Navigation: Loans > Loan Screens > Account Information Screen Group > Reserves Screen Group > Reserve Analysis Screen > Reserve Analysis tab >

New Reserve field group

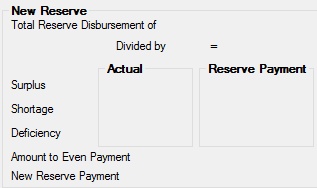

The fields in this field group are used to calculate the new reserve payment. These fields display two amounts. The first amount (in the Actual box) is the total amount calculated for each, and the second (in the Reserve Payment box) is the total amount divided by the payment frequency or by the options selected on this screen.

Information for these fields is automatically calculated by the system each time you access this screen. To create new reserves, use the Account Reserve Detail screen, and then access this screen to see how the new reserve affects the loan.

The fields in this field group are as follows:

Field |

Description |

This is the total of all reserve disbursement amounts divided by the payment frequency. Generally this is 12 months, but it could be 26 months, 6 months, etc. The Divided By field description changes based on the payment frequency. |

|

This is an amount by which the projected reserve account balance exceeds the low balance for the account. Two fields are displayed. The first (in the Actual box) is for the total surplus, and the second (in the Reserve Payment box) is the surplus divided by the payment frequency (generally 12 months). Based on the amount of the actual surplus (total) and Surplus Limit, this amount may or may be displayed in the Surplus Amount (-) field in the New Loan Payment field group.

If a loan has a surplus above your surplus limit and you click <Post Analysis>, you can then print a reserve excess check for the borrower using the Loans > Check Printing > Reserve Checks screen. |

|

This is an amount by which the projected reserve account balance falls short of the low balance at the time of reserve analysis. Two fields are displayed. The first (in the Actual box) is for the total shortage, and the second (in the Reserve Payment box) is the shortage divided by the payment frequency. Based on the amount of shortage and shortage option selected, you may or may not have an amount in the Reserve Payment box. See the Analysis Options field descriptions. |

|

This is the amount of negative Reserve 1 and Reserve 2 balances in the reserve account at the time of analysis. This is the actual amount that the reserve balance is below zero adjusted for prepayments or delinquencies. Reserve 2 will not be included if you have the Exclude Reserve 2 From Analysis option checked. Based on the amount of the deficiency and deficiency option selected, you may or may not have an amount in the Reserve Payment box field. See the Analysis Options field descriptions.

See the Account Reserve Detail screen help to learn more about negative reserve balances.

If a loan has a deficit and you “post to account” online or from the afterhours process, the amount of the deficit will be entered in the Deficit Amount field on the Options, Limits & Loan Fields tab. |

|

If the Round Payment to Nearest Dollar field is checkmarked on the Reserve Payment tab of the Account Reserve Detail screen screen, this is the amount by which the reserve payment will be adjusted to make the loan payment an even dollar amount. We always round down because to round up may require you to display the asterisk by all items in the history projection comparison. |

|

This is the total of the previous five items. It represents the total reserve payment beginning with the date you have entered in the Analysis Date field. This is the reserve portion of the first loan payment effective as a result of the analysis. |