Navigation: Loans > Loan Screens > Reports Screen Group >

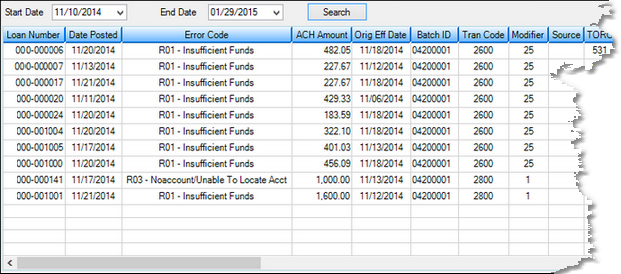

The list view on this screen displays information about any ACH transactions returned within the date range entered in the Start and End Date fields (when <Search> is clicked).

This screen is only available if your institution allows recurring loan payments via the FPAE record (ACH Funds Distribution). Click any column header to organize the list view by that column's information type.

Loans > Reports > ACH Returned Payments Screen

The columns in this list view are as follows:

Column |

Description |

||

|---|---|---|---|

Loan Number

Mnemonic: AE4NBR

|

This is the loan number connected to the ACH payment return. |

||

Date Posted

Mnemonic: AEDTPT |

This is the date the ACH payment was returned. |

||

Error Code

|

This column displays the ACH return code. ACH return codes provide a reason for the return. For example, a common return code is "R01 - Insufficient funds." See the Incoming Return Codes help page for a list of all possible return codes in CIM.

Option for Return Code 3 - No account/Unable to locate account

If the return code is "R03 - No account/Unable to locate account," the system automatically retracts the loan (tran code 2800-01) and closes the account. However, Institution Option SLAR allows your institution to choose what should be done with the loan. The loan is not automatically retracted (tran code 2800-01). Instead, someone at your institution can call the customer and ask for a new account to distribute the money into or ask if they want a check mailed to them. The loan can also be closed.

If Institution Option SLAR is enabled, the GEM Exception Report (FPSDR096) can be viewed to see which account distributions were rejected.

If the customer would still like the loan and provides a new bank account number to deposit the funds into, complete the following steps:

1.Change the routing and account numbers to the new routing/account number the customer wants in the Recurring field group on the Loans > Account Information > Payment Information screen. Recurring payment fields can also be changed from the Loans > Transactions > EZPay and Signature Loan Details screens.

2.Use the Miscellaneous > ACH/Wire > ACH Funds Upload screen to resend the funds. |

||

ACH Amount

Mnemonic: AEACH$ |

This is the amount of the ACH payment that has been returned. |

||

Orig Eff Date

Mnemonic: AEEFDT |

This is the effective date of when the ACH payment was sent by the system. |

||

Batch ID |

This is the batch identification number used to verify the transmission of the ACH record. |

||

Tran Code and Modifier |

This is the GOLDPoint Systems transaction code used to identify the type of transaction that was returned. Modifiers help pinpoint the transaction even further. A 2600 mod 25 transaction means it is a loan payment from the EZPay screen, which could also mean from your company's website. The TORC helps to further define where the payment came from. See the Loans > Loan System Reference > Chapter 2, Transactions, section in DocsOnWeb for a more detailed explanation of transaction codes. |

||

Source |

This is a one-letter code indicating the source where the return payment originated. Possible origination codes are:

O = Origination L = Lender Distribution (through a Credit Service Organization or CSO) P = Payee Distribution (through a Credit Service Organization or CSO) C = CIM W = Web G = GOLDPhone A = EZPay (via FPAS Record) R = Recurring Payments (via FPRA record) |

||

TORC |

This is the Transaction Origination Code of the transaction. This help determine how the transaction took place, such as GOLDPhone payment, Web payment, loan payment from lockbox, etc. For a list of all loan TORCs, see Accounting > GOLD Services > Appendix C.1, Loan System TORCs in DocsOnWeb. |

||

Teller |

This is the teller number associated with the transaction. Teller numbers 9998, 9999 refer to an afterhours teller. |

||

Descriptor |

This column displays the descriptor for the system's actions when the ACH payment return transmission was received. Descriptors are set up by institution options. |

||

ACH 5, 6, 7 |

These are further identifiers that help establish where the return file originated and the legitimacy of the data. |

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen. |