Navigation: Deposit Screens > Account Information Screen Group > Commercial Account Analysis Screen >

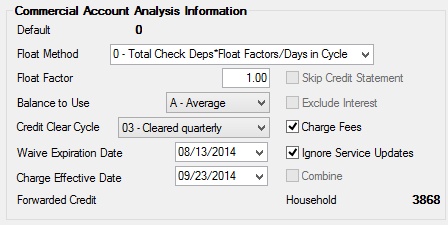

Commercial Account Analysis Information field group

Use this field group to view and edit information about the Account Analysis setup for the customer deposit account.

In order for this screen to be used on a customer account, institution analysis setup records must first be created and an option enabled on the account. This process is explained on the Account Analysis Setup help page.

The fields in this field group are as follows:

Field |

Description |

|||||||||

|

Mnemonic: DMDEFL |

This field displays the account analysis default number that is currently being used on the customer account. You can delete this default by clearing the Analysis Default field on the Deposits > Account Information > Additional Fields screen. Any information corresponding with that default, however, will be dropped.

Defaults for commercial analysis service charge codes are set up by marking relevant fields on the Defaults screen. There are 79 pre-defined codes and 20 user-defined codes available. Once the Defaults screen has been set up, that Analysis Default number can be entered on the Additional Fields screen. All default entries will then populate fields on this screen. |

|||||||||

|

Mnemonic: AAFOPT |

Use this field to indicate the float method code for check deposits on the customer account. See below for the possible selections in this field.

|

|||||||||

|

Mnemonic: AAFFCT |

Use this field to indicate the average number of days the customer account's check deposits are in "float." This field is only used for Float Method code 0 (see above). For example, enter "1.50" if check deposits on the account average 1 1/2 days in float (in other words, it takes 1 1/2 days for checks to process between depositing banks and paying banks). |

|||||||||

|

Mnemonic: AAUSEH, AAUSEL, AAUSEC |

Use this field to indicate the balance to use on the customer account for earnings credit in the analysis calculation for the month (in other words, whether to calculate interest based on the average account balance, the high account balance, or the low account balance for the month).

Earnings credits are subtracted from the service charge amount. The three possible selections in this field are:

A - Average H - High L - Low

The information to identify the customer account's average, high, and low balances is pulled from the Deposits > Account Information > Account Information screen. |

|||||||||

|

Mnemonic: AAFCYC |

Use this field to specify how often a forwarded credit amount is cleared (see Forwarded Credit below). See below for more information.

|

|||||||||

|

Mnemonic: N/A |

Use this field to indicate the date that the waive of selected account analysis services will expire.

A service is considered waived if the Waive field is marked. If this field is left blank, the waive does not expire. If this date falls within or on the Statement Cycle date (from the Deposit > Account Information > Account Information screen), the waive will be ignored and all charges will be assessed. |

|||||||||

|

Mnemonic: AASVDT |

Use this field to indicate the date that account analysis fees become effective on the customer account. No fees will be charged on the customer account prior to this date.

For example, this field can be used to indicate that there will be no account analysis fees on a new account for the first 90 days. In that case, in this field you would enter a date that is 90 days after the date the customer account was opened. If no date is entered, the fees are effective immediately. |

|||||||||

|

Mnemonic: AAFBAL |

This field displays a credit amount from statements against new charges for the current Statement Cycle (from the Deposit > Account Information > Account Information screen). For example, last month's statement yielded a $5.00 credit. That amount would be placed in this field. When the current month's statement is processed and yields a $9.00 charge, the $5.00 credit is applied to the charge reducing it from $9.00 to $4.00. The amount in this field is then cleared.

When consecutive credit statements are processed, this field accumulates the credit and applies them when they are needed. A zero is placed in this field periodically according to the setting in the Credit Clear Cycle field above. |

|||||||||

|

Mnemonic: AASKCR |

Use this field to indicate whether the system should have an account statement printed if a credit for services was computed on the customer account. |

|||||||||

|

Mnemonic: AAINSK |

Use this field to indicate whether interest earned on the customer account is to be ignored when processing account analysis charges. If this field is left blank, paid interest will be subtracted from the net earned amount to be used in the balance before services. If a this field is marked, interest will not be used in the analysis charges and will not appear on the statement.

Earned interest is interest paid to the customer account based on the percent entered in the Rate field on the Deposits > Account Information > Account Information screen. |

|||||||||

|

Mnemonic: AACHGS |

Use this field to indicate whether the customer account should be charged account analysis fees when the analysis is first set up. If this field is marked, the analysis calculation will be processed, and fees will be assessed. If this field is left blank, the statement will print with a note reading "Account Not Charged During Evaluation Period."

This field should be left blank for periods in which services are merely being evaluated. |

|||||||||

|

Mnemonic: AAUPDF |

Use this field to indicate whether the customer account should be excluded from the update found in the account analysis default record. Individual account analysis records can be updated according to the information found in the account analysis default record. |

|||||||||

|

Mnemonic: N/A |

This field indicates whether the customer account is part of a combined analysis. Combined analysis statements are set up in CIF. If a group record is set up, you will receive a combined statement for the customer account selected. |

|||||||||

|

Mnemonic: MNSEIN |

This field contains the household number tied to the customer account. The household number is pulled from CIF. |