Navigation: Deposit Screens > Definitions Screen Group >

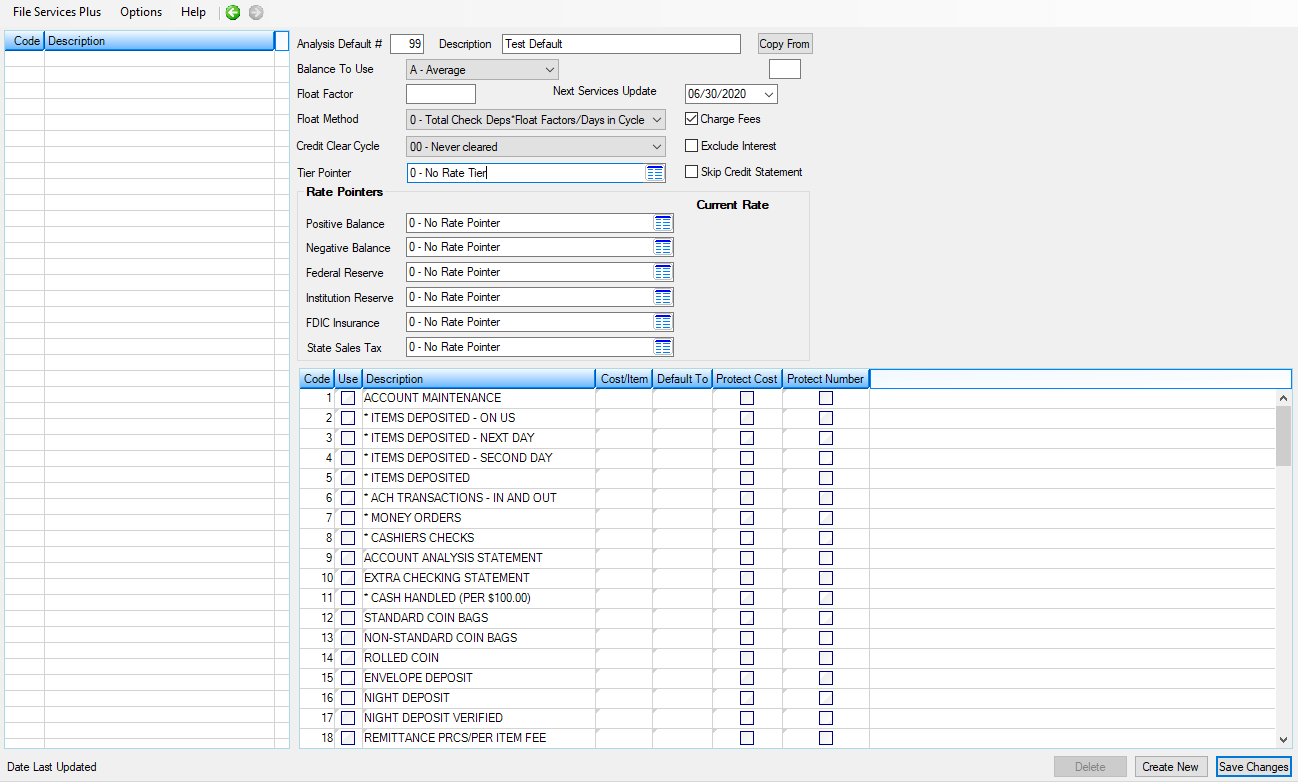

The Deposits > Definitions > Commercial Analysis Defaults screen allows analysis default numbers to be set up and used as a basis for service charge analysis. Only defaults set up on this screen can be used on the Deposits > Account Information > Commercial Account Analysis screen. Up to 10,000 different defaults (0-9999) are available to allow for a variety of offerings at your institution.

For example, small businesses and large commercial businesses can choose different analysis services because of their transaction and cash differences. These default records are then tied to individual customer accounts based on what services they want to use. After initial setup is finished on the account, the default record is never used again. Changes can be made manually on the account, and file initializations can be processed for your institution for mass changes.

To create a default, click <Create New> and enter the necessary information in the fields on this screen (see table below). Once all information is ready, click <Save Changes>. The new default will appear in the main list view on the left side of this screen.

To edit an existing default, select it in the main list view and change the desired information in the necessary fields. Then, click <Save Changes>. Note that the Analysis Default number cannot be changes once an item is created.

The fields and buttons on this screen are as follows:

Field |

Definition |

|

Mnemonic: AIDEFL |

This is the number (up to 4 digits) of the analysis default that is currently displayed on this screen. This field is not file maintainable.

"0000" is a valid default record. |

|

Mnemonic: AIDFDS |

This field contains the description for the analysis default number displayed. It can be up to 30 characters long and will appear on the Commercial Account Analysis screen. |

Use this button to create a new default by copying the information from an existing default, making changes, and saving the new item.

This is accomplished by entering the existing analysis default number to be copied in the unlabeled field beneath this button and then clicking the button. The fields on this screen will be populated with the existing default's information. Make the necessary edits and click <Save Changes> to save the new default number. |

|

|

Mnemonic: AISTAT |

This field contains the indicator for the balance to use for earnings credit in the analysis calculation. Earnings credits are subtracted from the service charge amount. The three possible codes are:

•A - Average •H - High •L - Low

The default for this field is "A - Average." This field is file maintainable. The information for the average, high, and low balances is pulled from the Deposits > Account Information > Additional Fields screen. |

|

Mnemonic: AIFFCT |

Use this field to indicate the average number of days the customer account's check deposits are in "float" for the selected default number. This field is only used for Float Method code 0 (see below). For example, enter "1.50" if check deposits on the account average 1 1/2 days in float (in other words, it takes 1 1/2 days for checks to process between depositing banks and paying banks). |

|

Mnemonic: AIDTEF |

Use this field to indicate the date on which the individual account analysis records will be updated. On the processing night before this date, the account analysis records will update account information according to changes made to the default record and its costed services.

On this date, costed fields on the accounts that are not found on the default record will be dropped from the account's analysis record. New costed fields found on the default record will be added. No item counts will be changed except those associated with services that were dropped.

This field is available so costed service charges can be rolled on a specified date. The timing for adding or deleting a costed service is very important. When the change adds or deletes a costed service, it will immediately affect all individual accounts that use the default:

•If the change eliminates a costed field, the previously accumulated totals on that field will never be charged. •If the change creates a new costed field, it will be available for accumulating totals immediately. An automatic field will start accumulating on the day the field is added. •If a new field is entered by a teller, it starts accumulating when the teller is instructed to use it.

Afterhours update function 49 must be set to "nextday" in order to process the default update. Changes will be active as of the morning of the specified date. GOLDPoint Systems suggests making changes to the effective date default on the first day of the cycle, which is generally the first of the month.

Specific accounts that should not be updated can be excluded by checking the Ignore Services Updates field found on the Deposits > Account Information > Commercial Account Analysis screen. |

|

Mnemonic: AIFOPT |

This field contains the float method code. The three possible codes are:

•0 = Total Check Deposits in Cycle * Float Factor/Days in Cycle: This calculation is processed by taking the total dollar amount of checks deposited in the statement period times the float factor (found in the Float Days field), divided by the number of days in the statement cycle. •1 = Use Average Uncollected: This amount is taken directly from the Average Uncollected Funds field (DMAUNC) on the Deposits > Account Information > Additional Fields screen. •2 = Float Not Used in Calculation |

|

Mnemonic: AICHGS |

Indicate with a checkmark whether accounts should be charged fees for account analysis when the analysis is first set up. If this field is checked, the analysis calculation will be processed and fees will be assessed. If this field is left blank, the statement will print "Account Not Charged During Evaluation Period." If you have a period in which you are evaluating services, this field should be left unchecked. |

|

Mnemonic: AIINSK |

This field indicates whether interest earned on the account is to be ignored when the analysis charges are processed. If you leave this box blank (which is the default), paid interest will be subtracted from the net earned amount to be used in the balance before services. If a check is entered, interest will not be used in the analysis charges and will not appear on the statement.

Earned interest is interest paid to the account based on the amount entered in the Interest Rate field. |

|

Mnemonic: AISKCR |

Indicate with a checkmark whether statements that calculated a credit for services instead of a charge should be printed in the afterhours. This field defaults to blank so that all statements will print, regardless of whether the account generated a credit or charge. |

|

Mnemonic: AIFCYC |

This field is used to specify how often a Forwarded Credit amount is cleared. The credit amount is the positive amount calculated from all the analysis service charges minus the balance before services. This means the customer keeps sufficient funds in the account to negate all analysis fees. If the credit is to be used in subsequent months toward future charges, then a value must be entered in this field. If credits are used only in the month earned, this field must be set to "1." The Forwarded Credit amount will be cleared after statement processing based on the following codes:

•0 - Forwarded credit is never cleared •1 - Forwarded credit is not used (same as cleared monthly) Note: When the Credit Clear Cycle field is changed to 1, the Forwarded Credit amount is cleared. •3 - Forwarded credit cleared quarterly •6 - Forwarded credit cleared semi-annually •12 - Forwarded credit cleared annually

Example: An account that cycles on the 15th of the month and has the Credit Clear Cycle field set to "3" will create a statement on the night of the 15th every month. The account will clear the Forwarded Credit field amount (found on the Commercial Account Analysis screen) on the 15th every third month. |

|

Mnemonic: AITPTR |

This field will be used to tier the positive interest rate, using the Positive Balance Rate Pointer field. For calculation of the rate to use on the positive balance credit, the current tier level will be based on the calculated amount in the Net Available Balance field on account analysis statements. |

Rate Pointer field group |

See Rate Pointer Field Group for more information. |

See Code List View for more information. |

|

This field displays the date and time the analysis default was last updated. It is not file maintainable. |

|

Record Identification: The fields on this screen are stored in the FPAI record (Account Analysis Inst Data). You can run reports for this record through GOLDMiner or GOLDWriter. See FPAI in the Mnemonic Dictionary for a list of all available fields in this record. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must subscribe to it on the Security > Subscribe To Mini-Applications screen. |