Navigation: Loans > Loan Screens > Account Information Screen Group > Signature Loan Details Screen > Loan tab >

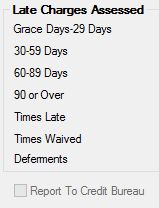

Late Charges Assessed field group

Use this field group (on the Loan tab of the Loans > Account Information > Signature Loan Details screen) to view and edit information about late charges assessed on the customer signature loan (payment method 16).

Further fields relating to late charges on customer signature loan accounts appear on the Late Fees/ACH tab. The fields in this field group are as follows:

Field |

Description |

|

Mnemonic: LNLT10, LNLT30, LNLT60, LNLT90 |

The Grace Days-29 Days, 30-59 Days, 60-89 Days, and 90 or Over fields indicate the number of times the customer account has been late (past grace days) over the life of the loan within the specified time ranges.

The system automatically updates these fields. When a late charge is assessed on the customer account (tran code 560), the number of days delinquent is calculated by subtracting the Due Date from the run-date (grace days night). If the days delinquent is less than the grace days, then nothing is updated. If the days delinquent is between grace days-29 days, the Grace Days-29 Days field is increased by 1. If the number of days delinquent is between 30-59, the 30-59 Days field is increased by 1. This process continues through the 90 or Over days delinquent.

If a late charge is assessed for a zero amount, these fields will still be updated.

These fields work in conjunction with the Times Late field. If the number of grace days is less than 10 and a late charge is assessed, only the Times Late field will be updated. The Grace Days-29 Days field is not updated because the assessment was less than 10 days. In this case, the total in the Times Late field will not be equal to the total of all the Grace Days-29 Days, etc. ranges added together.

If a late charge is waived (tran code 570), the Times Late field is reduced by 1 and the Times Waived field is increased by 1. In addition, if Grace Days-29 Days is greater than zero, it is reduced by 1. If Grace Days-29 Days is zero, the system checks the 30-59 Days field and, if it is greater than zero, it is reduced by 1. If 30-59 Days is zero, the same process continues for the 60-89 Days and 90 or Over fields. |

|

Mnemonic: LNLTNO |

This field indicates the number of times the customer account has been late (past grace days) over the life of the loan. |

|

Mnemonic: LNLTWV |

This field indicates the number of times late charges have been waived on the customer account over the life of the loan. This field increases by one each time a transaction code 570 (late charge waive) is processed. This field's maximum value is 256 and is zeroed out at assumption. |

|

Mnemonic: MLCNT1 |

This field indicates the number of times the customer account has been allowed a deferment over the life of the loan. Loan deferments are set up and processed from three Loans > Transactions screens: Make Loan Payment, EZPay, and CP2. See help for those screens to learn more. |

|

Mnemonic: LNCRBU |

Use this field to indicate whether information about the signature loan account should be reported to the Credit Bureau. See the Credit Reporting help for more information. |