Navigation: Deposit Screens > Definitions Screen Group > Product Codes Screen >

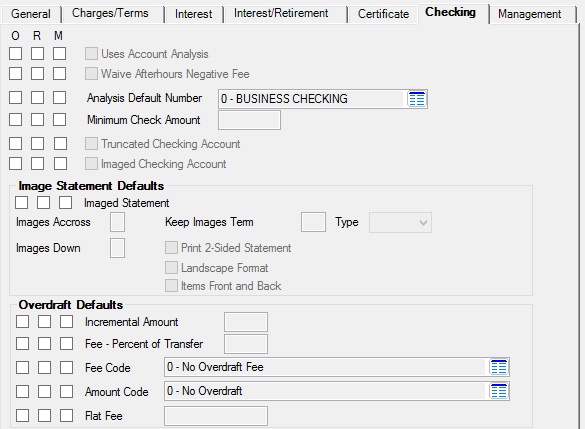

Use this tab to view and edit information about the checking features for the product being created/edited. Most of the fields on this screen are only available if the Certificate feature field is marked on the top of the screen. For more information about creating product codes, see the Entering Product Codes help page.

Deposits > Definitions > Product Codes Screen, Checking Tab

The fields on this tab are as follows:

Field |

Description |

|

|

Mnemonic: PCAANL |

Use this field to indicate whether the product use account analysis.

To learn more about account analysis, see help for the Deposits > Account Information > Commercial Account Analysis screen. In order for this feature to be used on a customer account, institution analysis setup records must first be created and an option enabled on the account. |

|

|

Mnemonic: PCWVFE |

When a product has a negative balance and Institution Option OPTJ-NGCH (Post Service Charge If Negative) is enabled, the product is assessed a service charge in the afterhours. Use this field to indicate whether this service charge should be waived and/or shown on statements for the product. See below for more information.

|

|

|

Mnemonic: PCDEFL |

Use this field to indicate the account analysis default number to use on the product. You can delete this default by clearing the Uses Account Analysis field above. Any information corresponding with that default will also be dropped.

Defaults for commercial analysis service charge codes are set up by marking relevant fields in GOLDVision on the Defaults screen. There are 79 pre-defined codes and 20 user-defined codes available. Once the Defaults screen has been set up, that Analysis Default number can be entered on the Deposits > Account Information > Additional Fields screen. All default entries will then populate fields on this screen.

To learn more about account analysis, see help for the Deposits > Account Information > Commercial Account Analysis screen. In order for this feature to be used on a customer account, institution analysis setup records must first be created and an option enabled on the account. |

|

|

Mnemonic: PCMNCA |

Use this field to indicate the minimum check amount that may be withdrawn from the product. If a check for less than the value in this field is presented for withdrawal, it will be rejected. This feature can be adjusted for individual customer accounts in the Activity field group on the Deposits > Account Information > Activity Information screen. |

|

|

Mnemonic: PCTRUN |

This option is not currently in use by GOLDPoint Systems. |

|

|

Mnemonic: PCIMAG |

Use this field to indicate whether the product will use imaged statements.

To use the imaged statement option, contact GOLDPoint Systems to designate a third-party check image processor and enable the necessary system features. For a current list of vendors available for this service, see Ancillary Services in the Other section in DocsOnWeb. If GOLDPoint Systems processes your imaged statements (Institution Option OPTU - FIMG), only statement cycle codes 102-131 can be used with imaged accounts. To learn more about imaged statements, see help for the Deposits > Account Information > Check Imaging screen as well as the Check Imaging Options help page. Imaged statement features can be adjusted for individual customer accounts in the Image Fields field group on the Deposits > Account Information > Statement Fields screen. |

|

Image Statement Defaults field group |

See Image Statement Defaults field group for more information. |

|

Overdraft Defaults field group |

See Overdraft Defaults field group for more information. |