Navigation: Deposit Screens > Account Information Screen Group > Activity Information Screen > Deposit Activity tab >

Cycle Limits field group

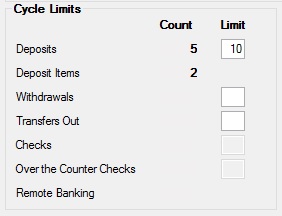

Use this field group to view and edit cycle information for the customer deposit account. An account's statement cycle is determined using the Statement Cycle field on either the Deposit > Account Information > Account Information or Additional Fields screen.

Most fields in this field group display two separate values: The Count value and the Limit value (as shown below). The Count value displays the number of times the corresponding action has occurred on the account during the current statement cycle. The Limit value (which is generally file maintainable) is used to indicate the maximum number of times per statement cycle the corresponding action is allowed on the account.

The information indicated in this field group is as follows:

Field |

Description |

|

|

Mnemonic: DMDPCY/DMLDPC |

The number of deposits processed/allowed on the customer account during the present statement cycle. This field is different from the Deposits Items Count field in that each deposit transaction may contain several individual deposit items. For example, a deposit transaction containing three individual items would be counted once in this field. Interest posting is not considered a deposit.

If the customer account reaches the deposit limit specified in the Deposits Limit field, Transaction Condition 13 determines whether further deposits are rejected or charged a service fee. You must have security clearance to change the value of this field. Additionally, you must have transaction condition 13 set up at your institution.

|

|

|

Mnemonic: DMDICY |

The total number of deposit transaction items to the customer account during the present statement cycle. This field is different from the Deposits Count field in that each deposit transaction may contain several individual deposit items. For example, a deposit transaction containing three individual items would be counted three times in this field. Interest posting is not considered a deposit. A Limit value cannot be indicated for deposit items. |

|

|

Mnemonic: DMWDCY/DMLWDC |

The number of withdrawals processed/allowed on the customer account during the present statement cycle. A zero (0) in the Withdrawals Limit field indicates that there is no enforced limit to the number of withdrawals on the customer account. Otherwise, the highest possible numeric value of this field is 999.

Your institution will decide whether further withdrawals are rejected or charged a service fee. |

|

|

Mnemonic: DMXFCY/DMLXFC |

The number of outgoing transfers processed/allowed on the customer account during the present statement cycle. If your institution charges service fees for transfers, this field will be used in the service charge definitions (as set up on the Deposits > Definitions > Service Charges screen and applied to the account on the Deposits > Account Information > Service Charge Fields screen).

A zero (0) in the Transfers Out Limit field indicates that there is no enforced limit to the number of outgoing transfers on the customer account. Otherwise, the highest possible numeric value of this field is 999. Your institution will decide whether further outgoing transfers are rejected or charged a service fee. |

|

|

Mnemonic: DMCKCY/DMLMCK |

The number of cleared checks processed/allowed against the customer account during the present statement cycle. The Checks Count field may be used in service charge calculation routines (as set up on the Deposits > Definitions > Service Charges screen and applied to the account on the Deposits > Account Information > Service Charge Fields screen). This field may also be used to reject inclearing checks if the Checks Count field is set (as in money market accounts).

A zero (0) in the Checks Limit field indicates that there is no enforced limit to the number of checks that can be cleared against the customer account. Otherwise, the highest possible numeric value of this field is 999. Your institution will decide whether it wants to reject or assess a service charge (as set up on the Deposits > Definitions > Service Charges screen and applied to the account on the Deposits > Account Information > Service Charge Fields screen) for any checks submitted past this limit (or process the checks but flag them to the reject handler). |

|

|

Mnemonic: DMOTCY/DMOTCL |

The number of cleared over-the-counter checks processed/allowed against the customer account during the present statement cycle. The Over the Counter Checks Count field may be used in service charge calculation routines (as set up on the Deposits > Definitions > Service Charges screen and applied to the account on the Deposits > Account Information > Service Charge Fields screen). This field may also be used to reject inclearing checks if the Over the Counter Checks Count field is set (as in money market accounts).

A zero (0) in the Over the Counter Checks Limit field indicates that there is no enforced limit to the number of checks that can be cleared against the customer account. Otherwise, the highest possible numeric value of this field is 999. Your institution will decide whether it wants to reject or assess a service charge (as set up on the Deposits > Definitions > Service Charges screen and applied to the account on the Deposits > Account Information > Service Charge Fields screen) for any checks submitted past this limit (or process the checks but flag them to the reject handler). |

|

|

Mnemonic: DMGPTN |

The number of remote banking transactions that have taken place on the customer account during the present cycle. Deposit transfers do not add to the value in this field. This field can be used to service charge GOLDPhone transactions (as set up on the Deposits > Definitions > Service Charges screen and applied to the account on the Deposits > Account Information > Service Charge Fields screen). |