Navigation: Deposit Screens > Account Information Screen Group > Activity Information Screen > Deposit Activity tab >

Activity field group

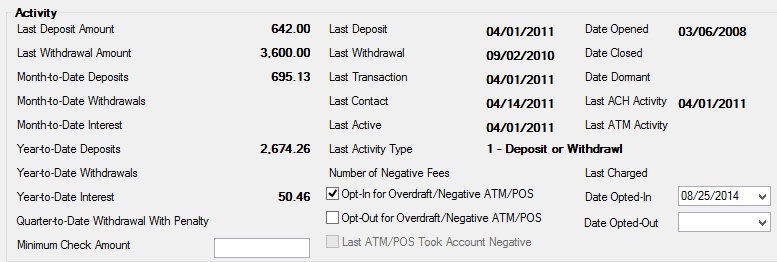

Use this field group to view and edit information about deposit activity on the customer account.

The fields in this field group are as follows:

Field |

Description |

|||

Last Deposit/Withdrawal Amount

Mnemonic: DMLDAM, DMLWAM |

These fields display the most recent deposit and withdrawal amounts on the account. Interest posting is not considered a deposit. |

|||

Month-to-Date Deposits/Withdrawals/Interest

Mnemonic: DMMDDP, DMMDWD, DMMDIN |

These fields display the current calendar month totals for deposits, withdrawals, and interest posting on the account. Interest posting is not considered a deposit. These fields are cleared each month during the month-end processing cycle. |

|||

Year-to-Date Deposits/Withdrawals/Interest

Mnemonic: DMCYDP, DMCYWD, DMIYTD |

These fields display the current calendar year totals for deposits, withdrawals, and interest posting on the account. Interest posting is not considered a deposit. These fields are cleared each year during the year-end processing cycle. |

|||

Quarter-to-Date Withdrawal with Penalty

Mnemonic: DMQWDP |

This field contains the total amount withdrawn from the customer account if it is a certificate account (the Certificate field on the Deposits > Account Information > Account Information screen is marked) during the current calendar quarter. If there is an amount in this field at the end of the quarter, the amount is entered on the Consolidated Maturity Rate (CMR) Report (FPSDR071) in the Early Withdrawals section. This field is cleared each calendar quarter. |

|||

|

Mnemonic: DMMNCA |

Use this field to indicate the minimum check amount that may be withdrawn from the customer account. If a check for less than the value in this field is presented for withdrawal, it will be rejected. |

|||

Last Deposit/Withdrawal/Transaction/Contact/Active/Activity Type

Mnemonic: DMDTLD, DMDTLW, DMDTLT, DMDTCC, DMDTLA, DMTPLA |

These fields display the date of the most recent deposit, withdrawal, and transaction performed on the account, the date of most recent contact with the customer, the date of the most recent activity on the account, and the type of activity performed (1 - Deposit or Withdrawal, 2 - File Maintenance, 3 - Backdated Deposit or Withdrawal, 5 - Interest Posting, 9 - No Activity Since Conversion to the System). Interest posting is not considered a deposit.

The Last Contact field is used to determine account dormancy status (see Date Dormant below). Open the link below for more information. |

|||

|

Mnemonic: DMDTOP, DMDTCL, DMDTDM |

These fields display the date of initial deposit on the account, the date the account was closed (if applicable), and the date the account was classified as dormant (if applicable). A customer account is considered dormant when the time length specified in the Term Until Dormant field (on the Deposits > Account Information > Additional Fields screen) has passed since the date entered in the Last Contact field (explained above). See below for more information about dormancy.

|

|||

|

Mnemonic: DMDACH, DMDATM |

These fields display the date of the most recent ACH and ATM activity on the account. |

|||

|

Mnemonic: DM#NGF |

This field contains the number of negative fees that were charged for the date specified in the Negative Fee Last Charged field (see below). A maximum possible value for this field can be set up using Institution Option NGLP. Once this limit is reached, no more charges will be assessed for the specified day's processing.

This field and the Negative Fee Last Charged field are valid only when Institution Option NGCH is active on the customer account. All negative charges processed through ATM, ACH, and after-hours transactions are included in calculating this field. |

|||

|

Mnemonic: DMNGLD |

This field contains the most recent date a negative fee was charged to the customer account. All negative charges processed through ATM, ACH, and after-hours transactions will be included in calculating this field.

This field and the Number Of Negative Fees field (see above) are valid only when Institution Option NGCH is active on the customer account. |

|||

Opt-In/Opt-Out for Overdraft/Negative ATM/POS

Mnemonic: M2AMOD, M2OOOD |

Use these fields to indicate whether the customer account opts in or out of overdraft services and fees (including negative limits for one-time transactions). Only one of these checkboxes can be marked at once. See below for more information.

|

|||

|

Mnemonic: M2DTOI, M2DTOO |

Use these fields to indicate the date the customer opted in for overdrafts as explained in the Opt-In for Overdraft/Negative ATM/POS field help above.

Overdraft features can be adjusted for individual customer accounts on the Deposits > Account Information > Overdraft & Secured Loans screen. For the transaction, institution, and CIM GOLD features that pertain to the use of the overdraft feature, see the Overdrafting Conditions and Options help page. In order to use the overdraft function on a customer account, the Overdraft field on the Deposits > Account Information > Account Information screen must be marked. |

|||

Last ATM/POS Took Account Negative

Mnemonic: M2ATMN |

This field indicates whether the last posted ATM or POS transaction took the customer account negative. |