Navigation: Loans > Loan Screens > Original Loan Disclosure Screen >

Loan Disclosure Information field group

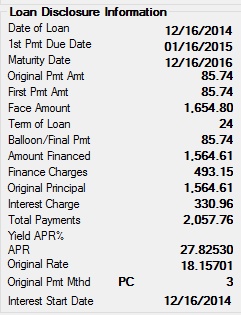

This field group displays how information was initially processed for the customer loan account when it was opened. If the loan is a renewal, the renewal information will appear on this screen and the old loan information will appear in the Prior Loans list view.

For disclosure information about loans purchased from another institution, see the Loans > Purchase Disclosure screen.

The fields in this field group are as follows:

Field |

Description |

||||||

|

Mnemonic: LNOPND |

This field displays the date the customer loan account was opened or funded. The system automatically supplies this information when a new loan (tran code 680) is set up. For loans with precomputed interest (payment method 3), this field is one of the values used in calculating rebates.

If there is a date in the Date Opened field while performing the open loan transaction, the date will not be changed. If the Date Opened field is blank, the following will occur:

|

||||||

|

Mnemonic: LN1DUE |

This field displays the first payment due date on the customer loan account. This is a critical field that is used by numerous afterhours reports. Coupons and bill/receipt statements use this date to determine the first coupon/billing.

If the first due date is not known for line-of-credit loans (payment method 5), the date the loan was opened will appear in this field. A bill/receipt will not be created until there is a principal advance. The statement will be created on the next coupon/bill cycle after the advance. |

||||||

|

Mnemonic: MLOMAT |

This field displays the date the last payment is due on the customer loan account (and the date the loan should be paid off). All loans must have a designated maturity date except payment methods 5 (revolving line-of-credit) and 8 (rental accounts), otherwise payments cannot be posted. See below for more information.

|

||||||

|

Mnemonic: LNOPIC |

This field displays the original payment amount for both principal and interest for the customer loan account. This field is used in connection with late charge code 24, which uses the original principal and interest in the late charge calculation.

At the time a loan is opened (transaction code 680), the system will automatically enter the P/I constant into the Face Amount field below. If there is a zero P/I, such as for a line-of-credit loan, "0" will appear in this field. |

||||||

|

Mnemonic: OTFPAM |

This field displays the first minimum payment amount for the customer loan account. Depending on how the loan is set up, the payment may be a monthly, bi-monthly, weekly, etc. payment.

This payment amount includes both principal and interest as designated by your institution. |

||||||

|

Mnemonic: LNPICN |

This field displays the face amount, or face value, of the loan. The Face Amount is calculated by taking the original balance on the loan and subtracting any maintenance fees (at origination) and original unearned precomputed interest (if applicable).

This field is used in Credit Reporting to determine the high or original amount. This field is also used in many amortizing calculations, such as amortizing fees and precomputed interest.

Face Amount = Original Balance - Maintenance Fees (amortizing fees that are designated at loan origination) - Original Unearned Interest

Example: The Original Balance on a loan is $1,450.00. The loan is a precomputed loan with Original Unearned Interest of $150.00, as well as $45 in maintenance fees.

$1,450.00 - $150.00 - $45 = $1,255.00 |

||||||

|

Mnemonic: MLOTRM |

This field displays the original maturity term (the time needed to pay off the loan) for the customer loan account.

Maturity term lengths are designated by your institution. |

||||||

|

Mnemonic: OTLPAM |

This field displays the final payment (or final balloon payment) amount on the customer loan account. See below for more information.

|

||||||

|

Mnemonic: OTAFIN |

This field displays the amount your institution financed for the customer loan account. The amount financed is the loan amount applied for less prepaid finance charges. Prepaid finance charges can be found on the Good Faith Estimate/Settlement Statement (HUD-1 or 1A).

For example, if the customer's note is for $100,000 and prepaid finance chargestotaled $5,000, the value in this field would be $95,000. This value is the figure on which the Annual Percentage Rate (APR, see below) is based. |

||||||

|

Mnemonic: OTTPMT - LNOBAL |

This field displays the amount of any finance charges accrued on the customer loan account.

This amount includes anything from loan origination fees, interest, etc. This field is calculated by subtracting the original balance of the loan (found on the Loans > Account Information > Account Detail screen) from the value in the Total Payments field below. |

||||||

|

Mnemonic: LN78OP |

This field displays the original amount of the customer loan account before unearned insurance and unearned interest were added. |

||||||

|

Mnemonic: LN78OI |

For precomputed accounts, this field displays the original amount of interest precalculated to be due over the life of the loan (also known as Original Unearned Interest). See below for more information.

|

||||||

|

Mnemonic: OTTPMT |

This field displays the total amount of all payments made toward principal, interest, and mortgage insurance (if applicable) over the life of the customer loan account. |

||||||

|

Mnemonic: MLBYAR |

This field is used in the Dealer Consolidation Report (FPSRP214) to identify the weighted average branch yield APR at your institution. |

||||||

|

Mnemonic: LNOAPR |

This field displays the original annual percentage rate (APR) of the customer loan account. |

||||||

|

Mnemonic: LN78AO, OTORAT |

This field displays the original interest rate on the customer loan account. For payment method 5 (precomputed) loans, the rate of add-on interest appears in this field.

Add-on interest is computed at the beginning of the loan, then added to the principal. Add-on interest must be repaid even if the loan is paid off early. |

||||||

|

Mnemonic: OTPMTH |

This field displays the loan interest type or payment method as indicated when the customer loan account was originated. See below for more information.

|

||||||

|

Mnemonic: OTINDT |

This field displays the customer loan account’s interest accrual start date. |