Navigation: Loans > Loan Screens > Account Information Screen Group > Account Detail Screen > Late/NSF tab >

Maturity Information field group

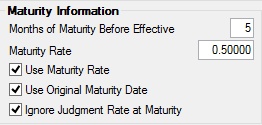

The following fields are found in the Maturity Information field group on the Late/NSF tab of the Account Detail screen.

The fields in this field group are as follows:

Field |

Description |

||

Months of Maturity Before Effective

Mnemonic: M1MMRE |

In this field, enter the number of months a loan must be past the maturity date before the system will start calculating interest based on the Maturity Rate (see below). For example, if a loan is accruing interest at 10 percent, and the account matures, if this field is set to "2" and the Maturity Rate field is set to "25," then the account will start accruing interest at 25 percent two months after the Maturity Date. If this field is blank, the Maturity Rate will take effect in the afterhours prior to the Maturity Date. |

||

|

Mnemonic: M1ARAT |

Enter the interest rate the system will accrue on this loan once the loan reaches the Maturity Date. If you enter a number in the Months of Maturity Before Effective field above, the Maturity Rate will not take effect until the number of months entered in that field after the Maturity Date.

|

||

|

Mnemonic: LNPMAT |

Check this box to use the maturity rate to accrue interest against this loan once the loan reaches maturity. (See the Maturity Date field for when the loan reaches maturity.)

If this box is checked, the system will accrue interest at the Maturity Rate once the loan has reached the Maturity Date. If it is not checked, the interest rate will remain the same after the loan has matured.

This field can only be used if the loan is a payment method 5 (line-of credit) or 6 (interest bearing).

The system looks at the loan in the night before the Maturity Date to determine if the Maturity Rate should be used. The interest will be accrued through the maturity date at the old rate, then the Maturity Rate (above) will be moved into the loan rate (the Interest Rate field on the Account tab of this screen). The interest will then accrue at the Maturity Rate from that time forward.

Note: See Use Original Maturity Date below and Months of Maturity Before Effective above for more information about when the system advances the Maturity Date to the Interest Rate.

Exceptions

Be aware of the following exceptions that may cause the Maturity Rate to not advance to the Interest Rate upon maturity:

•If the Use Maturity Rate box was checked after the account had already reached maturity, the Maturity Rate will not automatically advance to the Interest Rate. If you want to adjust the rate to a new rate after the loan has matured, you will need to send in a work order to have an init for all the accounts that need the new interest rate. If it's only a handful of accounts where the new interest rate is needed, and if you have proper security, you can maintain the interest rate yourself on the Interest Detail tab. (Warning: This should only be done by supervisors who understand the life of a loan. They may be aware of documentation included when the loan was originated disclosing to the borrower that their interest rate would change upon maturity.)

•If Hold Code 90 (Judgment) is on the account, the Maturity Rate does not advance to the Interest Rate at maturity. However, see the help for the Ignore Judgment Rate at Maturity option (M1IGJM) below, because if that option is checked, the system will still allow the account to use the Maturity Rate at maturity if Hold Code 90 is on the loan.

•If the Maturity Rate is more than the current Interest Rate, the system will only advance the Maturity Rate as the new Interest Rate at maturity if one of the following exists on the account: oThe loan is a fixed rate (Interest Rate Pointer is 0 or 255) and the current Interest Rate (LNRATE) is equal to the original Interest Rate (OTORAT). oThe loan has a variable rate (Interest Rate Point not equal to 0 or 255). (If the Maturity Rate is less than the current Interest Rate, then the Interest Rate Pointer is irrelevant and the change will be made.) |

||

|

Mnemonic: M1UOMT |

Check this box to signify to the system that the Maturity Rate (see above) will take effect on the Original Maturity Date (found on the Additional Loan Fields screen). If this field is not checked, the Maturity Rate will take effect in the afterhours prior to the date in the Maturity Date field.

If a number of months is entered in the Months of Maturity Before Effective field above, the Maturity Rate doesn't take effect until after the maturity date and the number of months entered in that field has passed. |

||

Ignore Judgment Rate at Maturity

Mnemonic: M1IGJM |

If this loan has had a court judgment against it, and a new rate will be implemented once the loan reaches the Maturity Date, this option allows the system to advance the Maturity Date to the Interest Rate in the afterhours immediately prior to the Maturity Date. This option is only for accounts that have had a judgment (Hold Code 90). |