Navigation: Loans > Loan Screens > Account Information Screen Group > Signature Loan Details Screen >

|

IMPORTANT: In CIM GOLD versions 7.9.3 and above, this tab no longer exists and has been replaced with the Late Fees, ACH Payments, and Card Payments tabs. If your institution is using CIM GOLD version 7.9.3 or higher, see help for those tabs instead. |

|---|

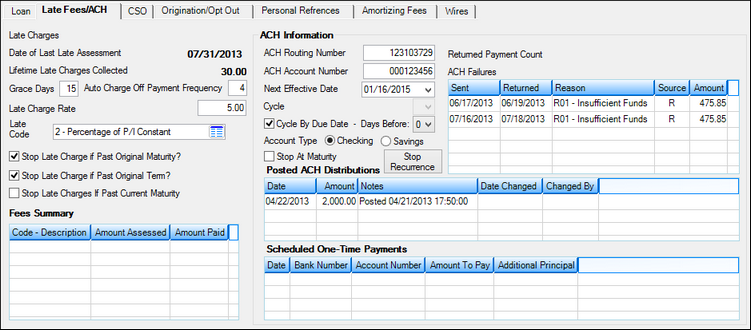

Use this tab (on the Loans > Account Information > Signature Loan Details screen) to view and edit late fee and ACH information about the customer signature loan (payment method 16).

|

Note: See help for the Collect Late Charges When Current field on the Loans > Account Information > Account Detail screen for detailed information about collecting late charges for the current month when payments are more than one month past due.

Certain circumstances (such as bankruptcy, judgment, or grading) can stop late charges from assessing normally on a consumer loan account. See the Special Late Charge Assessment and Grading page for information about the assessment process used in these circumstances. |

|---|

Loans > Account Information > Signature Loan Details Screen, Late Fees/ACH Tab

See Late Fees/ACH list views for more information about the four list views on this tab.

The fields on this tab are as follows:

Field |

Description |

|||

Late Charges

Mnemonic: LNLATE |

This field indicates the total amount of Late Charges due on the customer account. See below for more information.

|

|||

Date of Last Late Assessment

Mnemonic: LNLTDT |

This field indicates the most recent date Late Charges were assessed on the customer account. |

|||

Lifetime Late Charges Collected

Mnemonic: LNLLTC |

This field indicates the total amount of Late Charges (see above) collected throughout the life of the customer account. See below for more information.

|

|||

Grace Days

Mnemonic: LNLTGR |

Use this field to indicate the number of days after the Due Date your institution allows a payment to be late before a Late Charge is assessed. Late Charges will not be assessed on Saturday or Sunday unless Institution Option SALT is enabled. For Bi-weekly loans, the value in this field should be less than 14. |

|||

Auto Charge Off Payment Frequency

Mnemonic: LNACPF |

Use this field to indicate how many loan payments can be missed before the system automatically initiates charge-off procedures on the account, if your institution allows automatic charge-offs. See below for more information.

|

|||

Late Charge Rate

Mnemonic: LNLTRT |

Use this field in conjunction with the Late Code field to indicate how Late Charges (see above) should be calculated on the customer account. See below for more information.

|

|||

Late Code

Mnemonic: LNLTCD |

Use this field in conjunction with the Late Charge Rate field above to indicate how late charges should be calculated on the customer account. See Late Codes for more information. |

|||

Stop Late Charge if Past Original Maturity?

Mnemonic: LNLCPM |

Use this field to indicate whether a Late Charge (see above) should be assessed on the customer account if the account's original Maturity Date has passed. |

|||

Stop Late Charge if Past Original Term?

Mnemonic: LNSLOT |

Use this field to indicate whether a Late Charge (see above) should be assessed on the customer account if the account's original Term has ended. |

|||

Stop Late Charge if Past Current Maturity

Mnemonic: MLSLCM |

Use this field to indicate whether a Late Charge (see above) should be assessed on the customer account if the account's current Maturity Date has passed.

|

|||

ACH Information field group |

See ACH Information field group for more information. |