Navigation: Loans > Loan Screens > Account Information Screen Group > Signature Loan Details Screen > Loan tab >

Payment Information field group

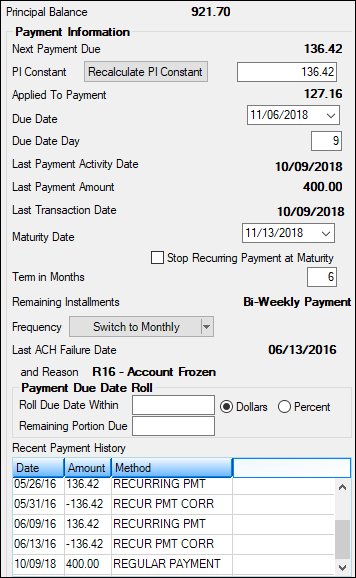

Use this field group on the Loan tab of the Signature Loan Details screen to view and edit payment information on the customer signature loan (payment method 16).

The fields in this field group are as follows:

Field |

Description |

||

|---|---|---|---|

The Principal Balance field above this field group displays the unpaid balance of the loan. It can only be entered, changed, or otherwise affected by teller transactions. It cannot be file maintained on this screen. |

|||

|

Mnemonic: ASBANXTPAY |

This is the amount of the next payment due. It is the P/I Constant plus Reserve 1/2 Constant, but only if the Payment Application includes paying reserves. If it does not include reserves, then this amount is the P/I Constant.

It does not include late charges past due or miscellaneous fees owing. |

||

|

Mnemonic: LNPICN |

This field displays the principal and interest payment due. This amount is usually the same as the Next Payment Due above. If a new Frequency is selected and <Recalculate PI Constant> is clicked, this field reflects the payment amount as changed by the new frequency (the Next Payment Due field is not affected by the new frequency until <Save Changes> is clicked).

For example, a customer is originally set up with a monthly frequency payment of $100. They request a weekly frequency payment, so you select “Switch to Weekly” in the Frequency field, then click <Recalculate PI Constant>. The PI Constant field will then display $25 ($100 divided by 4). |

||

|

Mnemonic: LNPRTL |

This field indicates any extra amount paid by the customer or any amount that did not add up to a full payment. If this amount is less than a full payment, the Due Date may not roll (depending on the settings for the Payment Due Date Roll field group). The amount paid toward the payment due is automatically stored in this field until the full payment amount is met. The full payment amount is reflected in the Next Payment Due field (see above).

This field is used in determining whether a Late Charge should be assessed on the customer account.

|

||

|

Mnemonic: N/A |

Use this field to indicate the date the customer account's next regular payment is due. See below for more information.

|

||

|

Mnemonic: N/A |

Use this field to indicate the date payment is due each month (for example, if "15" is entered in this field, the payment Due Date will be the 15th of each month). See below for more information.

|

||

|

Mnemonic: LNDTLP |

This field indicates the most recent date payment activity occurred on the customer account.

If institution option NDLP is not set and a deferment was recently run, this field will display the deferment date. |

||

|

Mnemonic: LNLPMA |

This field indicates the most recent amount paid on the customer account. Each time a payment transaction is run on the account, this field is updated with the amount of the transaction.

If institution option NDLP is not set and a deferment was recently run, this field will display the deferment amount.

For loans that are boarded through GOLDAcquire Plus or GOLD Loan Gateway, an institution option is available that affects whether an amount is transferred into the Last Payment Amount field. If institution option OP30 UOLP is set, when a loan is boarded through GOLDAcquire Plus or GOLD Loan Gateway, the Origination Tracking Final Payment amount (OTLPAM) will transfer into the Last Payment Amount field (LNLPMA) for the loan. Without this option set, the Open Loan transaction (tran code 680) clears the amount in LNLPMA. If UOLP is set, then the CSOT record will be read and populate LNLPMA with OTLPAM.

The Final Payment amount field (OTLPAM) is found on the Loans > Purchase Disclosure or Original Loan Disclosure screens. |

||

|

Mnemonic: LNTRAN |

This field indicates the date of the most recent transaction on the customer account. |

||

|

Mnemonic: LNMATD |

Use this field to indicate the date the last payment on the customer account is due (and the loan should be paid off). Information is entered in this field at loan origination. Generally speaking, this date should not be changed. See below for more information.

In order for a loan to mature and close, the following monetary balances must be zero: Principal balance, reserve balance, partial payments, miscellaneous funds, late charges, loan fees, accrued interest, accrued interest on reserves, and accrued interest on negative reserves. In addition, the loan cannot have an LIP Method code greater than zero. When the Close Loan transaction is run, the system will update the Last Transaction Date (see above) and Payoff Date fields. The loan will automatically close on the night of the maturity date. If the maturity date is on a weekend or holiday, the loan will close on the night of the first business day following the maturity date.

For loan advances (tran code 500 field debit to principal), if a loan is past the maturity date, a principal advance (increase) will not be allowed. The error message "LOAN PAST MATURITY, ADVANCES NOT ALLOWED" will be displayed both in the GOLDTeller system and the "daily rejects" for line-of-credit loans. If there is no maturity date, advances will continue to process. This is true for all payment methods.

The following institution options pertain to this field:

•OPTC CLZB automatically closes zero-balance line-of-credit loans. At the time the loan is closed, the Payoff Date is also updated. The Close Loan transaction is a file maintenance tran code 22 to field 999. This transaction is run by the system in the afterhours of the maturity date. It is displayed on the Loans > History screen for the account at maturity.

•OP02 APML allows a principal increase to be processed if a loan is past the maturity date. This requires a supervisor override (SOV).

•OP02 APCO allows a loan payment (tran code 600/608) or an optional loan payment (tran code 690/698) to be processed if a loan has been charged off (hold code 2). |

||

Stop Recurring Payment at Maturity

Mnemonic: LNASTP |

Check this box if you want recurring payments to stop once the loan has reached maturity. The system will reject all recurring ACH payments after the Maturity Date. The Afterhours Processing Exceptions Listing report (FPSRP013) lists all ACH payments that rejected because the recurring payment was made after the Maturity Date, and this option is set for that account. A user would then need to remove recurring payments from the account on the EZPay screen and follow your institution's best practices, which could include calling the borrower and setting up future one-time payments to pay off the loan.

The system automatically defaults to halting recurring ACH payments at maturity, but this default can be overridden using this field and Institution Option DSAM.

See also: •Recurring Payments on the EZPay screen

|

||

|

Mnemonic: LNTERM |

Use this field to indicate the term of the loan in months. This field is used to calculate payments and should reflect the number of calendar months over which the loan is being amortized. The number of months does not always necessarily add up to the Maturity Date of a loan (see above). |

||

|

Mnemonic: N/A |

This field indicates the number of payments that must be made before the customer loan is paid off. |

||

|

Mnemonic: LNFREQ |

Use this field to indicate the payment frequency for the customer signature loan account. See Frequency codes for more information. |

||

Last ACH Failure Date and Reason

Mnemonic: UPDTPT, UPERCD |

These fields indicate the date of the most recent failed ACH payment attempt (and the reason the attempt failed). Failed ACH payment attempts are displayed in the ACH Failures list view.

ACH payments are set up on the Late Fees/ACH tab. A report listing all failed ACH payments can be viewed on the Loans > Reports > ACH Returned Payments screen. |

||

Payment Due Date Roll field group

Mnemonic: LNDDRA, LNDDRT |

Use this field group to indicate due date roll information.

Use this field group if your institution is willing to accept less than the full Payment amount and still roll the payment Due Date forward one payment period (the length of which is determined by the Frequency field) without assessing penalties or fees on the customer account.

Use the Roll Due Date Within field (mnemonic LNDDRA) to indicate a proximity range to the full Payment amount that your institution is willing to accept. Use the Dollars and Percent radio buttons (mnemonic LNDDRT) to indicate whether the value entered in the Roll Due Date Within field is a monetary amount or a percentage. If Percent is marked, at least the indicated percentage of the full Payment amount must be paid in order to roll the due date. If Dollars is marked, any dollar value up to the indicated amount can be left unpaid and the Due Date will still roll.

•Example 1: A loan Payment amount is $120.00, "80" is entered in the Roll Due Date Within field, and Percent is marked. The Due Date will roll without assessing penalties or fees on the customer account if at least $96.00 (which is 80% of $120.00) is paid.

•Example 2: A loan Payment amount is $120.00, "25" is entered in the Roll Due Date Within field, and Dollars is marked. The Due Date will roll without assessing penalties or fees on the customer account if at least $95.00 (which is $25.00 less than $120.00) is paid.

•Example 3: Two payments at $100.00 are due and $180.00 is received. The first payment of $100.00 is processed and the due date advanced. The second payment of $80 is compared to the Roll Due Date Within field to determine whether the due date should be advanced. In this case, the payment is not advanced, because the Roll Due Date Within field is set to $10.00.

The Remaining Portion Due field (mnemonic LNPDUE) indicates the amount of money still owed by the customer after processing a partial payment using this feature. This amount will be added to the Next Payment Due amount following processing of the payment.

Late charges are not taken into consideration when determining the dollar or percentage portion of the payment. For example, if the Payment Application is late charge, then principal, then interest (421), the system first takes the late charge and then performs the percentage or dollar calculation of the Roll Due Date Within field to determined when to advance the due date.

Additionally, the system takes into account whether any amount is displayed in the Applied To Payment field. The system will include the amount in the Applied To Payment field in determining whether the applicable dollar or percentage amount has been received. For example, the loan payment due is $200.00. The Applied To Payment field displays $30.00. A payment of $160.00 is made. The Roll Due Date Within limit is set to $10.00. The due date will roll because $160.00 (payment amount) + $30.00 (Applied To Payment amount) + $10.00 (Roll Due Date Within limit) = $200.00. |

||

The Recent Payment History list view at the bottom-left of this tab displays all recent payments made on the customer account. It also displays any corrected payments. “CORR” will display in the description in the Method column if the payment was reversed (see the example above). Making loan payments is determined by your institution. You can use CIM GOLDTeller or the Loans > Transactions > Make Loan Payment or EZPay screen as allowed by your institution. |