Navigation: Loans > Loan Screens > Account Information Screen Group > Reserves Screen Group > Reserve Analysis Screen > Options, Limits & Loan Fields tab >

Analysis Limits field group

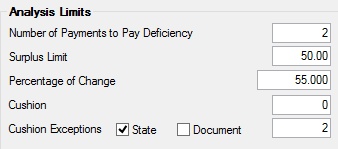

The fields in this field group allow you to set limits for the reserve analysis, such as how many months you want to be used for the reserve deficiencies, a surplus limit, etc. This is for the selected account only. Use the Loans > Account Information > Reserves > Reserve Analysis Options screen to set up institution-wide reserve analysis options.

The fields in this field group are as follows:

Field |

Description |

||

Number of Payments to Pay Deficiency

Mnemonic: ABNDEF |

This field shows how many payments (2-12) you want to be used to repay the reserve deficiency. The default is two months. See the Deficiency Option field description and warning for more details. |

||

|

Mnemonic: ABSURP |

This field is the surplus limit amount on which refunds will be based. If a surplus is calculated on an account and the amount of that surplus is greater than or equal to the surplus limit, the entire surplus is refunded to the borrower. The surplus is calculated after the cushion. The default (set by RESPA) is $50.00.

Due to mathematical limitations, any surplus less than 12 cents will not appear on the statement. |

||

|

Mnemonic: ABCHNG |

This field is available to the lender to enter the percent of change for all disbursements based on the Consumer Price Index. The lender determines their own change, if they want one, and enters the amount here. The default is zero. Example: If you want a 1% increase it would be entered as “1.000”. There are 3 decimals to the right.

|

||

|

Mnemonic: ABCUSH |

This is the option for the cushion amount to be used, which cannot be larger than 1/6 of the total reserve disbursements. “0” = no cushion, “1” = 1 month cushion or 1/12 of the total reserve disbursements, and “2” = two months cushion or 1/6 of the total reserve disbursements. The default is “0” or no cushion. This field also appears on the Reserve Analysis Options screen. The options on those screens are institution-wide options. If the information in this field is different from the information on the Reserve Analysis Options screen, the system will use the amount entered in this field.

|

||

Cushion Exceptions/State/Document

Mnemonic: LNCSHN, LNOSTA, LNODOC |

Use the checkbox fields to indicate whether the loan has a State or Document required cushion limit.

The adjacent numeric field is used to indicate how many months' cushion is allowed on this loan based on state or document limitations. These fields override the institution default option and are used with both the online and afterhours analysis process.

Example: If your institution option for the cushion is two (2) months and you have selected either State or Document, and a 1, when either an online or afterhours analysis is processed, this loan will only result in a one-month cushion.

For more information on what controls the cushion, see Cushion above. |