Navigation: Loans > Loan Screens > Account Information Screen Group > Account Detail Screen >

The rules for how and what your institution charges when a customer is late making a loan payment are established at loan origination. You can set up the options for the Late/NSF tab using Loan Patterns, and the system would then apply those patterns after loans are boarded from GOLDTrak PC.

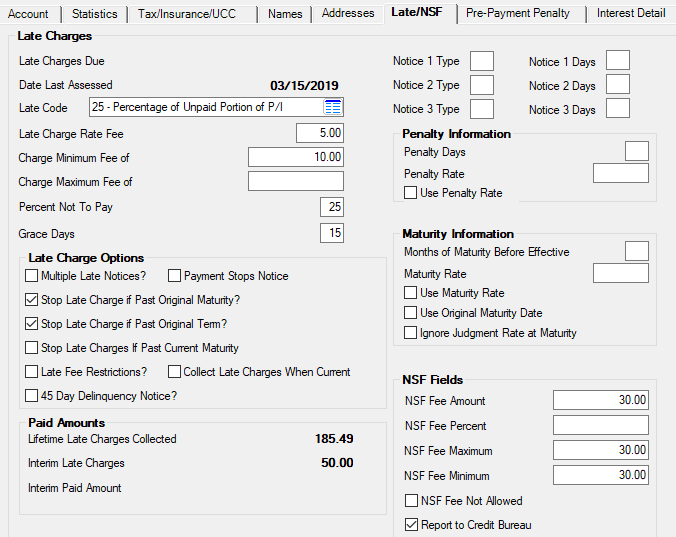

Loans > Account Information > Account Detail Screen > Late/NSF Tab

On occasion, you may need to make changes to individual accounts using this tab. Certain fields are file maintainable with proper security clearance. If you need changes made to all your loans currently in the system, contact your GOLDPoint Systems account manager or send in a work order detailing which field you want changed. We can run an init (initialization) of that field to update it for all your customers. For example, if your policies changed for how much to charge for late payments, we could update the Late Code field and Late Charge Rate Fee field accordingly (or any other late fee changes).

Late charges are usually assessed automatically by the system in the afterhours of when loan payments are late (Due Date + Grace Days). However, if the Due Date + Grace Days lands on a Saturday, Sunday, or holiday, the system may assess late charges in the afterhours of the following day, previous day, or even on that date, depending on certain institution options being set (as explained below). The account owner may have another day or two to make their payment before late charges are assessed, should certain options be set.

The three institution options that affect assessing late charges on Sundays/holidays are:

•SULT: When this option is on, the system assesses late charges before Saturdays, Sundays, and holidays.

•SALT: When this option is on, the system assesses late charges on Saturday.

•LTED: When this option is on, late charges are assessed everyday (even Sundays and holidays) and SULT and SALT are ignored. This is a new option as of 01/17/2021.

See the table below if you are not planning on setting up institution option LTED to know how SULT and SALT affect late charges.

SULT On? |

SALT On? |

Results |

|---|---|---|

Remember: If LTED is on, SULT and SALT are ignored. Institution option LTED assesses late charges everyday of the week, even Sundays and holidays. |

||

No |

Yes |

Late charges assess every day except Sundays and holidays.

•If Due Date + Grace Days lands on a Sunday, the system will assess late charges in the Monday afterhours after Sunday.

•If Due Date + Grace Days lands on a holiday, late charges will be assessed on the next day after the holiday (not before). If the day after the holiday happens to be a Sunday, the system assesses the late charges in the Monday afterhours (essentially giving the borrower two extra days to make a payment and not get a late charge). |

Yes |

No |

Late charges are assessed every day except Sundays and holidays.

•If Due Date + Grace Days lands on a Sunday, late charges will be assessed the Saturday before the Sunday.

•If Due Date + Grace Days lands on a holiday, late charges will be assessed the day before the holiday, not on the holiday or after the holiday. If the day before the holiday is a Sunday, the system assesses the late charge the Saturday before the holiday (essentially giving the borrower two less days to make a payment before getting a late charge). |

Yes |

Yes |

Late charges are assessed every day except Sundays and holidays.

•If Due Date + Grace Days lands on a Sunday, late charges will be assessed the Saturday before the Sunday.

•If Due Date + Grace Days lands on a holiday, late charges will be assessed the day before the holiday, not on the holiday or after the holiday. If the day before the holiday is a Sunday, the system assesses the late charge the Saturday before the holiday (essentially giving the borrower two less days to make a payment before getting a late charge). |

No |

No |

Late charges assess Mondays through Fridays, but not Saturday, Sundays, and holidays.

•If Due Date + Grace Days lands on a Saturday or Sunday, the system will assess late charges in the Monday afterhours after Sunday.

•If Due Date + Grace Days lands on a holiday, late charges will be assessed on the next day after the holiday (not before). If the day after the holiday happens to be a Saturday or Sunday, the system assesses the late charges in the Monday afterhours after the holiday and weekend (essentially giving the borrower two to three extra days to make a payment and not get a late charge). |

|

Note: One late code, 31 (Daily Portion of P/I), assesses late charges after Due Date + 30 days. The system begins calculating for the late charge as soon as the payment is late, which is Due Date + Grace Days, but does not assess until the afterhours of the Due Date + 30 days. See Late Code 31 help for more information concerning this late charge. |

|---|

Manually Assessing Late Charges

You can also manually assess late charges in CIM GOLDTeller using the Assess Late Charge transaction (tran code 560). You can also waive late charges using the Waive Late Charges transaction (tran code 570, note that waiving late charges does not stop the account from being delinquent). If a payment is backdated prior to the late charge assessment date and Institution Option WVLC is enabled, the late charge will be automatically waived.

Paying and Reversing Late Charges

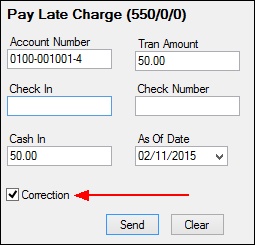

Late charges can be paid directly using the Pay Late Charge transaction (tran code 550), or they can be paid with a normal loan payment. However, the Payment Application field must have the Late Charges box checked. If the Late Charges box is listed first in the Payment Application field, late charges are paid first before any other part of the loan payment (principal, interest, fees, etc).

Your institution determines whether or not late charges are included with loan payments, and in which order they are paid. To reverse a late charge payment, use tran code 550, but check the Correction box, as shown below:

Make sure you enter the same amounts that were entered on the original Late Charges transaction. (Late charges can also be reversed with a payment reversal. The system reverses the payment in the same order as set up in the Payment Application field.)

History records late charges paid as tran code 550 and corrected late charges as 558. If you do correct a late charge, you must also run the Late Charge Reversal G/L transaction (tran code 1800-00-10) to remove those funds from your General Ledger.

If Institution Option KLLT is enabled, late charges will not be cleared when performing the Judgment transaction (tran code 2510-02) or when the Bankruptcy transaction (from either the Loans > Bankruptcy and Foreclosure > Bankruptcy or Bankruptcy Detail screen) is run.

If an account is assessed a late charge, the account will appear on both the Late Charge Journal (FPSRP065) and Loan Afterhours Processing Exception Listing (FPSRP013).

|

Note: See help for the Collect Late Charges When Current field for detailed information about collecting late charges for the current month when payments are more than one month past due.

See also Special Late Charge Assessment and Grading for information about special late charge assessment and grading. |

|---|

Field Descriptions

The field groups on this tab are as follows:

Late Charge Options field group

Penalty Information field group