This field is cleared whenever any of the following occurs:

•An Interest Only transaction (tran code 2600-03) is run. •A Judgment transaction (tran code 2510-02) is run. •A CP2 (Exception) transaction (tran code 2600-00) is run. •An Assess Late Charges transaction (tran code 560) is run.

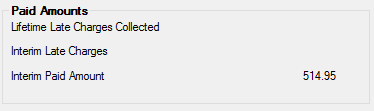

This field is used to keep track of the amount paid toward the current payment due. Once late charges have been assessed for the current payment or a payment is made that advances the Due Date into the future, this field is cleared. Otherwise, this field will continue to accumulate all payments made toward the current payment due only if late charges are collected during payment (Payment Application includes "Late Charges") or Late Fee Restrictions? is selected.

There are four possible scenarios that can occur when a payment is made. These scenarios will occur only if late charges are collected during payment or if Late Fee Restrictions? is marked.

1.A full payment is made and the Due Date advances.

•Because the account is now paid into the future, this field is cleared. The formula is: Due Date minus one Frequency plus Grace Days. If the result is in the future, the field is cleared.

Example: The P/I Constant due on a loan is $100.00. The account owner makes a $100.00 payment on 08-19-18, five days past the Due Date of 08-14-18 (but before the Grace Days end). If there are no late charges or fees due, the $100 payment is enough to satisfy a full payment and the Due Date advances to 9-14-18. (9-14-18 – 1 (frequency) = 8-14-18. 8-14-18 + 10 grace days = 8-24-18. Is 8-24-18 greater than or equal to the transaction date? If yes, this field is cleared. If no, in the afterhours that night, the system assesses late charges to the account.)

2.A full payment is made and the Due Date does not advance. This can happen when there are outstanding late charges or fees to be collected and the Payment Application code starts with a 4 (late charges) or a 7 (fees).

•A full payment was made so the account is now eligible for grading to determine whether a late charge should be assessed as well as the delinquency status of the account (see Late Charge Grading on the Special Late Charge Assessment and Grading topic).

•If grading determines that a late charge is not assessed, this field will be cleared the night late charges would have normally been assessed. A history item is written showing a late charge assessment of zero and this field being cleared.

•This field displays the amount of the full payment and will be cleared on the night late charges are assessed. The same calculation in #1 above is used to determine when to clear this field. (In this case, the answer to the question in the example is "no").

3.A short payment is made.

•This field displays the amount of money that was paid (in this case an amount less than the P/I Constant amount). In the afterhours of the Due Date, the system assesses late charges to the account because a full payment was not made.

4.Several short payments are made before late charges are assessed.

•If the total amount paid is equal to or greater than a full payment and the Due Date advances, then this scenario is the same as scenario 1.

•If the total amount paid is equal to a full payment but the Due Date does not advance, this scenario is the same as #2.

•If the payment amount is less than the P/I Constant, see scenario #3.

Interim Paid Amount for Late Code 30

If the selected Late Code is "30 - Percentage of Current Payment," this field displays the accumulation of all amounts paid during the late charge grace period less Fees Paid (tran code 850) and Principal Decrease (tran code 510-47). The amount in this field will be increased if the transaction date for a payment falls before or within the grace period. The late charge grace period is the period from the Due Date to the Due Date plus Grace Days.

Example: If a loan had a Due Date of 06-01-18 and Grace Days of 10, the Interim Paid Amount field will increase for each payment received from 06-01-18 through 06-11-18.

The Interim Paid Amount field is cleared whenever any of the following occurs:

•An Interest Only transaction (tran code 2600-03) is run. •A Judgment transaction (tran code 2510-02) is run. •A CP2 (Exception) transaction (tran code 2600-00) is run. •An Assess Late Charges transaction (tran code 560) is run. •A payment is enough to advance the Due Date to a date in the future. •The new Due Date is later than the date the payment was posted. |

See also:

Special Delinquency Calculations for Consumer Loans

Special Late Charge Assessment and Grading

|