Navigation: Loans > Loan Screens > Credit Reporting > Credit Reporting Screen >

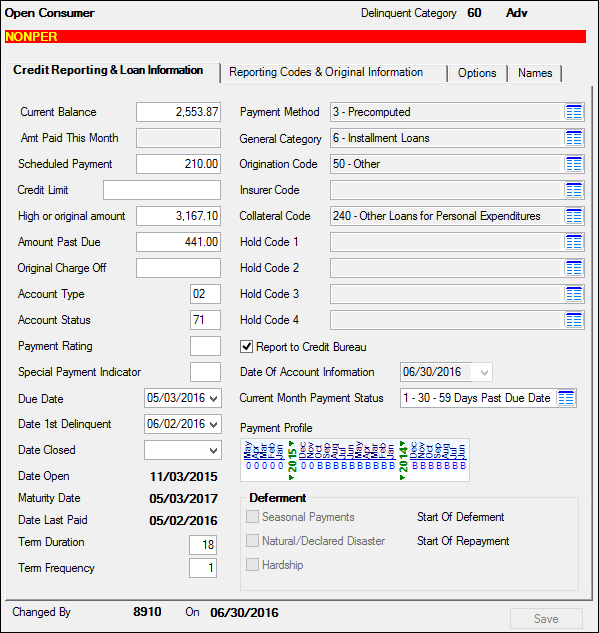

The Credit Reporting & Loan Information tab on the Loans > Credit Reporting screen is used to enter and view credit reporting and loan information for the account.

See the following example of this tab, followed by links for definitions of the fields on this tab:

Loans > Credit Reporting Screen > Credit Reporting & Loan Information Tab

The fields on this tab are as follows:

Field |

Description |

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUPOBL |

The Current Balance on the Credit Report and transmission reflects the entire loan amount required to pay off the loan, including late charges, interest, and miscellaneous fees, as of the monthend date. Each monthend when the Credit Reporting screen is updated, the system enters the payoff amount into the Current Balance field, and that is the amount reported to Credit Bureaus using the Credit Bureau Report and transmission file (FPSRP184). The Current Balance is displayed in the Base Segment of the report and transmission. |

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUAPTM |

This field displays the to-date amount the borrower paid during the current month on the loan. You cannot make changes to this field; it is updated by the system when payments are made. See below for more information.

|

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUSCPM |

This is the scheduled payment amount. This is reported in Base Field 15 (Scheduled Monthly Payment Amount) of the Credit Report transmission (FPSRP184) at monthend. This field is calculated as of monthend as follows:

•P/I Constant - Subsidy Balance (if the loan has any subsidies) •If the loan has reserves, then the payment amount is calculated as Reserve Constant 1 + Reserve Constant 2 - Subsidy + P/I Constant.

CDIA guidelines require this amount to be in whole dollars. The amount will be truncated (not rounded) and will not show any decimals.

Note: If the account has been charged-off, this amount will be zero (0). Also, deferments will be reported with 0. |

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUCRLM |

This file-maintainable field is for line-of-credit loans (payment method) and is pulled from the Line-Of-Credit Limit field on either the Loans > Account Information > Consumer Line-of-Credit or Loans > Line-of-Credit Loans screen (depending on what type of line-of-credit this is) as of monthend. File maintenance to this field writes to Loan History. |

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUHOAM |

The system updates this field each time the monthend Credit Reporting Update program runs. See below for more information.

|

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUAMPD |

This is calculated based on the payment method, number of payments past due, and each month’s scheduled payment, plus all late charges and fees as of monthend. A past due payment is any payment that has not been made after 30 days from the Due Date. Grace days are not included.

This field is pulled from the Total Due field on the Loans > Account Information > Account Detail screen > Payments tab.

If the account is current (Account Status is 11), the Amount Past Due will be "0."

Additionally, accounts that are in deferment are reported with Amount Past Due as "0" if the account was current before a deferment is run. If the account was delinquent before the deferment, it will continue to report the applicable Amount Past Due.

If the Account Status (see below) is 97 (charged off), this field reflects the payoff amount in whole dollars. Any decimal amounts are dropped (not rounded). This field is cleared if the loan has a confirmed bankruptcy of a Consumer Information Indicator of "H" (discharged Bankruptcy 13). |

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUOGCO |

The original charge-off amount is updated by the system at monthend. If a hold code 2 (charge off) is present in either of the Hold Code fields and there is a valid charge-off date in the Charge Off Date field (LNCODT), the system will put the amount of the Partial Charge-Offs field (LNCOBL) in this field. File maintenance to this field writes to loan history.

The charge-off date must be entered once a foreclosure, repossession, or charge off occurs. (See Coding of Derogatory Credit Status.) |

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUACCO |

The Credit Bureau account type is determined based on the loan as of monthend. Examples of an account type are as follows:

97 Charged Off

The system pulls information into this field based on the account's insurer codes, collateral codes, and General Category. This field is reported in Field 9 (Account Type) of the Base Segment of the Credit Report transmission (FPSRP184). See the Credit Bureau Type (Account Type) topic for more information. |

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUCBRS |

The Credit Bureau account status is determined by the status criteria discussed. (See Credit Bureau Status (Account Status).) File maintenance writes to loan history. See below for more information.

|

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUPTRT |

The payment rating identifies whether the account is current or past due at monthend. It must be reported if the CB Account Status (see above) is 5, 13, 65, 88, 89, 94, or 95. See below for more information.

|

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUSPPI |

The special payment indicator identifies special payment terms, such as balloons or single payment loans. If the loan is coded with a maturity modifier of 1 (balloon) or 2 (single payment) or an action code of 1 (balloon) or 18 (single payment), "1" will be placed in this field when the screen is updated each monthend. File maintenance to this field writes to loan history. |

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUBUDT |

This is the loan due date as of monthend. |

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUDFDL |

Delinquency is calculated based on whole days. Date of first delinquency is placed on an account when the payment has not been made after 30 days from the Due Date. See below for more information.

|

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUCLDT, BUOPND |

The Closed date is the date the loan was paid off or closed due to zero balance. See below for more information.

The Open date is the date the loan was opened as of monthend. This date indicates to the credit repository that this is a new loan; therefore, once the loan has been opened, it should not be changed. |

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUMATD |

This is the maturity date as of monthend. The system will pull the date associated with the action code 1 (balloon payment due) or 18 (final payment due), if different from the maturity date. |

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUDTLP |

This is the date the last payment was made (LNDTLP) as of monthend. An option is available that causes the Date Last Paid to not be updated when a payment is made on a loan that is in deferment. Deferment payments are made either through Loans > Transactions > EZPay or CP2 screen or through GOLDTeller transaction code 2600-13. If you would like this option set up for your institution, send in a work order with your request or talk to your GOLDPoint Systems account manager that you want Institution Option OP23-NDLP enabled.

For more information, see the Deferment Transactions in the Transaction Manual in the CIM GOLDTeller User's Guide. |

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUTERM/BUFREQ |

The Term Duration field displays the length of the loan term in days.

The Term Frequency field displays the payment frequency pulled from the Payment Frequency field on the Loans > Account Information > Payment Information screen or the maturity modifier (LNMATM) at monthend. See below for more information.

|

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUPMTH |

This is the payment method as of monthend. The Payment Method is pulled from the Loans > Account Information > Account Detail screen, Account tab. |

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUGENL |

This is the general category as of monthend. This information is pulled from the Loans > Account Information > Account Detail screen, Account tab. What is entered in this field affects how the Account Type is recorded in the Credit Bureau Report and transmission file (FPSRP184) sent to Credit Bureaus. See the Credit Bureau Type (Account Type) topic for more information. |

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUORIG |

This is the origination code as of monthend. This is pulled from Origination Code field on the Loans > Account Information > Additional Loan Fields screen, Origination/Maturity tab. |

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUINSU |

This is the insurer code as of monthend. This field is pulled from the Loans > Accounts Information > Additional Loan Fields screen, Classification/Purpose tab at monthend. This is the type of insurer. What is selected in the Insurer Code field affects how the Account Type is recorded in the Credit Bureau Report and transmission file (FPSRP184) sent to Credit Bureaus. See the Credit Bureau Type (Account Type) topic for more information. |

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUCOLL |

This is the collateral code as of monthend. The Collateral Code is pulled from the Loans > Account Information > Additional Loan Fields screen, Origination/Maturity tab.

What is selected in the Collateral Code field affects how the Account Type is recorded in the Credit Bureau Report and transmission file (FPSRP184) sent to Credit Bureaus. See the Credit Bureau Type (Account Type) topic for more information. |

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUHLD1-4 |

These are the hold codes on the Loans > Account Information > Account Detail screen, Account tab as of monthend. These hold codes are used to adjust the CB status of the loan.

See also: Coding of Derogatory Credit Status > Hold Codes |

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUCRBU |

If this field is checked, the account will be reported to the credit repositories (FPSRP184). See below for more information.

|

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUDUPD |

This is the date the account information was reported to the Credit Bureaus. See below for more information.

|

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUCMPH |

This field is for your convenience; it is not reported to Credit Bureaus during the monthend Credit Reporting Update function. It displays what the payment status is for the current month before the monthend Credit Reporting Update process occurs. This status moves into the first month of the Payment Profile field at monthend. |

|||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: BUPMHS |

See Payment Profile for more information. |

|||||||||||||||||||||||||||||||||||||||||||||

Deferment field group |

See Deferments field group for more information. |