Navigation: Loans > Loan Screens > Account Information Screen Group > Signature Loan Details Screen >

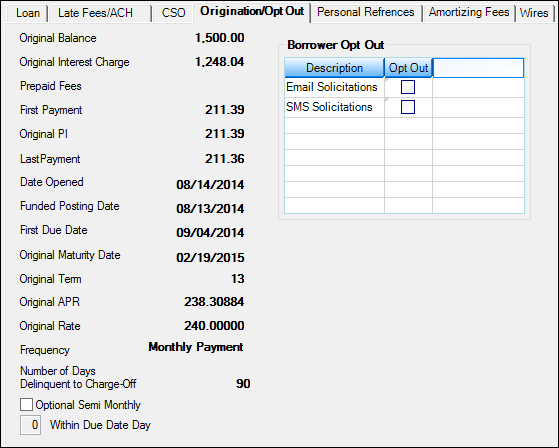

Use this tab (on the Loans > Account Information > Signature Loan Details screen) to view origination information (and indicate opt-out information) about the customer signature loan (payment method 16).

Loans > Account Information > Signature Loan Details Screen, Origination/Opt-Out Tab

Use the list view on the right side of this screen to indicate whether the person selected in the Names list view wants to opt out of email or SMS (text) solicitations by your institution. This information is usually entered when the loan is originated, but if your institution allows it, you can make changes here. If you check the Opt Out boxes, the customer will not receive any emails or text solicitation messages through the Notification System. They may, however, still receive alerts in regards to their account, such as the balance being low, a payment needing to be made, etc. See the Notification System manual for more information.

The fields on this tab are as follows:

Field |

Description |

|

|

Mnemonic: LNOBAL |

The Principal Balance of the loan at its creation. |

|

|

Mnemonic: OTOINT |

The calculated interest charge (as a dollar amount) for the loan at its creation. |

|

|

Mnemonic: OTPPF1-OTPPF5 |

The amount, if any, of charges and fees previously paid by the customer at the time of the loan's creation. |

|

|

Mnemonic: OTPFAM |

The first amount paid by the customer on the loan. |

|

|

Mnemonic: LNOPIC |

The PI Constant calculated on the loan at its creation |

|

|

Mnemonic: OTLPAM |

The most recent amount paid by the customer on the loan. |

|

|

Mnemonic: LNOPND |

The date of the loan's creation. |

|

|

Mnemonic: MRFUND |

The date loan funds were available to the customer following the loan's creation. |

|

|

Mnemonic: LN1DUE |

The Due Date of the first scheduled payment on the loan. |

|

|

Mnemonic: MLOMAT |

The initial Maturity Date of the loan indicated at the loan's creation. |

|

|

Mnemonic: LNTRMO |

The initial Term of the loan indicated at the loan's creation |

|

|

Mnemonic: LNAPRO |

The initial APR of the loan indicated at the loan's creation. |

|

|

Mnemonic: LNORTE |

The initial Interest Rate of the loan indicated at the loan's creation. |

|

|

Mnemonic: LNFREQ |

The Frequency of the loan indicated at the loan's creation. |

|

Number of Days Delinquent to Charge-Off

Mnemonic: N/A |

The amount of time (in days) a customer account is allowed to be delinquent before the charge-off transaction is processed. Charge-off transactions are processed on the Loans > Transactions > Charge Off Transactions screen. |

|

|

Mnemonic: LNOO24 |

Check this option to indicate that your institution uses an alternate version of the regular semi-monthly payment Frequency. See below for more information.

|

|

|

Mnemonic: LNWIDY |

This option is available for customers who are set up to make automatic recurring payments (see ACH Information field group on the Late Fees/ACH tab) but who also want to make additional payments within the same frequency. This option affects the number of times the system rolls the Due Date for payments. See below for more information.

|