Navigation: Loans > Loan Screens > Original Loan Disclosure Screen >

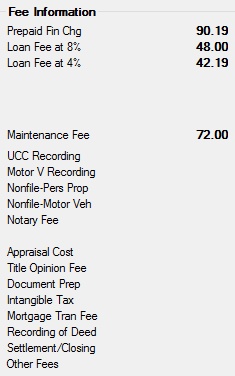

Fee Information field group

This field group displays how fee information was initially processed for the customer loan account when it was opened.

The fields available in this field group may vary depending on options set up for your institution.

These fields are based on fees charged up front for the loan and are included as part of the loan amount.

For disclosure information about loans purchased from another institution, see the Loans > Purchase Disclosure screen.

The fields in this field group are as follows:

Field |

Description |

|||

|

Mnemonic: OTPFCN |

This field displays the total amount of any prepaid finance charges on the customer loan account when it was opened.

Prepaid finance charges are certain charges made in connection with the loan and which must be paid upon its close. These charges are defined by the Federal Reserve Board in Regulation Z and the charges must be paid by the customer. Non-inclusive examples of such charges are: loan origination fee, "points" or discounts, private mortgage insurance or FHA mortgage insurance, and tax service fee. Some loan charges are specifically excluded from the prepaid finance charge, such as appraisal fees and credit report fees.

Prepaid finance charges are totaled and then subtracted from the loan amount (the Face Amount of the Deed of Trust/Mortgage Note). |

|||

|

Mnemonic: OTPC8A |

This field displays the fee amount when the loan reaches 8 percent of payoff. This fee is assessed during loan origination. |

|||

|

Mnemonic: OTPC4A |

This field displays the fee amount when the loan reaches 4 percent of payoff. This fee is assessed during loan origination. |

|||

|

Mnemonic: OTMNTA |

This field displays the fee amount your institution charges for maintenance performed on the customer loan account. A maintenance fee is a charge assessed on some types of brokerage accounts at a fixed frequency (usually annually). See below for more information.

|

|||

|

Mnemonic: OTUCCA |

This field displays the UCC recording fee for the customer loan account. This must be assessed when the loan is originated (through GOLDTrak PC).

UCC stands for Uniform Commercial Code. This code is set of laws regulating commercial transactions, especially ones involving the sale of goods and secured transactions. |

|||

|

Mnemonic: OTMVRA |

This field displays the motor vehicle recording fee on the customer loan account, if applicable.

The fee amount charged for motor vehicles varies from state to state. This fee is assessed during loan origination. |

|||

|

Mnemonic: OTNPPA |

This field displays any fees connected with the customer loan account due to the customer not filing a tax return.

If the customer did not file a tax return and the government places a tax lien on the property loan which your institution lent to the customer, your institution can charge a fee. This fee is assessed during loan origination. |

|||

|

Mnemonic: OTNMVA |

This field displays any fees connected with the customer loan account due to the customer not filing a tax return.

If the customer did not file a tax return and the government places a tax lien on the motor vehicle loan which your institution lent to the customer, your institution can charge a fee. This fee is assessed during loan origination. |

|||

|

Mnemonic: OTTERA |

This field displays the fee charged to have a notary verify all signatures on the customer loan account (if applicable). This fee is assessed during loan origination. |

|||

|

Mnemonic: OTAPCA |

This field displays the fee charged to have the property connected with the customer loan account appraised.

Having a property appraised requires a professional to inspect the property and surrounding properties to determine the value of the property within that area (fair market value). |

|||

|

Mnemonic: OTCRFA |

This field displays the fee charged to have an attorney or other qualified professional (depending on the state) verify that a loan property title is valid.

A title opinion is a statement issued by an attorney as to the quality of title after examining an abstract of the title. |

|||

|

Mnemonic: OTDOCA |

This field displays the fee charged for preparing documents for the customer loan account.

Your institution will prepare some of the legal documents that borrowers sign at the time of closing, such as the mortgage, note, and truth-in-lending statement. This fee covers the expenses associated with the preparation of these documents. |

|||

|

Mnemonic: OTINTA |

This field displays any intangible personal property tax charged to the customer loan account.

Intangible personal property that can be taxed includes stocks, bonds, certain money market funds, mutual funds, loans, notes, a portion of accounts receivable, and limited partnership interests. This tax is a state tax, so this field is only displayed for applicable loans in applicable states. |

|||

|

Mnemonic: OTMTFA |

This field displays the mortgage transaction fee on the customer loan account (if applicable). This fee is assessed during loan origination.

A mortgage transaction fee is a fee or tax charged by some state and local governments when a mortgage is obtained. |

|||

|

Mnemonic: OTREDA |

This field displays the fee amount charged to record the deed (or mortgage) into public record for the customer loan account (if applicable).

The recording fee is a fee charged by the local government to record mortgage documents into the public record so that any interested party is aware that your institution has an interest in the property.

|

|||

|

Mnemonic: OTSCLA |

This field displays the settlement or closing cost charged on the customer loan account (if applicable).

A settlement or closing cost is a fee charged by a title company, closing agent, or attorney to act as a representative and agent for your institution to perform the closing of a real estate transaction. |

|||

|

Mnemonic: OTTTLA and OTLTCA |

This field displays any other fees incurred by the customer loan account. These fees are assessed during loan origination. |