Navigation: Loans > Loan Screens > Account Information Screen Group > Reserves Screen Group > Reserve Analysis Screen > Reserve Analysis tab >

New Loan Payment field group

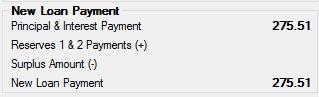

The fields in this field group display the new calculations for the loan payment in regards to any new reserves that have been added or reserves that have been changed.

To add new reserves or change currently set up reserves, use the Loans > Account Information > Reserves > Account Reserve Detail screen, then access this screen to see how the loan payment is affected.

Field |

Description |

||

|

Mnemonic: LNPICN |

This is the principal and interest payment that will be used on the reserve analysis date. This is pulled from the Loans > Account Information > Account Detail screen, or (for ARM loans or payment method 4 or 6 with the Use ARM Fields field checkmarked) it may come from the P/I Table on the Loans > Account Information > ARM Information screen. |

||

|

Mnemonic: N/A |

This is the total of the monthly reserve 1 and 2 payment. This information is calculated by the system whenever you access this screen. This information will change if you add reserves or change reserve information through the Account Reserve Detail screen.

Monthly reserve payments are paid during the normal course of loan payments (the Payment Application field group on the Loans > Account Information > Account Detail screen should include 3 (Amount to Reserve 1) and 6 (Amount to Reserve 2, if applicable)). These amounts add up in the reserve account until your institution pays for those reserves on a designated date, as set up on the Reserve Analysis Options screen.

See also: New Loan Payment (below) |

||

|

Mnemonic: N/A |

If a Surplus amount exists for this loan, the surplus amount is displayed here. For example, perhaps you set up a reserve for taxes on a property, and the property taxes went down by $200 for that account. At the end of the year when the analysis is run, this account would have a surplus of $200.

|

||

|

Mnemonic: RABLNPMT |

This is the new payment amount if a reserve surplus, shortage, or deficiency exists on the loan. If those do not exist on the loan, the new payment amount will be the same as the old payment amount.

This field is calculated by adding the Principal & Interest Payment amount by the Reserves 1 and 2 Payments (see above) minus any Surplus Amount. This field is not calculated until an analysis is posted by clicking <Post Analysis> or through the afterhours process after an automatic analysis is processed.

Usually, reserve analysis takes place on a yearly basis. |