Navigation: Loans > Loan Screens > Account Information Screen Group > Reserves Screen Group >

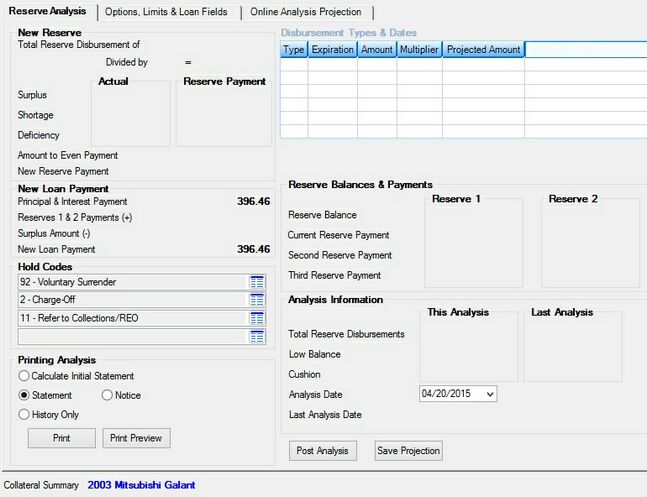

This screen allows you to view reserve information for a loan. If you set up new reserves or change already-established reserve information using the Loans > Account Information > Reserves > Account Reserve Detail screen, and then you access this screen, it will show you how the new reserve or changed reserve information affects the loan.

Loans > Account Information > Reserves > Reserve Analysis Screen

Once you see how the loan is affected, you can post the analysis by clicking <Post Analysis>, and you can print a statement. Or in the case of deficiencies or shortages, you can print a notice. When you post an analysis, the analysis posting date is only for the current date and will not be repeated every year. Analysis posting that is performed automatically every year is set up using the Loans > Account Information > Reserves > Reserve Analysis Options screen.

Generally, reserve analysis is done yearly, according to how the options are set up on the Reserve Analysis Options screen. But if you do use this screen to process reserve disbursements per loan on more than a yearly basis, you will need to manually process transactions in GOLDTeller (Reserves) to accompany those disbursements, as well as manually use Check Writer in GOLDTeller to create any disbursement checks or excess checks.

The Check Reconciliation program in GOLD Services tracks and records all check information.

Analysis options are determined in the following ways.

1. System defaults are used if your institution does not set up its own options.

| 2. | To set up your institution's system-wide reserve options, use the Reserve Analysis Options screen. These options override the system defaults. |

3. You can set up online one-time loan-by-loan reserve options, but they aren't saved permanently for the loan. These options are set up on the Options, Limits & Loan Fields tab.

•For reserve cushions, the Account Reserve Detail screen and the Reserve Analysis screen can be used on a loan-by-loan basis.

Additionally, you can download and print statements to send to your customers notifying them of reserve payment projections using the Reserve Analysis Statement (FPSRP339). For more information on this statement and report, see Reserve Analysis Statement (FPSRP339) and Reserve Analysis Report (FPSRP339) on DocsOnWeb.

|

Note: There is a charge each time the analysis runs in the afterhours for each statement created. To learn what this charge is, consult your GOLDPoint Systems customer service representative. |

|---|

Tabs on this screen:

•Options, Limits & Loan Fields tab

•Online Analysis Projection tab

The Collateral Detail field at the bottom of this screen displays the user-defined Collateral information entered on the Loans > Account Information > Account Detail screen.

|

Record Identification: The fields on this screen are stored in the FPLN and FPAB records (Loan Master, Analysis Option). You can run reports for these records through GOLDMiner or GOLDWriter. See FPLN and FPAB in the Mnemonic Dictionary for a list of all available fields in these records. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen.

•Set up the desired field level security in the FPAB record on the Field Level Security screen/tab. |