Navigation: Loans > Loan Screens >

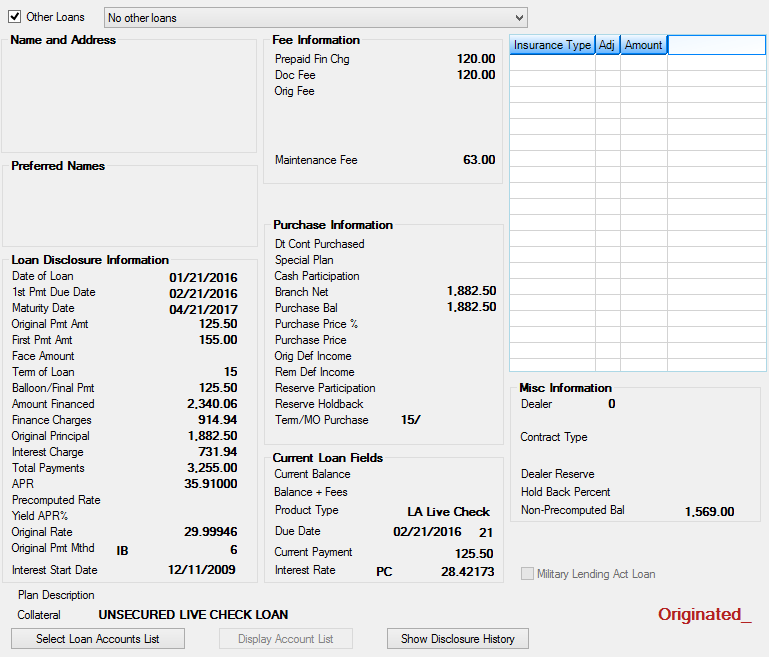

This screen displays how information was initially processed for the customer loan account when it was opened at its original institution. This screen displays information about loans that originated at another institution and were later purchased by your institution.

For disclosure information about loans originating at your institution, see the Loans > Original Loan Disclosure screen.

Loans > Purchase Disclosure Screen

Use the Other Loans checkbox field (mnemonic BCCSSN) at the top of this screen to indicate whether information from another account under the selected customer's name should appear on this screen. Use the drop-down field to the right to indicate which account to view.

The Insurance Type list view on the right side of this screen displays information concerning insurance policies purchased by the customer during loan origination. See below for more information about this list view.

A letter may appear next to premium amounts for certain account statuses: C = Canceled and E = Expired. Insurance policies may be expired or canceled due to loan renewals. Insurance policies can be canceled using the Loans > Insurance > Adjustments screen.

The possible types of insurance policies that can appear in this list view are accident and health (A/H), life, auto, property, unemployment, and homeowner.

Depending on the type of insurance policy, two or three of the following pieces of information will appear beneath the corresponding insurance type in the list view:

|

Use the Military Lending Act Loan field at the bottom-right of this screen (mnemonic OTMLAA) to indicate whether the selected customer loan account was designated as a Military Lending Act (MLA) account at loan origination. This field is used for informational purposes only. Your institution is responsible for making sure the account meets the necessary MLA requirements.

The Plan Description field at the bottom of this screen displays a description of promotions on the customer loan account (if any). Examples of promotions include 90 days no interest, interest free, and no sales tax. Promotions are institution-defined. To create different plans for your institution, use the Dealer Setup > Plans screen in CIM GOLD. Once plans are created, apply them to the dealers who sell loans through your institution. Add dealers to plans using the Plans screen, then click <Relationships>. The dealers added can then offer those plans to customers and secure loans through GOLDTrak PC or eGOLDTrak.

The Collateral field at the bottom of this screen displays information about collateral on the customer loan account. GOLDTrak files transfer collateral data from the CL23N5 field to CIM GOLD. Collateral information is set up on the Loans > Collateral Detail screen.

Three buttons appear at the bottom of this screen. See below for more information about these buttons.

•<Select Loan Accounts List> - Click this button to view the Loan Selection Parameters dialog. Use this dialog to indicate a criteria of loans available to display on this screen. This dialog can also be used to help narrow down specific loan accounts for customers with multiple loans. Once selection criteria has been entered, click <Apply> to apply the criteria, then click <OK> to return to this screen. The loans fitting the criteria will be the only loans available for view on this screen. To view the next or previous loans fitting the criteria, click <Previous> or <Next> (or select an account from the Selected Accounts dialog).

•<Display Account List> - Click this button to view the list of Selected Accounts that match the parameters set up on the Loan Selection Parameters dialog.

•<Show Disclosure History> - Click this button to view the Disclosure History screen. See help for that screen for more information. |

The field groups on this screen are as follows:

Loan Disclosure Information field group

Purchase Information field group

Current Loan Fields field group

|

Record Identification: The fields on this screen are stored in the FPLN, FPML, and CSOT records (Loan Master, Miscellaneous Loan Fields, Loan Origination Tracking). You can run reports for these records through GOLDMiner or GOLDWriter. See FPLN, FPML, and CSOT in the Mnemonic Dictionary for a list of all available fields in these records. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen.

•Set up the desired field level security in the FPML and CSOT records on the Field Level Security screen/tab. |