicator (LNTIND) = 2

The following steps are used to determine how much time has elapsed:

1.The system verifies if the payment method (LNPMTH) is 3 for precomputed interest. If the payment method (LNPMTH) <> 3, it will skip amortization.

2.The system uses the original contractual term of the loan to determine the time period. If LNTRMO is blank, the system will use LNTERM. If both are blank, amortization will not occur.

Term of Loan = LNTRMO or LNTERM

| 3. | The system calculates the extension interest in determining the adjusted P/I and adjusted rate (if needed). This only needs to be done if the account is currently a payment method 3 (LNPMTH = 3), or if the account was converted to a payment method 6 (LNPMTH = 6 and LNPCIB = Yes). It is calculated as follows: |

Extension Interest = LNOBAL – (LNTRMO * LNOPIC)

| 4. | If the account was originally not a payment method 3 (LNPCIB <> Yes and LNPMTH <> 3), the adjusted Payment Amount is equal to the original P&I (LNOPIC). |

Payment Amount = LNOPIC

If the account is currently a precomputed loan (LNPMTH = 3) or was converted to an interest bearing account (LNPCIB = Yes), the adjusted Payment Amount is calculated by taking the Term of Loan times the original P&I (LNOPIC), add the calculated Extension Interest, then divide by the Term of Loan.

Payment Amount = ((Term of Loan * LNOPIC) + Extension Interest)/Term of Loan)

| 5. | From the new Payment Amount, we calculate the Adjusted Rate of the loan to be used. The Adjusted Rate is calculated using the Term of Loan, the adjusted Payment Amount, and the face amount of the loan (LNFACE). The following Excel ® calculation can assist: |

Adjusted Rate = Rate (Term of Loan, Payment Amount,-LNFACE)*12

| 6. | Now that we have calculated the adjusted Payment Amount and Adjusted Rate, we can now calculate how many periods have elapsed. Based on the current payment method and whether the account was converted from a payment method 3 will determine how to calculate the periods elapsed. (Note: The calculation of the elapsed periods should never be greater than the Original Term of the loan.) |

If the payment method is equal to 3 (LNPMTH=3), the elapsed periods are calculated as follows:

Elapsed Periods = (LNOBAL-LNPBAL)/Payment Amount

| 7. | If the payment method is not equal to a 3 (LNPMTH<>3) and the account was not converted from a payment method 3 to a 6 (LNPCIB<>Yes), the elapsed periods are calculated using the following Excel® calculation: |

Elapsed Periods = NPER(AdjustedRate/12,Payment Amount,-LNFACE,LNPBAL)

Note: If you were to calculate the same formula in logs, the following calculation could replace NPER:

Elapsed Periods = (-log(1-(LNFACE/Payment Amount)*(Adjusted Rate/12))+log(1-(LNPBAL/Payment Amount)*(Adjusted Rate/12)))/log(1+(Adjusted Rate/12))

If the payment method is not equal to a 3 (LNPMTH<>3) and the account was converted from a payment method 3 to a 6 through PC2IB (LNPCIB=Yes), the elapsed periods are calculated as follows:

Elapsed Periods = (LNOBAL-LNPBAL)/Payment Amount

Now that we have calculated how many periods have elapsed based on the change in balance, we can calculate the amount of amortization.

| 1. | The system calculates a new payment amount on the loan. This will allow us to continue amortization if the payment of the loan ever changes. The following Excel® calculation can assist: |

New Payment = (LNFACE+LN78OI)/Term of Loan

| 2. | Next, the system calculates a new rate on the loan. This will allow us to continue amortization if the rate of the loan ever changes. The following Excel® calculation can assist: |

New Rate = Rate (Term of Loan, New Payment, -LNFACE)*12

| 3. | Next, the system calculates the cumulative amount of interest amortized over the elapsed periods. The following calculation Excel® can assist: |

Total Earned Amount = -CUMIPMT((New Rate/12), Term of Loan, LNFACE, 1, Elapsed Periods, 0)

| 4. | Finally, amortization will be the difference between the remaining amount, the original amount, and the calculated earned amount. The total amount of earned interest cannot be greater than the original (LN78OI). |

Precomputed Interest Amortization = LN78CG - (LN78OI-Total Earned Amount)

| 5. | Amortization will decrease LN78CG for precomputed interest amortization. If the above calculation creates a negative amount, amortization (or un-amortization) will not occur. |

Amortization Code 7 (Constant Yield):

The Constant Yield amortization method calculates the total amount of interest to come up with a total amortizing balance (LN78AB). The amortizing balance is then divided by the term of the loan (LNTRMO or LNTERM if LNTRMO is 0) to come up with a calculated principal and interest payment. From the calculated principal and interest payment, term, and amount financed (Original Principal Before Add-Ons (LN78OP), we calculate an amortizing rate. One month’s earnings can then be calculated by multiplying the amortizing APR with the original principal, then dividing by 12.

Note: If institution option APFD is set up for your institution, then precomputed interest can start amortizing to the General Ledger prior to the first payment due date, even when the Use Anniversary of 1st Due Date is selected.

LN78AB for GOLDTrak PC can be calculated as follows:

LN78AB (Calculated Amortizing Balance) = LN78OI (Mnemonic LN78AM using Constant Yield Method) + F1FORG: AFC 1, AFC 2, AFC… (Mnemonic F1GMET using Constant Yield Method) + INNORG: Seq. 1, Seq. 2, Seq… (Mnemonic INIFCM using Constant Yield Method) + LN78OP (LN78OP = Amount Financed) (Note: AFC = Amortizing F1 Fee Code)

Determine the Term of the Loan:

WK 1 (Term of Loan) = IF LNTRMO <> 0, then use LNTRMO, else LNTERM

The system then calculates a P/I by taking the Calculated Amortizing Balance and divides this by LNTRMO (Original Term) or LNTERM (Current Loan Term) if LNTRMO is not available.

WK 2 (Calculated P & I) = LN78AB/LNTRMO or LNTERM

The system then calculates the amortizing rate as follows:

WK 3 (Amortizing Rate) = Rate(WK 1, WK 2, -LN78OP) (This is shown as an Excel calculation for your understanding.)

*This is in LNVAL called CALC_RATE

For this amortization, one day equals one month. If the account is opened on any day of the month (MRFUND is the date that is checked), including the last day, then that month is earned. Each following month is added as one month.

For example, the loan was opened on 10-31-10 with monthend on 01-31-11 = 4 months

To calculate earnings, the system uses the following calculation:

1 Month Earned = (WK 3* LN78OP)/12

WK 4 (Cumulative Earned) = -Cumipmt(WK 2, WK 1, LN78OP, 1, Elapsed Months, 0) (Excel calculation)

To calculate the portion of earned interest, the system performs the following calculation:

WK 5 (Earned Interest) = (LN78OI/LN78AB)*WK 4

The amount of amortization is determined by the following formula:

Interest Amortization Amount = LN78CG - (LN78OI – WK 5)

Note: WK 5 cannot be greater than Original Unearned Interest (LN78OI).

Amortization Code 8 (Daily Level Yield):

This method of amortization accrues precomputed interest on a daily basis for anticipated earnings as of the current day, and then the system runs a full amortization at monthend and clears the accrual amortization. Amortization accrual occurs on the account until it reaches maturity or the loan becomes non-performing (based on option NPDY and options AMOP SAPI and SAAF being set to "Y"). The amortization resumes if the account either becomes performing or the account is charged off (see below).

Amortization of precomputed interest will cease on the loan if any of the following occurs:

•Action Code 23 (Loan Locked for Payoff).

•Hold Code 60 (Account frozen), 4, or 5 (Bankruptcy).

•Loan is released (LNRLSD = Yes).

•If Trading Indicator (LNTIND) is 2 (Held for Resale).

•If the loan is non-performing.

•If Asset Classification (LNACLS) is 4–doubtful or 5–loss.

The system will stop amortization based on the number of days in institution option NPDY (number of days delinquent to set to non-performing) if institution option SAPI (stop precomputed G/L amortization if delinquent) is enabled.

If the loan is charged off (and the charge-off option (COOP) is set to 1 or greater for your institution), the system amortizes the entire amount of the precomputed interest that is Unearned Interest at monthend.

Since amortization is based on the elapsed number of days of the loan, the system calculates how many days have elapsed since the loan open date to the current date of amortization, then divides by 30 to determine months. Since amortization is daily, the system ignores the Rebate Rule Days (LN78DR) for the 15/16-day rule. If the account has an extended first period, the amortization could finalize up to 15 days prior to the original maturity date of the loan.

Note: If institution option APFD is set up for your institution, then precomputed interest can start amortizing to the General Ledger prior to the first payment due date, even when the Use Anniversary of 1st Due Date is selected.

The following calculation is used in this amortization method:

ETERM (Elapsed Periods) = DAYS360(LNOPND,CURRENT RUNDATE)/30

1.The system uses the contractual term of the loan (LNTRMO). If LNTRMO is equal to 0, the system then uses the LNTERM.

2.The rate of the loan is calculated by the term, principal and interest, and face amount. This is normally calculated in Payment Calculator when the loan is originated. The rate is passed by GOLDTrak into LNRATE and LNORTE:

LNORTE (Rate of Loan) = Rate(OTERM, LNOPIC, -LNFACE)*12

The program will use LNORTE if present, otherwise, LNRATE. A zero rate will return an error.

The system calculates the rate of precomputed interest by using the number of original days divided by 30, the original principal and interest, and adding the original amount of the precomputed interest to the face amount of the loan:

ADJRT (Loan Precomputed Interest Rate) = Rate (OTERM, LNOPIC, -(LNFACE+LN78OI))*1

3.To calculate how much needs to amortize, the system uses LNVAL to amortize the cumulative amount of interest and the cumulative amount of fee/cost and takes the difference between the two. The elapsed periods can have a decimal value which is calculated in the two cumulative amounts. The following calculations can assist (these are Excel calculations):

EARNPI (Earned Precomputed Interest for accounts less than 30 days old) =

(-CUMIPMT(LN0RTE/12,OTERM,LNFACE,1,1,0) * ETERM)

+ (CUMIPMT(LNORTE/12, OTERM,(LNFACE+LN78OI),1,1,0) * ETERM)

EARNPI (Earned Precomputed Interest for accounts greater than 30 days old) =

(-CUMIPMT(LNORTE12, OTERM,LNFACE,1,TRUNC(ETERM),0)

+ CUMIPMT(ADJRT/12, OTERM,(LNFACE+LN78OI),1,TRUNC(ETERM),0))

+ (-CUMIPMT(LNORTE/12, OTERM,LNFACE,1,TRUNC(ETERM),0) * (ETERM - TRUNC(ETERM))

+ (CUMIPMT(ADJRT/12,OTERM,(LNFACE+LN78OI),1,TRUNC(ETERM),0) * (ETERM - TRUNC(ETERM))

4.Amortization will be the difference between the unearned interest, the original unearned interest, and the calculated earned amount (EARNPI, see above).

Precomputed Interest Amortization Amount = Unearned Interest - (Original Unearned Interest - EARNPI)

(Note: EARNPI cannot be greater than the Original Unearned Interest.)

5.Each day the precomputed interest is amortized, the system decreases the amount of amortization from the Unearned Interest and increases the Earned Interest field by that amount. On the rare occasion the calculation creates negative amortization in the afterhours, the loan is sent to the Error and Exception Report (FPSRP013) with the message: "Can’t Neg. Amort Deferred Amortizing Cost." You will need to manually correct the error on the account.

Amortization Code 9 (Straight Line on Balance):

This amortization code can be used by institutions who amortize their PC interest on a straight-line basis determined by the movement of the principal balance. If a loan's principal balance has not changed from the prior month, amortization will be skipped for the current month. This code is only valid for PC interest amortization (Payment Method 3 loans).

Before running calculations, the system checks for a difference in principal balance amounts between the current month and the previous month. If there is no difference, the system will not amortize. Otherwise, in order to determine the amortization amount, the system needs to first perform the following calculations:

1.Monthly Amount = Original Balance (LNOBAL) / Original Term (LNTRMO)

2.Remaining Months = Principal Balance (LNPBAL) / Monthly Amount (result of calculation #1)

3.Earned Months = Original Term (LNTRMO) - Remaining Months (result of calculation #2)

4.Total Earned Interest = Original Unearned Interest (LN78OI) x (Earned Months (result of calculation #3) / Original Term (LNTRMO))

The amortization amount is then calculated as:

Total Unearned Interest (result of calculation #4) - (Original Unearned Interest (LN78OI) - Unearned Interest (LN78CG))

|

Note: Remember that an account cannot negatively amortize. If for some reason these calculations result in a negative amortization amount, the system will instead return an amortization amount calculation of zero. |

|---|

This code cannot be used on accounts with the following conditions present:

•The loan is locked for payoff (Action Code 23).

•The account is frozen (Hold Code 60).

•The account is service released.

•Asset Classification on the account is "Doubtful" or "Loss."

•The account is held for resale (Trading Indicator 2).

Institution Option SAPI affects the functionality of this code (if an account is delinquent three payments or more and this option is enabled, precomputed G/L interest will stop amortizing). This code ignores an account's non-performing status and Hold Codes 4 and 5 (bankruptcy).

This code uses GL Transaction Code 531.

Amortization Code 10 (Daily Accrual Basis):

This amortization method is available on any payment frequency. A refund is not eligible if the payoff date (PODATE) is equal to the original maturity date (MLOMAT). The anniversary of the date opened that is just prior to the payoff date will be calculated.

If the interest for a payment is more than the PI constant, the payment will consist entirely of interest and any excess interest will be carried over to the next amortization period and added to the interest accrued for that period.

This amortization method is calculated as follows:

•The calculation is run through an amortization schedule using the open date (LNOPND) and the first due date (LN1DUE).

•For any subsequent periods, LN1DUE and the original frequency (LNFRQO) are used for the next period date. If LNFRQO is blank, the system uses the loan frequency (LNFREQ).

•The face amount (LNFACE = Total Payments - Original Unearned Interest) and original interest rate (LNORTE) are used as the starting balance and rate, respectively. An error occurs if either of these fields are blank.

•The first payment amount (OTFPAM) is used for the period from LNOPND to LN1DUE. If OTFPAM is blank, the original P/I constant (LNOPIC) is used instead.

•For every subsequent anticipated payment, the system uses LNOPIC.

•Subsequent payments run from due date to due date unless the target due date exceeds the amortization date, in which case a partial period interest calculation is made from the last due date to the amortization date.

•The system calculates the amortization based on the elapsed periods using the interest calculation method (LNIBAS) code. The number of days is based on the dividend and the interest base on the divisor. For example, if LNIBAS=103, 365/360, then the days are calculated on a 365-day basis but the interest calculation is divided by 360.

•The total of these calculations is the amount of interest earned.

•The amortization is then determined by subtracting this interest earned from the remaining unearned interest (LN78CG) on the account.

Amortization will stop if any of the following is placed on the account:

•Action Code 23 – Loan Locked in for Payoff

•Action Code 39 – Stop fees and cost amortization up to action date

•Hold Code 60 – Account Frozen

•The loan is released (LNRLSD = Yes).

•The asset classification (LNACLS) is 4 (doubtful) or 5 (loss).

•The trading indicator (LNTIND) is 2 (held for resale).

•The loan is non-performing (LNNONP = Yes).

Amortization Code 12 (TN Actuarial w/o Fee):

This method processes as follows:

•This method works on simple months (every monthend is 1 month of earnings). If the open date is on the last day of the month and the afterhours is run that day, the system amortizes the first month’s earnings that day. Every monthend afterwards will be 1 additional month of earnings. For example, the first month of earnings is calculated on the open date, regardless of whether the loan had an extended first period. At the next monthend, the second months’ worth of earnings will be amortized.

oFor first month amortization, The calculation is: Earned = LNFACE (Face Amount) * LNORTE/100 * (Days Elapsed in 360 Basis/360) where interest calculated does not exceed OTFPAM (First Payment) – (OTMNTA/LNTRMO) (Maintenance Fee / Original Term)

oFor second month amortization, The calculation is: Earned = LNFACE (Face Amount) * LNORTE/100 * (Days Elapsed in 360 Basis/360) where interest calculated does not exceed LNOPIC (Original P/I Payment) – (OTMNTA/LNTRMO) (Maintenance Fee / Original Term)

Note: If there was carryover interest from the prior period, that interest will be collected in the following months until the interest is fully collected.

•Subtract the interest earned from the original interest (LN78OI) and compare against the current unearned (LN78CG) to determine how much interest will amortize. This amortization method is a 360-day basis along with any extended days.

Notes about this method:

•This method uses the original contract rate (LNORTE) as the rate to amortize by.

•When running payments through the amortization schedule, the odd first payment (OTFPAM) will be considered for the first payment.

•The maintenance fee amount (OTMNTA) is divided by the original term to come up with the monthly maintenance fee. The monthly maintenance fee amount will be subtracted from the original payment (OTFPAM) and original payment (LNOPIC) when running the payments through the amortization schedule.

•The amortization schedule determines the sum of interest earned for a period and calculates the remaining unearned.

•The method can handle negative amortization situations. If the first few periods are negative amortization, the unpaid portion of the interest will be carried over to the following periods until satisfied. At that point, the loan balance will begin to decrease in the schedule.

•If the amortization is greater than the original interest (LN78OI) and there is a remaining amount in LN78CG, LN78CG is the amount to amortize.

•If Institution Option AMOP SAPI is set, amortization stops when the loan is non-performing (LNNONP). Once the loan is performing again, amortization will catch up on the account at the next monthend.

•If the account is non-accrual (LNACST = Y), amortization will stop until the non-accrual indicator is removed. This can be coded in the method or set as an option.

Amortization Code 13 (Rule of 78s - Multi Frequency):

For this amortization method, a customer account will earn money on a monthly basis based on the number of installments elapsed using the Rule of 78’s method. For example, on a weekly loan, some months they will earn only 4 weeks of interest, other months they will earn five. This amortization method follows the same time period calculation as the refunding for Int Rebate Method code 13. The system will stop amortization based on the number of days in institution option NPDY if institution option SAPI is enabled.

Amortization Code 14 (TN Actuarial - Multi Frequency):

This amortization method calculates similarly to Amortization Code 12 (TN Actuarial w/o Fee), except that it calculates loans with weekly, bi-weekly, and semi-monthly frequencies. The system begins amortizing the precomputed interest to the General Ledger based on whether the Use Anniversary of Date Opened (LN78DO) or Use Anniversary of 1st Due Date (LN78AF) fields are selected.

The system will amortize income on a monthly basis. Based on the frequency, the system calculates the number of frequencies elapsed to determine how many installments to amortize precomputed interest. If the frequency is weekly, there are months the system will amortize four weeks of interest. In other months, five weeks of interest will be amortized. If the frequency is bi-weekly, there are months the system will amortize two weeks of interest. In other months, three weeks of interest will be amortized.

If the payment is past due longer than the number of days established in institution option NPDY (and institution option SAPI is enabled), amortization of precomputed interest will stop until either the account is charged-off or the due date is brought current (or at least to the number of days within the number allowed in institution option NPDY). If the loan is brought current, amortization will “catch-up” based on where the current Installment Number is calculated.

For example, if the loan is three frequencies past due but is later brought current, the Installment Made will advance three times and the precomputed interest will amortize three times, thereby collecting three frequencies of unearned precomputed interest.

Amortization Code 15 (Daily Accrual Basis Less Prepaids):

This amortization method functions identically to Amortization Code 10 (Daily Accrual Basis), except all prepaid charges are subtracted from the first and regular monthly payment amounts. These removed prepaid charges include the Fee at 8%, Fee at 4%, Prepaid Fees, and Maintenance Fee amounts.

This method can be used to meet regulatory requirements when local laws prevent interest being charged on fees.