Field

|

Description

|

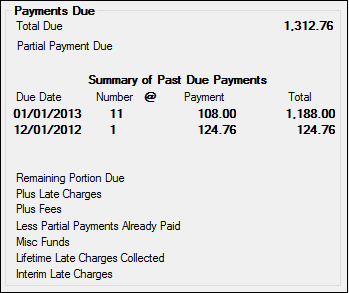

Total Due

Mnemonic: CLSTOT

|

This field shows the total amount due on the loan to bring it to a current status. It is the sum of all payments due on the loan plus late charges and fees minus partial payments made (see fields below).

|

Partial Payment Due

Mnemonic: LNPICN - LNPRTL

|

This is a calculated field displaying the principal and interest due minus any partial payments already paid (see below). Once the customer pays this amount, the due date will roll one frequency.

|

Summary of Past Due Payments

Mnemonics: CLDAT1_0-3; CLCNT1_0-3; CLTOT1_0-4; CLTOT2_0-3

|

These fields display a summary of any payments that are past due. If the loan is current, these fields will be blank. Open the link below for more information.

Due Date: These fields allow for four due dates. The three additional due dates are used for graduated payments, adjustable rate mortgages, or whenever the payment is not a fixed amount for the life of the loan. The dates will be broken down by each payment change. For example, a loan is six months delinquent. In that time, the loan has had one payment amount change. For two months, the payment was at $360.00 per month. For the other four months, the loan payment was at $400.00 per month. Two dates will be listed in this column: first for the most recent payment amount, and second for the oldest payment amount.

If the customer has modified payment plans set up, and the customer has been delinquent in paying the modified payment, this field will also reflect those amounts. Note: Your institutions determines whether or not to allow modified payment plans. To set up a modified payment plan for a customer, use the Loans > Transactions > CP2 screen > Payment Schedule tab.

Number @ Payment: These fields show the number of payments owing at (or @) a specific payment amount. If a customer has not made the last six payments due on the loan, and three of the months payments were at $360 and the other three were at $400, then this field would show the loan as three times late at (@) one payment amount, and three times late at (@) the other payment amount.

Total: This field shows the total of all payments owed on the loan. It multiplies the payment amount due times the number of payments late. For graduated payments, each payment change will be totaled in these fields. For example, if a loan was late for three payments at a rate of $350 and late for two payments at a rate of $400 dollars, then the total would show as $1050 for the first payment amount, and $800 for the second payment amount. A grand total of payments due, plus late charges and fees is totaled at the bottom of this column. This amount is added to calculate the Total Due field above.

|

|

Remaining Portion Due

Mnemonic: LNRPDU

|

This field is used in connection with the Roll Due Date Within and Dollars/Percent fields. It stores the remaining unpaid portion of the payment. Open the link below for more information.

The amount is then added to the total due on the billing statement (Bill and Receipt, Pmt Mth 0, 6, and 7 (Cycled Billing) (FPSRP003) and Bill and Receipt, Pmt Mth 0, 6, and 7 (Variable Billing) (FPSRP155)).

When payments are posted to the loan, the remaining portion due is paid before the due date is rolled based on the Roll Due Date Within field. So, if the payment minus the Remaining Portion Due is less than the Roll Due Date Within limit, the due date will not roll.

Example: A customer has $30 in the Remaining Portion Due field. The Roll Due Date Within limit is set to $80. The loan payment due is $100, plus the remaining $30 for a total of $130. The customer sends in a $100 payment. The system first applies $30 of that $100 payment to pay for the Remaining Portion Due, leaving $70 toward the loan payment. The system would then roll the previous month's due date to this month's due date. However, the system will not roll this month's due date to the next due date because the $70 does not reach the $80 Roll Due Date Within limit required.

If Institution Option ILF6 is enabled, then this field will display the principal amount of the payment that is due. This field clears to zero when the current month's payment is posted. If, at monthend, the current month's payment is not paid, the amount is subtracted from the principal variance, this field is cleared to zero, then the Monthend Calculations are processed for the next month and the next month's principal due is entered into this field.

Example: The 9/1 payment has a principal due of 71.88. On 9/30, the payment is still due for 9/1. The principal due clears to zero, the principal variance becomes negative (-71.88) and the principal due for 10/1 is recalculated and stored in the Remaining Portion Due field.

|

|

Plus Late Charges

Mnemonic: LNLATE

|

This is a calculated field that shows the total amount of late charges due on the loan. Late charges come from the Late Charges Due field. This amount is added to any outstanding loan payments due to calculate the Total Due (above).

|

Plus Fees

Mnemonic: LNFEES

|

This is a calculated field that shows the total amount of fees due on the loan. Fees are pulled from the Total Loan Fees field on the the Loans > Account Information > Additional Loan Fields screen. These amounts are added to calculate the Total Due field above. Note: Fees are separate from late charges (see above). For more information on assessing, paying, or waiving fees, see the Miscellaneous Fee Processing topic in the Loans > Marketing and Collections screen help.

|

Less Partial Payments Already Paid

Mnemonic: LNPRTL

|

This field shows funds paid to the loan but not applied to the loan because it was not a full payment. This amount comes from the Applied to Payment/Partial Payments field. This amount will be subtracted to calculate the Total Due (above).

|

Misc Funds

Mnemonic: LNMISC

|

This field is generally not used by GOLDPoint Systems. This field shows all miscellaneous funds on the loan. This is a money field entered through a teller transaction only. The use of this field can be determined by your institution. Possible uses are insurance claim funds or rents collected on properties in foreclosure. The Misc Funds field is a memo field for payment method 8 loans-rentals.

|

Lifetime Late Charges Collected

Mnemonic: LNLLTC

|

This is the amount of late charges collected on this account since it was opened. Open the link below for more information.

This field is updated each time a late charge is paid or the late charge payment is reversed. Late charges can be paid directly using the Pay Late Charge transaction (tran code 550), or they can be paid with a normal loan payment. However, the Payment Application field must have the Late Charges box checked. If the Late Charges box is listed first in the Payment Application field, late charges are paid first before any other part of the loan payment (principal, interest, fees, etc.). Your institution determines whether or not late charges are included with loan payments, and in which order they are paid. To reverse a late charge, use tran code 550, but check the Correction box, as shown below:

Make sure you enter the same amounts that were entered on the original Late Charges transaction. (Late charges can also be reversed with a payment reversal. The system reverses the payment in the same order as set up in the Payment Application field.)

History records late charges paid as tran code 550 and corrected late charges as 558. If you do correct a late charge, you must also run the Late Charge Reversal G/L transaction (tran code 1800-00-10) to remove those funds from your General Ledger. You must know the General Ledger account number where late charges are stored for your institution.

|

|

Interim Late Charges

Mnemonic: MRCLCC

|

The Interim Late Charges field stores an accumulated amount of late charges collected over a period of time. Open the link below for more information.

This field is cleared whenever the following happens:

•An Interest Only transaction (2600-03) is run. •A Judgment transaction (2510-02) is run. •A CP2 (Exception) transaction (2600-00) is run. •The account is brought current (anytime the due date is advanced beyond the transaction date).

This field is used in conjunction with the Applied to Payment/Partial Payments field during the grading process (see Special Late Charge Assessment and Grading for more information).

This field only has information in it if Institution Option UDQG is enabled.

|

|