Navigation: Loans > Loan Screens > Line-of-Credit Loans Screen > Finance Charge Information tab >

Finance Charge Information field group

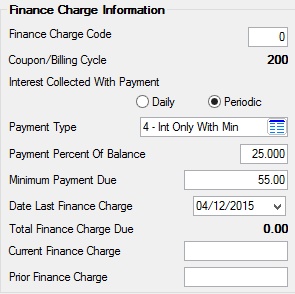

Use this field group to view and edit finance charge information for the customer line-of-credit (LOC) loan account.

To learn more about how LOC loans function, see the Line-of-Credit Loan Information help page.

The fields in this field group are as follows:

Field |

Description |

|||||||||||||||||||||

|

Mnemonic: LNRLFC |

Use this field to indicate a finance charge code for use on the customer line-of-credit loan account. See below for more information.

|

|||||||||||||||||||||

|

Mnemonic: LNBCYC |

Once information is entered in the Finance Charge Code field above, this field displays the cycle by which the coupon or bill and receipt statement on the customer loan account will be printed. This field also determines whether a loan should receive a year's worth of coupons, coupons for the life of the loan, coupons up to the next P-I change date, or coupons to the reserve analysis date. See Coupon/Billing Cycle codes for more information. |

|||||||||||||||||||||

Interest Collected With Payment

Mnemonic: LNRLDP |

Use these fields to indicate when your institution wants interest collected as payments are received on the customer loan account.

•Mark the Daily radio button to indicate daily simple interest. Interest will be collected from date of payment to date of payment on this loan. •Mark the Periodic radio button to indicate periodic interest. Interest will be collected from due date to due date on this loan.

This is a required selection. |

|||||||||||||||||||||

|

Mnemonic: LNRLPT |

Use this field to indicate how payments on the customer loan account should be calculated by the system. See Payment Types for more information. |

|||||||||||||||||||||

|

Mnemonic: LNRLPB |

Use this field to indicate the percentage of the original balance that your institution uses to determine the Minimum Payment (see below) it will accept from a customer loan account. |

|||||||||||||||||||||

|

Mnemonic: LNRLMD |

Use this field to indicate the minimum payment amount accepted by your institution on the customer loan account. |

|||||||||||||||||||||

|

Mnemonic: LNRLFD |

At the time the loan is opened (tran code 680), the system automatically enters the current date in this field, unless a date has been entered in the pattern, in which case the date in the pattern will be used. Once the loan is functioning, the system enters the date the finance charges were last charged. As interest (finance charge) is charged for periodic interest, the system will transfer the amount of accrued interest to the Current Finance Charge field.

For daily simple interest the accrued interest amount will equal the total remaining unpaid amount on the loan. This field is a key date in determining the charging period for the loan and should agree with the Due Date displayed on the Loans > Account Information > Account Detail screen once the payment is made. Otherwise, the Due Date will be the number of payments unpaid behind this date. This date is always the beginning date of the next charging period. The low, average, and high balances for a period are calculated starting with this date.

This field is also used as the action code 109 (Recreation of Previous Statement) date. When finance charges are assessed a tran code 520 is performed. Tran code 520 also updates the Last Transaction field on the Account Detail screen. If an overdraft comes through on the same night as the finance charge (from teller 9999) and the principal balance is zero, this field will be updated with the current date. |

|||||||||||||||||||||

|

Mnemonic: N/A |

This field displays the sum of the Current Finance Charge and Prior Finance Charge fields below. When interest is charged, this is the amount of interest due with the next payment. It applies only to periodic loans. When reversing a payment (tran code 608) if there was a billing between the payment and the reversal, the system will add the reversed payment to the Prior Finance Charge amount and increase this field by that amount. The Current Finance Charge field will remain the same. |

|||||||||||||||||||||

|

Mnemonic: LNRLCC |

Use this field to indicate the amount of interest charged on the Date Finance Charge. Each time interest is charged, any unpaid interest remaining in this field is added to the Prior Finance Charge field below before the current charge amount is transferred from the Accrued Interest field and placed in this field. It applies only to periodic loans. When reversing a payment (tran code 608) if there is not a billing between the payment and the reversal, the system will re-enter the amount in this field prior to the payment that was posted. If there is a billing between the payment (tran code 600) and the reversal (tran code 608), the system will add the reversed payment to the Prior Finance Charge amount and increase the Total Finance Charge Due field above by that amount. The Current Finance Charge field will remain the same. |

|||||||||||||||||||||

|

Mnemonic: LNRLPC |

This field displays the sum of all finance charges owed prior to the last charging period. This field applies only to periodic loans. |