Navigation: Loans > Loan Screens > Account Information Screen Group > Account Detail Screen > Interest Detail tab > Interest Information field group >

Some institutions offer deferred interest and payments for interest-bearing accounts (payment method 6 loans). If the loan is paid off within the interest deferral period, deferred interest is not applied and essentially waived at payoff. However, if the loan is not paid off by the expiration date, the deferred interest that accumulated during that time period is then added as part of the payment using a deferred interest constant amount. The interest accrued on the loan is kept separate from the deferred interest both in payments and accrual.

The following differences exist in the system for these types of loans:

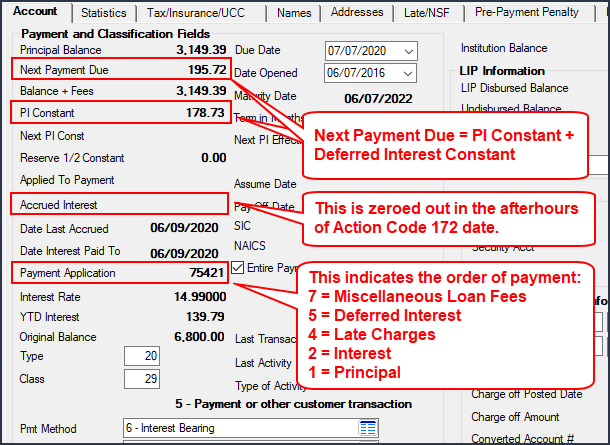

•Payment Application 5 (Deferred Interest) is available.

•Action Code 172 (Deferred Interest Period) holds the date deferred interest expires, when the deferred interest amount moves from Accrued Interest into the Original Deferred Interest and Remaining Deferred Interest fields, and when the Deferred Interest Constant field is calculated.

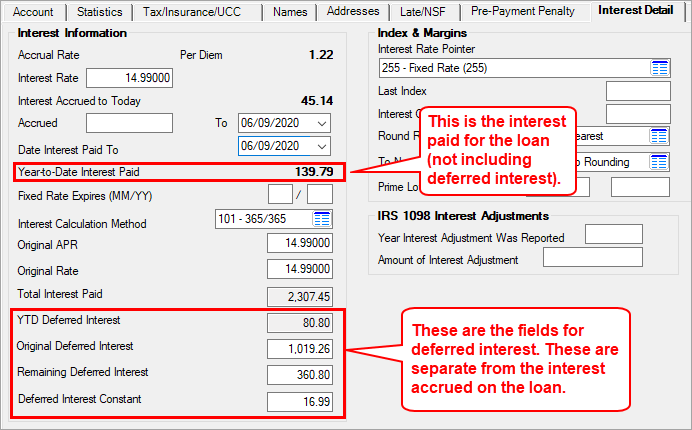

oThe Accrued field holds the interest accrued during the deferred interest period. It will be zero unless the borrower makes a payment during the period, and then the system accrues interest from Date Last Accrued to the date of payment and puts that amount in the Accrued field. This continues with every payment made during the interest deferral period. If no payments are made, this field remains zero.

oWhen Action Code 172 expires, the system accrues the interest from the Date Last Accrued to the end of the deferral period to get the total amount of deferred interest, zeroes out the Accrued field (if not zero already), then moves that amount to two fields: Original Deferred Interest and Remaining Deferred Interest (see following bullet point). This is done using Update Function 55 (explained below).

oRemaining Deferred Interest will be reduced every month when a payment is made (and part of the payment goes to Deferred Interest (Payment Application 5). Once the Remaining Deferred Interest reaches zero, the payment no longer applies funds to deferred interest (see the calculation for Deferred Interest Constant).

oThe deferred interest fields at the bottom of the Interest Information field group are available to show the amount of deferred interest for loans where no interest (and possibly no payments) are required for a designated number of months after the loan is opened.

Afterhours Update Function (55 - Process End of PM6 Deferred Interest Period)

This afterhours function must be set up by your GOLDPoint Systems account manager to run daily. This afterhours function will control moving the deferred interest amount from Accrued into the Original Deferred Interest and Remaining Deferred Interest fields and calculating the Deferred Interest Constant when Action Code 172 expires.

See the screen examples below for additional details/examples of these types of loans:

Loans > Account Information > Account Detail Screen > Account Tab

Loans > Account Infromation > Account Detail Screen > Interest Detail Tab