Navigation: Loans > Loan Screens > Account Information Screen Group > Reserves Screen Group > Account Reserve Detail Screen >

The Reserve Disbursements tab of the Account Reserve Detail screen allows you to set up reserve records to be automatically disbursed by the system to insurance companies, taxes, etc. To actually print the checks to be sent to those entities, you would use the Loans > Check Printing > Reserve Checks screen.

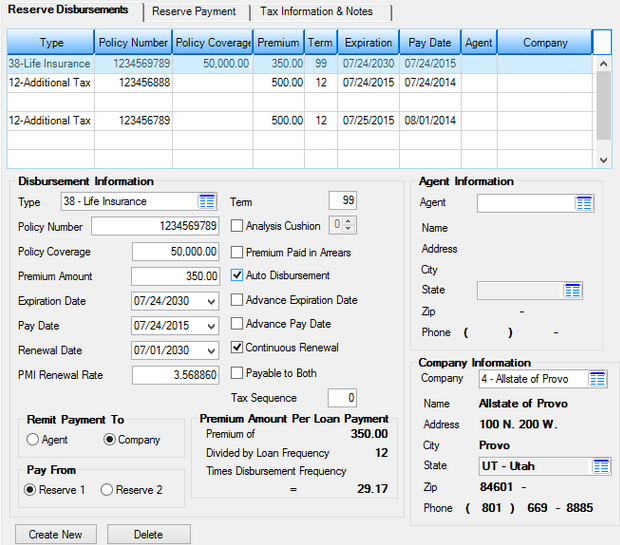

The list view at the top of this tab displays any reserve disbursements that have already been set up for the selected loan account. You can add more reserve disbursements through the fields below this list view. Click <Add Disbursement> if you want to set up a new disbursement. If you want to change information on an already listed disbursement, double-click on that disbursement in this list view, and the information will appear in the fields below this list view, where you can file maintain any of the fields. The information displayed in this list view corresponds to information entered in the Disbursement Information, Agent Information, and Company Information field groups on this tab.

Loans > Account Information > Reserves > Account Reserve Detail Screen, Reserve Disbursements Tab

When adding new reserve records to the account by clicking <New Disbursement>, you will need to run a transaction in GOLDTeller to increase the reserve balance. Reserve balances can only be increased or decreased via a teller transaction. Increasing or decreasing the reserve balance may require a supervisor override or approval. For example, each year insurance premiums and taxes can go up or down. Additionally, borrowers may choose to purchase different insurance policies. Someone at your institution would be responsible for updating the account reserve record on this screen, as well as change the reserve balance a certain transaction. See below for a list of these transactions.

|

The information entered on this screen describes how and when reserve disbursements for taxes, mortgage insurance, fire insurance, etc., are made. The Premium Amount Per Loan Payment field group breaks down how much reserve payments are for each month. Use the Reserve Payment tab to set up the reserve payment records.

No Limit on Disbursements

There is no limit to the number of disbursement records available per loan. However, the maximum number of disbursements that can be processed in the reserve analysis is 48. If you want to add additional reserve disbursement records, click <New Disbursement> and the system will clear all the fields, and then you can enter more disbursements for the account.

Disbursements may be done either automatically by the system or by a teller transaction (tran code 440 for reserve 1 and 640 for reserve 2).

Disbursements preformed automatically are processed through Loans > Check Printing > Reserve Checks screen in the afterhours of the day you set up on the Loans > Account Information > Reserves > Reserve Analysis Options screen.

If a teller originates the disbursement, the disbursement fields will not be updated and must be file maintained to the correct information. Use the Loans > Account Information > Reserves > Reserve Analysis to determine reserve payments, surpluses, or shortages for online reserve analysis (not saved for future payments).

Credits to Reserve

Teller transaction code 140 allows you to credit funds to either reserve account 1 or 2 identifying the reason for the refund by using the disbursement code. For example, if you received a $25 refund from the insurance company for an overpaid premium, use tran code 140. The GOLDTeller screen has a field for the disbursement code. If you entered “22,” the history will display “Reserve refund - 22 fire insurance.” This works better than using a field credit (tran code 510) because it explains the reason for the refund.

The field groups on this tab are as follows:

Disbursement Information field group