Navigation: Loans > Loan Screens > Account Information Screen Group > Signature Loan Details Screen > Late Fees/ACH tab >

ACH Information field group

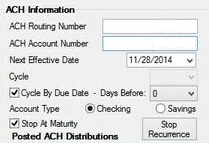

Use this field group (on the Late Fees/ACH tab of the Loans > Account Information > Signature Loan Details screen) to view and edit ACH information about the customer signature loan (payment method 16).

Click <Stop Recurrence> to halt repeating ACH payments set up in this field group. This button must be clicked in order to edit information in this field group. The button will then be renamed <Re-Start Recurrence> and can be used to resume ACH payments once the information in this field group is set as desired.

Field |

Description |

|

Mnemonic: LNANBR / RAACH#, LNABNK / RAABNK |

Use these fields to indicate the Routing and Account numbers of the account used by the customer to make ACH payments on the signature loan. If the indicated Routing number is invalid, an error message will appear.

Use the Account Type radio buttons below to indicate whether this account is a Checkings or Savings account. |

|

Mnemonic: RAEFDT |

Use this field to indicate the next date an ACH payment on the signature loan will take effect (from the account indicated in the ACH Routing Number and ACH Account Number fields above). This field is automatically updated once a payment is made.

See the Frequency field for more information. |

|

Mnemonic: RAPCYC |

Use this field to indicate the day of the month ACH payments are made on the signature loan (from the account indicated in the ACH Routing Number and ACH Account Number fields above). This field is only used if the Frequently field is set to "Monthly."

Alternatively, the ACH payment cycle can be set up in relation to the Due Date in the Cycle By Due Date - Days Before field below. |

Cycle By Due Date - Days Before

Mnemonic: RABYDU, RADYSB |

Use these fields to indicate the payment date for ACH payments on the signature loan (from the account indicated in the ACH Routing Number and ACH Account Number fields above).

This field is used to indicate the payment date in relation to the loan's Due Date. Use the Days Before field to indicate how many days prior to the loan's Due Date the cycle should start (available selections are 0-3).

Alternatively, the ACH payment cycle can be set up as a certain day of the month using the Cycle field above. |

|

Mnemonic: RAACCK |

Use these fields to indicate whether the account indicated in the ACH Routing Number and ACH Account Number fields above is a Checking or Savings account. |

|

Mnemonic: LNASTP |

Use this field to indicate whether repeating ACH payments set up in this field group should halt when the customer account's Maturity Date is reached. The system automatically defaults to halting recurring ACH payments at maturity, but this default can be overridden using this field and Institution Option DSAM. |